In the age of globalization, it is very important that companies properly prepare their financial statements. