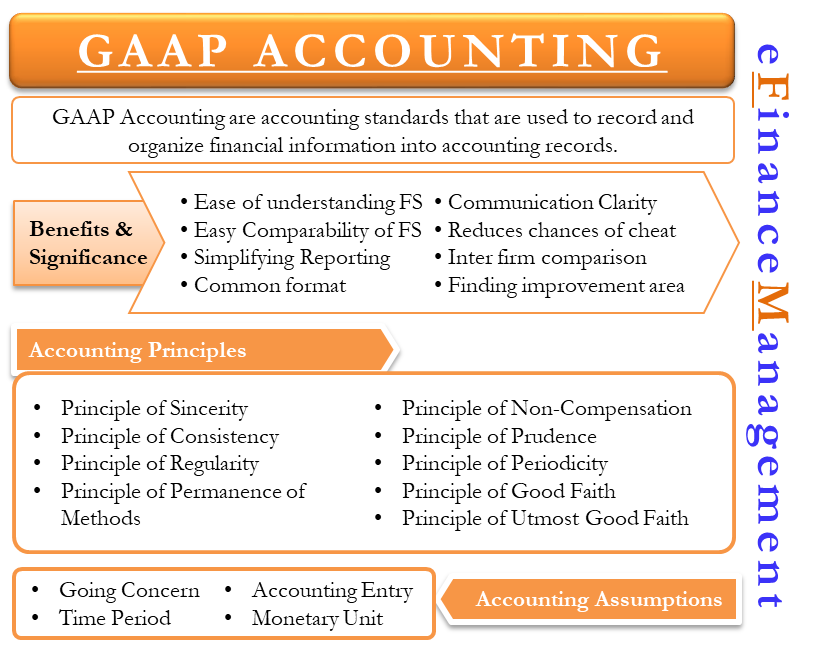

Generally Accepted Accounting Principles or more widely known as GAAP, is the set of accounting standards. Organizations use the GAAP principle to record and organize their financial information into accounting records. If the records are maintained as per GAAP accounting, it becomes easier for the auditors, investors, and any other stakeholders to understand the financial information.

Also, since all companies use a common format under GAAP to list their financial statements, it becomes easier for stakeholders to compare different companies as well. All companies follow the same set of rules under GAPP accounting, resulting in simplifying the accounting reporting. There might be some changes in the industry-specific GAAP principle, but the underlying and generic standards remain the same.

Various government-sponsored accounting entities, such as the Financial Accounting Standards Board (FASB) and Securities and Exchange Commission (SEC), also issue pronouncements through their Accounting staff Bulletins. These bulletins primarily hold relevance in the case of publicly-held companies and are considered to be part of GAAP. There are other standards, such as Pro-forma accounting and IFRS standards, but both are non-GAAP.

Also, read – GAAP vs. Non-GAAP.

Significance of GAAP Accounting

GAAP is a mix of authoritative standards and commonly accepted ways of recording and reporting accounting information. GAAP standards bring clarity of communication in financial information. These standards are important for accounting rules and standardizing financial statements.

Also Read: Importance of GAAP

In the absence of any universal standard, companies will report financial statements on the basis of their own standards. This would make it difficult for the auditors and other stakeholders to know the validity of the financial statements of the companies.

Therefore, GAAP regulations ensure that companies don’t cheat while reporting. It also helps investors compare the financial statements of different companies and pick the one for investment.

Companies also benefit by this practice as they get a clear insight into their own financial statements to know the best practices and things that they are doing right. It also helps companies identify areas for improvement.

Read more on the Importance of GAAP.

GAAP Principles

Following are the basic principles of GAAP that one should know:

Principle of Sincerity

Under this principle, the accountant works towards offering an accurate understanding and view of the company’s financial situation.

Principle of Consistency

As the name suggests, professionals should focus on the consistency of the reporting process to prevent errors or discrepancies. Accountants should be able to apply the same standards, disclose any errors or differences, and explain reasons as to why certain standards have changed or got updated.

Also Read: GAAP

Principle of Regularity

The accountant should make sure that they follow the rules and regulations set under GAAP.

Principle of Permanence of Methods

Accountants should ensure that the procedure in financial reporting should be consistent. GAAP principles can’t change, and therefore, reporting should be consistent.

Principle of Non-Compensation

A company should not hide any facts and figures from investors. A company will have both negative and positive data, and an accountant should report both.

Principle of Prudence

Fact-based representation of financial data is a must in a company, and therefore, nothing should be speculated.

Principle of Periodicity

An accountant should distribute all accounting entries as per appropriate periods of time. For instance, while reporting, the company must show revenues as per the relevant period.

Principle of Good Faith

Also known as the principle of materiality, accountants should focus on revealing as much as they can in the financial reports. Full disclosure about the company should be the priority for the managers.

Principle of Utmost Good Faith

The term is largely used within the insurance industry. According to this principle, all parties should remain honest with each other during the transaction.

Basic Assumptions of GAAP Accounting

Going Concern

GAAP assumes that the business will keep on running for an indefinite period without any intention of dissolution.

Time Period

All companies should follow a standard time period for reporting financial statements. The reporting is usually done monthly, quarterly, and annually.

Accounting Entity

In the financial world, the owner is considered as a separate entity from the business. Therefore, it becomes important that the financial books of the owner and the company are separate.

Monetary Unit

All the accounts must have one monetary unit. For instance, if a company is in the US, then it should use the US dollar in the financial statements. In the financial statements, the company must record only those transactions that carry some monetary value and can be stated in terms of a currency.

GAAP Reporting

On the basis of GAAP, companies are usually responsible for providing reports of their profit-making abilities, cash flows, and overall financial conditions. The following three statements cover all these requirements-

- Income statement

- Balance sheet

- Cash flow statement

Income statement covers the revenue and expense for a period, while the balance sheet lists all the assets and liabilities of the business. The cash flow statement records all the sources and payments of cash.

Thanks.