GAAP (Generally Accepted Accounting Principles) is a set of rules and guidelines that tell a company how to prepare financial statements. All companies, whether public, government, or nonprofit, are required to prepare their financial statements in accordance with GAAP rules. Therefore, all of us in the accounting and business community should understand the importance of GAAP well. This will help us prepare, understand, and analyze financial statements prepared according to GAAP.

The idea of GAAP was conceived with the sole purpose of developing and establishing uniform accounting rules and guidelines for the preparation and presentation of financial statements across companies and countries. With this objective, the Financial Accounting Standards Board (FASB) and the American Institute of Certified Public Accountants (AICPA) have joined forces and, over time, developed these rules. And these are dynamic rules and policies are subject to constant change and improvement. By following these rules and guidelines, it becomes easier to read and draw conclusions from the accounting and financial aspects of companies across the segment and from different countries. GAAP provides a standardized platform for the financial statements of all such companies. In addition, these standards ensure that the financial statements reflect the true position of a company. And that a company properly discloses all important information to investors.

Overall, we can say that GAAP ensures that the information in the financial statements is clear, comprehensive, and easy to understand for both insiders and outsiders.

Now that you know what GAAP is let’s understand its importance.

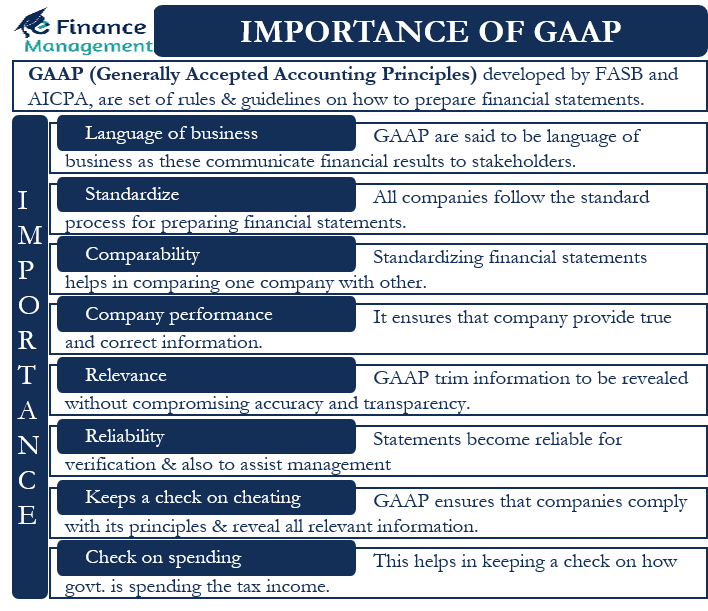

Importance of GAAP

The following points will help highlight the importance of GAAP to the Company, investors, and other stakeholders:

Language of Business

GAAP, together with its accounting standards, is said to be the language of business. This means that GAAP accounting helps communicate a company’s financial results to both investors and other stakeholders.

Standardize

As mentioned above, GAAP standardizes the entire process of making financial statements. It establishes the assumptions, rules, and regulations that companies must follow when preparing financial statements. It also specifies when and how companies must comply with the standards, ensuring that all companies follow the same guidelines when preparing and disclosing their financial statements.

Comparability

Since GAAP standardizes financial statements, it helps compare one company with another. Or, a company can compare its financial over time, which means that management or other stakeholders can easily compare their numbers with others in the industry. In addition, comparing a company’s performance from one period to another helps analyze progress if the company has made any progress.

In addition, comparing the performance can also help management pinpoint the problem areas. And it can also identify the potential opportunities for a company.

Company Performance

GAAP standards cover all types of situations and scenarios. This ensures that an entity discloses its real and true financial position regardless of the transactions it undertakes. In addition, there is long-term consistency in accounting standards. This helps to ensure that the financial statements provide a realistic view of the company’s performance over the years and that accounting policies are not changed year-over-year to make them incomparable with other motives.

Relevance

A company records many transactions in a reporting period, but not all transactions have an impact on the financial health of the company. GAAP standards ensure that a company records recognizable transactions and useful details that users need to make better decisions. So, we can say that GAAP helps reduce the information a company must disclose without compromising the aspect of accuracy and transparency.

Also Read: GAAP Accounting – All You Need To Know

Reliability

Financial statements prepared in accordance with GAAP standards are more reliable. This is because auditors can also audit these financial statements. Moreover, it is very important for companies to have the financial statements audited because lenders use audited financial statements to decide whether or not to lend to a borrower.

In addition, reliable statements help management to take superior actions that are consistent with a company’s objectives. Because GAAP contains so many controls and safeguards, it also reduces the risk of incorrect financial reporting.

Keeps a Check on Misleading or Wrong Information

Without these standards, companies would have a free hand in deciding what information they do not want to disclose to investors, or they would disclose the information as they see fit. GAAP ensures that companies do not mislead, conceal or share wrong financial information.

Check on Spending

All companies, including government entities, must adhere to these standards. This ensures that people can easily obtain details of how government entities spend their tax money.

Final Words

GAAP is undoubtedly the lifeline for companies when it comes to accounting. Overall, we can say that it ensures that stakeholders can easily understand and analyze a company’s financial position.

Frequently Asked Questions (FAQs)

GAAP rules are defined for all types of companies, and each company must comply with them, resulting in the standardization of the preparation of financial statements.

Yes. GAAP applies to all companies, including government companies.

GAAP violations reduce the reliability on the financial statements of companies. It leads to improper reporting, inaccurate management decisions, impacts credibility, and much more.