What is Prime Cost?

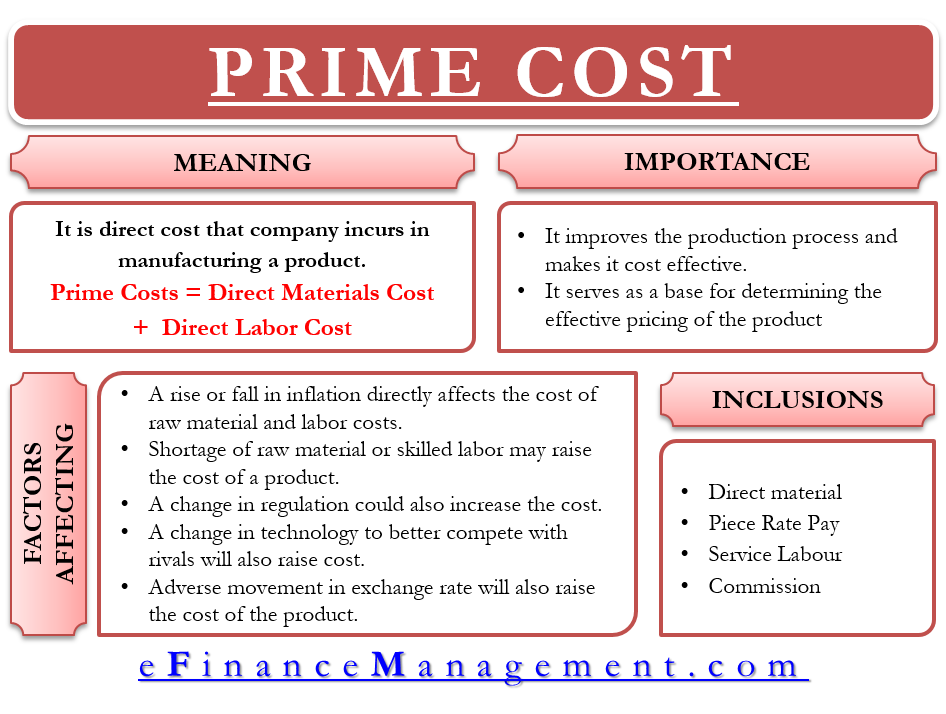

Prime Cost (or Flat Cost or First Cost) in managerial accounting is the direct cost that the company incurs in manufacturing a product or providing a service. Such costs include direct production costs, like the cost of raw materials and direct labor costs.

In other words, we can say prime costs are the core production costs, which are the first stage of basic costs for any activity – production of goods or provision of service. Moreover, this very cost serves as the basis for allocating overheads to different products.

Components of Prime Cost:

Mainly the Prime cost includes:

Direct Materials

These are the basic raw material items or tangible goods that a company uses to manufacture its goods. In other words, these are the primary raw materials needed for production and get converted to finished goods through the production process. The key criteria to term the items as direct materials are the items that could be directly associated or identified with the final unit of production.

Such costs may also include the supplies that the company consumes for producing individual units.

Direct Labor

For converting raw materials to finished goods, you need the machines and workers to work on it. Therefore, the cost that the company incurs on workers having direct involvement and engagement in this production process is the direct labor cost. Moreover, here their engagement or productive time can be directly attributed to the end product. Hence, all such costs for such direct workers are the direct labor cost and are part of the Prime Cost.

Also Read: Prime Cost Calculator

It includes the cost of labor and the payroll taxes directly attributable to the production of an additional unit. All costs that could not be directly identified with the final production unit will not be part of such costs—for example, labor costs for operating an assembly line.

Service Labor

In the case of a service provision, such costs include the cost directly attributable to a client or project. For example, the cost of consulting labor billed to a client.

Direct Expenses

Besides these two core items – raw materials and labor, prime costs will also include direct expenses, which we can directly trace to the end unit or service provision. For example, the commission to a salesperson if it is attributable to a specific sale.

Similarly, for service projects, costs incurred for the survey, licensing, test marketing, etc., are the direct cost incurred for the client. Hence, all such expenses will also form a part of the prime cost.

Also Read: Types of Costing

Apart from these, more items can come under prime costs depending on the purpose of the review. For instance, if the objective is to trace the cost of a distribution channel, then the prime costs would also include maintaining the distribution channel, like marketing expenses.

On the contrary, if the purpose is to find the costs attributable to a client, then it will also include the cost of field servicing, warranty claims, returns processing, and more. Separately, if the purpose is to determine the cost for a region, then it would include warehousing expenses for the region as well.

Indirect costs, like allocated factory overhead and administrative expenses, do not come under the prime cost. A company excludes such a cost because it is difficult to quantify and allocate them and could not be identified directly with the end product.

Formula

One can calculate prime costs using any of the following formulas depending on the type of information available. Generally, we use the first formula.

Prime Costs = Direct Materials Cost + Direct Labor Cost

Prime Costs = Total Manufacturing Costs – Total Manufacturing Overheads

Calculation with An Example

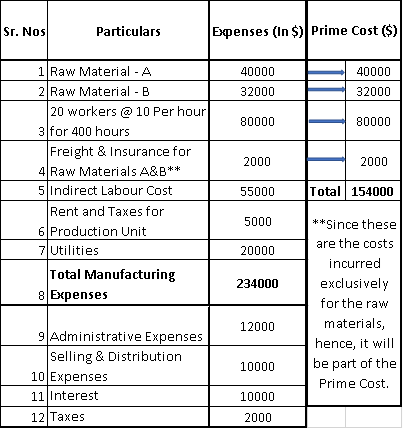

Let us understand the calculation of Prime Cost with an example. Company A has provided you with the following expenses for producing goods during August 2020. With these details, we will work out the Prime Cost as below:

If we want to calculate the Prime Cost with the second formula, we first need to calculate the total manufacturing overheads. In this example, these include – Indirect Labor Cost + Rent and Taxes + Utilities.

= 55000 + 5000 + 20000 = 80000

Therefore, the prime cost is =Total Manufacturing Expenses – Total Manufacturing Overheads, i.e., 234000-80000=154000.

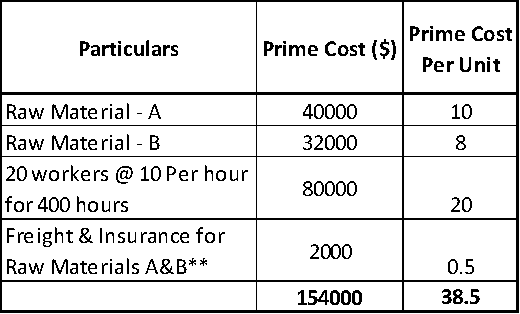

Calculation of Prime Cost Per Unit

The standard formula to calculate the prime cost per unit is very simple:

Prime Cost per Unit = Total Prime Cost / No of Units Produced.

If in the above example, suppose company A has produced 4000 units in the month, then the prime cost per unit would be:

Total Prime Cost (154000) / No of Units Produced (4000) = 154000 / 4000 = 38.5 per Unit.

You can also use our calculator – Prime Cost Calculator

One important point to note here is that instead of dividing the total prime cost, we can also determine the cost per unit for the individual components of prime cost. Because in prime cost, all the costs are directly related and traceable. Taking further the above example, let us attempt to derive the prime cost per component per unit of the production.

Importance

A company primarily uses prime costs to improve the production process and make cost objects more efficient. For example, if the company plans to determine prime costs for a paint department, then paints, supplies, chemicals, and other materials that this department uses will constitute ‘prime cost.’ In this way, the management can analyze the cost process and develop ways to minimize the consumption and cost of all these individual components.

Prime Cost also serves as a base for determining the effective pricing of the product and also defines the profit margin of the company. A company can use these costs to determine the minimum break-even selling price. Of course, since it does not include the overhead costs, they are not looked into while defining the long-term profitability of the company.

Along with companies, the concept of prime costs is essential for self-employed individuals as well. For instance, those selling custom-made furniture would calculate such a cost to ensure their hourly wage is as per the expectations and make a profit on the product produced.

