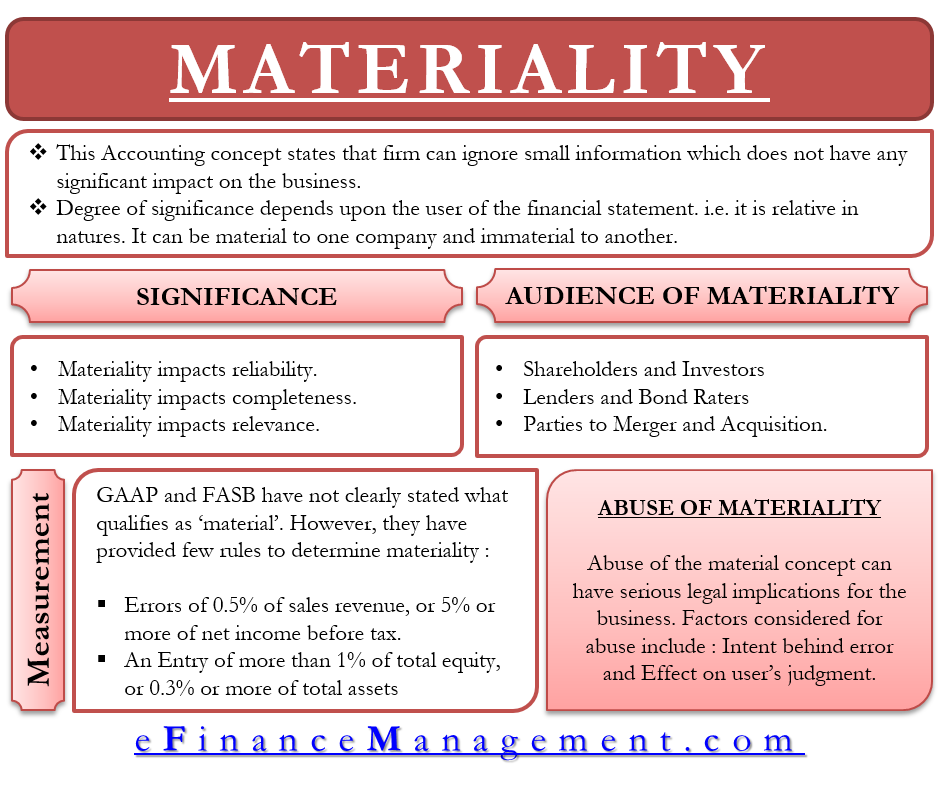

Materiality is a concept in accounting that states that a firm can ignore small information that does not significantly impact the business. This also means that a business must include all other information in its financial statements which is material/significant enough. This degree of significance is determined from the perspective of the users of the financial statements. So, if a piece of information is significant enough to change the opinion of a user about the company, the information must be present in the financial statements. On the other hand, if the information is not significant enough to change the opinion or decision of a user, the information is immaterial. Hence, it need not be included in the financial statements.

E.g., I have a big pair of scissors which have lost their sharpness from a few days back. So, I got them to a local who deals in scissors, and he made them sharper by rubbing them against iron. I paid $1 to him for his 2 minutes of service to me. Now, the materiality concept states that an expense of $1 is immaterial for my business to report in the financial statements adding the fact that my net profit was $50,000 last year.

Materiality is Relative

From the above explanation, it should be clear that the concept of materiality is relative in nature. A piece of information can be material to one company, and the same can be immaterial to another. This becomes clearer when you think about the materiality of a transaction from two different perspectives. A large company versus a small company. E.g., for a large company with $10 million worth of assets, an expense of $5,000 is immaterial. However, for a small company with assets worth $50,000 only, the same expense of $5,000 is material. So, it must be present in the financial statements of that company.

Significance of Materiality Concept

The concept of materiality is ‘material’ or important in the world of accounting because of three reasons:

Materiality Impacts Reliability

The omission of a material or important fact from the financial statements may compromise a user’s ability to make correct decisions. This is because most investors decide whether to invest in a company or not based on their analysis of that company’s financial statements. So, if a company’s financial statements omit certain information, the reliability of the financial statements will become low.

Materiality Impacts Completeness

According to Generally Accepted Accounting Principles, the financial statements of a company must represent a ‘true and fair’ view of the business. To be able to do this, the information contained in its financial statements must be ‘complete’ in all material aspects. Hence, if a material piece of information is not present in a company’s financial statements, the statements can not be considered complete. And therefore, they are incapable of providing a true and fair view of the business.

Materiality Impacts Relevance

Only the material information is relevant to the needs of users. So, if the Income Statement of a company is laden with so many categories of expenses, with a small income from many different sources and so on, which do not at all have any impact on the decisions of users, a major part of the income statement becomes irrelevant for the. Hence, the materiality concept also impacts the relevance of the information presented in the financial statements of a business.

Measuring Materiality

GAAP (Generally Accepted Accounting Principles) and FASB (Financial Accounting Standards Board) have not clearly stated what qualifies as ‘material.’ While reviewing specific cases, however, they have set some rules of the thumb against which materiality of information can be measured.

- In the Income Statement, errors of 0.5% of sales revenue or 5% or more of net income before tax are seen as large enough to matter.

- In the Balance Sheet, a questionable entry of more than 1% of total equity, or 0.3% or more of total assets, is likely to be viewed suspiciously and hence, ‘material.’

Abuse of the Materiality Concept

Abuse of the material concept can have serious legal implications for the business. A purposeful attempt to manipulate constitutes material abuse. Now suppose that a business commits an error that the regulators consider to be material enough. Now, while deciding whether there is a materiality ‘abuse’ or not, regulators will take the following 2 factors into account apart from the magnitude of the error. They are:

Also Read: Accounting Principles

Motivation and Intent behind the Error

Courts are more likely to judge an error as a material abuse if any of the following intent is proved:

- Intent to inflate the stock prices artificially.

- Intent to enlarge reported net profit.

- Influence mergers and acquisitions.

Likely Effect on User Judgement

Similarly, courts are more likely to judge an error as material abuse if it is proved that the motivation was to influence the user’s judgment about the company. E.g., suppose that there is a company whose sales revenue is $50,000 for a year. This company does not disclose a purchase worth $2,000, considering it immaterial. This error is more likely to be termed as materiality abuse. The reason is that not considering this purchase will inflate the Gross Profit by 4%. This may affect a user’s judgment about the company.

Intended Audience for Materiality

We have been saying that the financial statements should be material from the point of view of the users of accounting. So, who are the users, or rather, the intended audience, for whom we are trying to maintain the materiality? There are three major categories of them:

Shareholders and Investors

The financial statements must enable shareholders and investors to evaluate the firm’s current performance and future prospects. So, if the firm’s net profit is artificially inflated, investors may make a wrong decision.

Lenders and Bond Rating Agencies

Lenders and bond rating agencies are majorly concerned with evaluating a company’s creditworthiness. Creditworthiness means that if a firm receives a loan of some amount (depending on the size of the firm) today, how capable and likely the firm is to pay back the loan. So, the financial statements must have all the material information to enable these lenders and rating agencies to properly evaluate the firm’s creditworthiness.

Parties to Mergers and Acquisitions

When a business is getting into a merger, each party must know the other’s business accurately. Therefore, both parties must disclose all the material information accurately. This information may be the investment in capital assets, the capital structure of the company, variable costs of operation, etc. It must not hide any such information.

Read more about various other Accounting Principles.

Clearly explained about Materiality in accounting.