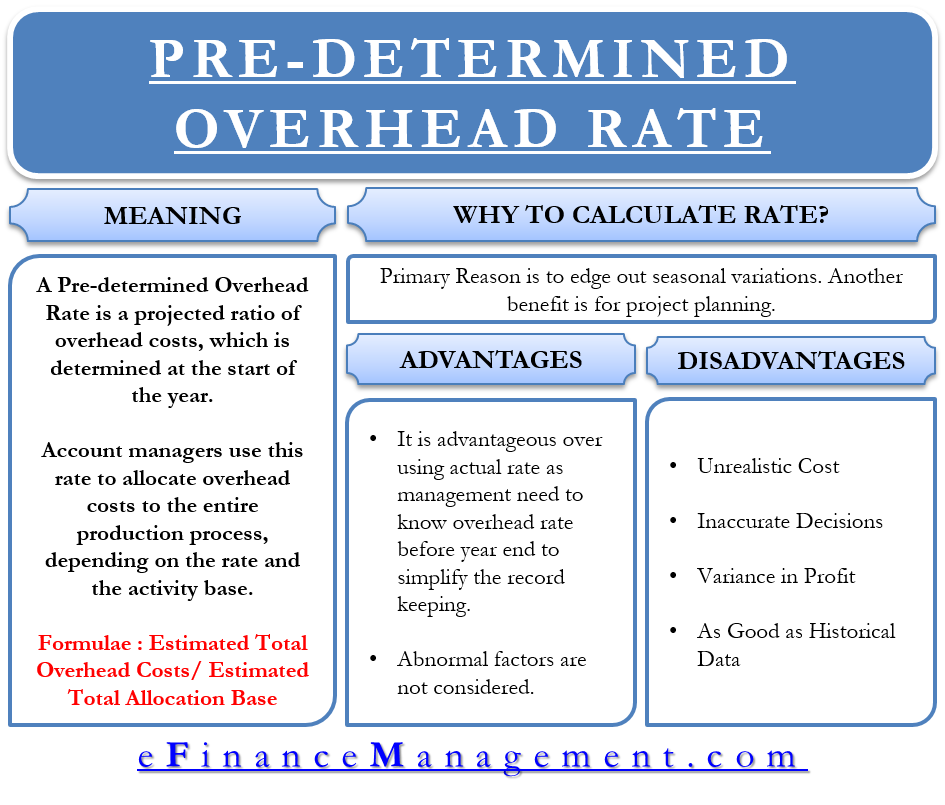

A Pre-determined Overhead Rate is a projected ratio of overhead costs, which is determined at the start of the year. A company determines this ratio (or overhead absorption rate) on the basis of another variable and uses it to spread costs during the production process. To put it simply, a company uses this rate to apply manufacturing overhead to products or projects on the basis of some underlying activity base such as machine hours, direct labor hours, and more.

Overhead are the expenses that an accountant can’t directly relate to a specific job or project. For example, rent, utilities, office supplies, and more. Thus, the overhead rate is the percentage necessary to calculate the overhead costs for the projects that are yet to start. It includes taking a known cost and then applying to it the percentage or the pre-determined overhead rate to arrive at the estimated cost that is not known.

Basically, account managers use this rate to allocate overhead costs to the entire production process, depending on the rate and the activity base. The calculation of this rate is helpful for the managers in closing the books more quickly. The use of this rate allows the management to avoid the actual manufacturing overhead costs for the year-end closing process.

How to Calculate?

In order to accurately calculate the predetermined overhead rate, the historical cost should be handy. The more historical data a company has, the greater accuracy it would have in ascertaining the pre-determined overhead cost.

Also Read: Overhead Costs – Types, Importance, and More

Companies use the following formula to calculate the predetermined overhead rate:

Estimated Total Overhead Costs/ Estimated Total Allocation Base

The overhead costs would include items such as administrative salaries and wages, electricity, rent, and more costs that a company incurs on the business as a whole. On the other hand, the allocation base is the costs a company associates with the actual project. A few common allocation bases are machine hours, direct labor dollars, direct materials, and direct labor hours.

Lets’ understand the calculation with the help of an example. For instance, if a company estimates overhead expenses at $10 million for a specific period and the activity cost of the project is $40 million, then the pre-determined rate would be 1:4. It means that for every dollar the company spends on the direct costs, it should assign 25 cents to the overhead cost.

A company calculates this rate at the start of the year. An account manager recalculates it if the earlier one gives a result different from the actual or is materially incorrect. If there are no significant changes, then the company can continue to use the same in the following year.

Why Calculate Pre-determined Overhead Rate?

Seasonal Variations

One of the primary reasons for calculating this rate is to edge out seasonal variations in overhead costs. There could be various reasons for such variations, including seasonality. However, an account manager should evaluate the actual cost of the project independently, irrespective of the season in which the project completes.

Project Planning

Another benefit of a predetermined overhead rate is for Project Planning. Managers use this rate to determine the future cost of the projects. Without such a rate, a company looking to identify the actual cost of a project will have to wait for the project completion.

Why Pre-determined Rate is Better Than Actual Cost?

Companies go for the pre-determined rate and apply it to overhead costs than using the actual cost because the management needs to know the overhead rate before the year-end to simplify the record-keeping.

Also, while calculating the actual overhead cost, the abnormal factors are not taken into account. On the other hand, the predetermined overhead costs do take all the abnormal costs into account specific to the factor related to any specific job.

A point to note is that an account manager needs to reconcile the difference between the actual. And estimate at the end of each fiscal year.

Disadvantages

Unrealistic Cost

The predetermined overhead rate can give an unreal picture since both the numerator and denominator are the estimates. The result could be drastically different from the actual overhead rate.

Inaccurate Decisions

A company makes crucial decisions on the basis of a pre-determined rate. And, if the rate is inaccurate, then those decisions could also go wrong. Such inaccurate decisions might affect the overall project and the actual outcome.

Variance in Profit

The difference between actual and pre-determined amounts could be huge. And this difference could add to the expense in the current period. This might cause a significant change in the amount of profit. Not only profit, but it is also useful in other types of variance analysis.

As Good as Historical Data

Historical information may not apply to the calculation of rate if there is a sudden increase or drop in costs.

To enhance the accuracy of the predetermined overhead rate, bigger companies may come up with a different rate for each production department. Though this increases accuracy, it also increases the work of the accounting department.

This was a very helpful article.

Thank you