Limitations

- Since it only includes direct costs, it does not tell the total cost of production. Overhead expenses, such as electricity and others to keep the factory running form a significant portion of the manufacturing expenses. Thus, the prime cost may give an incomplete picture of the manufacturing process.

- Sometimes it gets difficult to know with accuracy what costs are direct. Many expenses form part of the manufacturing process, but not all go into calculating prime costs. There must be a clear distinction between the costs that can be directly attributable to each unit versus those that the company spends on the whole business.

- Another limitation is that the specific expenses that go into calculating prime cost vary depending on the purpose and the product in question.

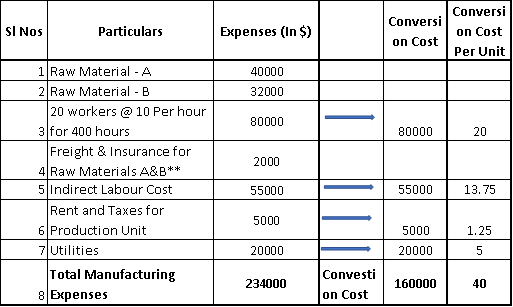

Prime Cost vs. Conversion Cost

As per the above discussion, prime costs are the direct core costs. It includes all direct costs, which could be identified and tracked easily with each unit of production. On the contrary, conversion costs are the costs that go into the conversion of the direct raw materials into the finished goods.

As we know, there are three major constituents of manufacturing costs:

- Direct raw material costs

- Direct labor costs

- Manufacturing overheads may include indirect material, indirect labor, other common manufacturing expenses, cost of utilities, and all such expenses. All these are overheads, as their direct identification to each unit of production is challenging. Therefore, these expenses are allocated over all the units produced.

Hence, the prime cost includes the first two items – direct material and direct labor costs. Whereas for calculation of conversion cost, it includes all direct labor costs, together with all other indirect costs and manufacturing overheads. In other words, the conversion cost is all other costs incurred to transform the basic raw materials and inputs to the ‘finished goods’ stage.

Conversion Cost Formula and Example

The formula for calculation of conversion cost is thus,

Conversion Cost = Direct Labor Costs + All manufacturing Overheads

Moreover, by using a similar formula ( like prime cost), we can also calculate conversion cost per unit of production.

Conversion Cost Per Unit = Total Conversion Cost / No of Units Produced

Taking the above example further, let us calculate the Total Conversion Cost and Conversion Cost Per Unit as below:

Factors Affecting Prime Costs

- A rise or fall in inflation directly affects the cost of raw materials and labor costs.

- A shortage of raw material or skilled labor may raise the cost of a product. It is an industry-specific issue. Other industries may not face the same problem.

- A change in regulation could also increase the cost for the entire industry or all industries. For example, an increase in sales tax could raise the cost for all companies. While, if the government introduces new emission norms for pollution, it will raise the cost for auto companies.

- A change in technology for better competition with rivals or to get on par with others will also raise the cost.

- If a company exports its products, then an adverse movement in the exchange rate will also raise the cost of the product.

Also, read – other Types of Costs and their Basis of Classification

Final Words

The prime cost is the primary level cost, and its percentage of total cost varies from product to product. However, for manufacturing companies, prime cost forms a large part of the total cost of production. Moreover, this is a variable cost where much tweaking is not possible. Hence, a company must always strive to minimize the prime cost per unit. It will help in the maximization of profits.

Quiz on Prime Cost.

Hi,

I appreciate the way you explain the perspective about costing.

For this article, in particular, I would like to update you that Conversion cost includes only Labor + Overhead. Conversion cost does not include Direct material.

Thanks,

Shalin

Thanks Shalin for your encouraging feedback.

Yes, you are right that conversion cost covers only Labor and overheads. Utilities, however, remains an integral part of the process of conversion/ production. Depending upon the quantum and value it can be classified as part of total overheads or sometimes where it has a high value it can be taken together with overheads, being essential for conversion or production.

Thanks.

Don’t find any mistake in the article.