For any company, there are two possible inventory valuation methods, LIFO and FIFO. Where LIFO stands for last in first out, FIFO, on the other hand, stands for First in first out. In the LIFO method, you sell the latest goods first, and in FIFO, you sell the oldest inventory first. For any company, as compared to the LIFO method, FIFO is more logically beneficial. It is because most aged inventory is moved and utilized first in production.

What is FIFO?

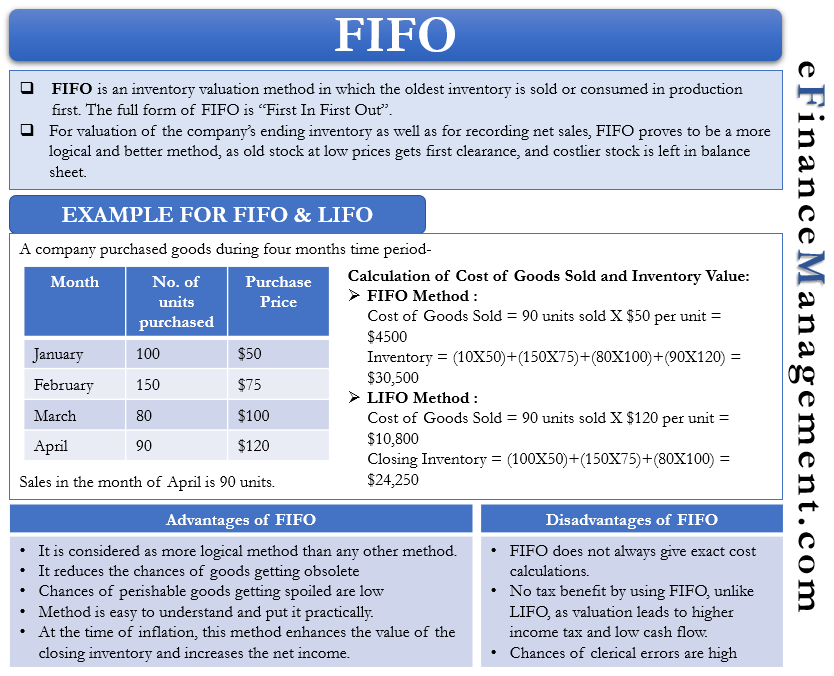

When a company makes sales as per the FIFO method, the oldest inventory or stock is used or sold first, and consecutively the second last will be sold, and so on. Thus the cheapest inventory is consumed first, and the costliest recent stock will form the ending inventory. It will add up to the company’s balance sheet. Thus, simply putting FIFO will increase the net income as cheap old stock will be used to calculate the current cost of goods sold. But on the other hand, higher taxes will be levied on the company for higher net income.

For the valuation of the company’s ending inventory as well as for recording the net sales, FIFO proves to be a more logical and better inventory valuation method. It is because, in this method, old stock at low prices gets first clearance, leaving behind the costlier stock in the balance sheet for the future market at a higher price range.

Thus FIFO method is the most approved and used inventory valuation method used by companies with its added advantage of protecting goods and products from getting out of fashion or obsolete. The Generally Accepted Accounting Principles (GAAP) and International Financial Reporting Standards (IFRS) prescribe this method of valuing inventories.

Also Read: Inventory Costing

For the calculation of the inventory valuation method, it is vital first to understand inventory.

What is Inventory?

Inventory is any raw material or work in progress material, or finished good held with the company. Simply stating total inventory is goods at the beginning of the calculation period with the addition of the material purchased to it and then subtracting the goods sold by the company, i.e., the cost of goods sold (COGS) during the period. This calculation will give the total inventory available to the company for that particular period. Thus simply, the formula for calculating inventory at any given time will be:

Starting inventory + Net purchases – COGS = Ending inventory

Understand FIFO with an Example

A simple example to explain LIFO and FIFO inventory valuation method

Mark wants to sell a fan from his inventory maintained for January, February, March, and April. Specifications of the inventory are as per below:

| Month | No of units of fan | Price paid |

| January | 100 | $50 |

| February | 150 | $75 |

| March | 80 | $100 |

| April | 90 | $120 |

So in May, Mark has to calculate the Cost of goods sold, supposing that he has sold 90 units of the fan.

Using the FIFO method

COGS= Number of fans * Price in January (because Mark will sell fans by FIFO method and will consume the oldest stock at $50 per unit of the fan.)

COGS= 90* $50 =$4500

Ending inventory value= 10*$50 (10 units remaining from January stock after selling 90 units via FIFO) + 150*$75+80*$100+90*$120

Ending inventory value using FIFO = $30550

Using LIFO method

COGS= Number of fans * Price in April (because Mark will sell fans by the LIFO method and will consume the newest stock at $120 per unit of the fan.)

COGS= 90* $120=$10800

Ending inventory value using LIFO= 100*$50 + 150*$75+80*$100+0(90 units sold from April stock via LIFO)

Ending inventory value using LIFO= $24250

Thus the LIFO method will reduce the profit made by Mark but will give him tax benefits. LIFO reserve is the difference in COGS using the LIFO and FIFO method, which amounts to $6300 here. In other words, effectively, there is a deferment of the profits of the company for the current period and consequent tax payable thereon to future year(s) by this amount.

Also Read: LIFO Liquidation – Meaning, Use and Example

FIFO vs. LIFO

Let’s understand which method is better, LIFO vs. FIFO.

Preferring one method out of the two – FIFO or LIFO -depends on the requirements of the business and external environmental factors.

- When for any business, the need is cash conservation, inflation is persistent, and inventory is increasing, the LIFO is the preferred method. However, the FIFO is the preferred method under the same conditions for profit maximization.

In the case of deflation, where prices are declining and businesses need to conserve cash, again, the FIFO method gets the preference. And for maximizing profits under the same conditions, the LIFO is the method for the purpose.

- The decision to use an inventory valuation method again depends on business types. For example, if the business is of supermarkets, pharmaceuticals, auto parts, farm or construction equipment, liquor or wine stores, hardware, steel, electrical and electronic store, furniture, and food product distribution related, the LIFO method is advisable.

Whereas, in the case of small and perishable goods, items like vegetables, fruits, and products with an expiration date, the FIFO method is better.

- Moreover, during inventory liquidation, the older stocks are sold, and thus LIFO and FIFO have similar effects on cash flow and profit.

Pros of FIFO

- It is a better inventory valuation method as in this method. The company utilizes an older inventory first for production/sale. Also, the end inventory’s value on the balance sheet is at par with the current market prices.

- It reduces the chances of goods getting obsolete as the movement of the oldest stock gets the priority, minimizing the chances of change in taste and trends of the end consumer.

- The chances of perishable goods getting spoiled are low as old inventory will be sold first.

- This method is easier to understand, put into practice, calculate, and follow.

- The movement of goods and inventory in this method is in accordance with proper inventory management practices. It underlines the importance of the movement of the oldest stock first while the latest stock remains in inventory for later consumption.

- At the time of inflation, this method enhances the value of the closing inventory and increases the net income.

- The company’s closing stock in this method consists of the latest purchases, and thus it is valued at market prices.

Cons of FIFO

- Firstly as prices of the oldest stock will be used to calculate the Cost of goods sold in present times, FIFO does not always give exact cost calculations.

- Secondly, there is no tax benefit by using FIFO, unlike LIFO, as valuation leads to higher income tax and low cash flow.

- Thirdly, the chances of clerical errors are high while calculating FIFO when inventory has to be maintained frequently and at varied costs.

Visit to learn more about other Methods of Inventory Costing.

Quiz on FIFO.

Let’s take a quick test on the topic you have read here.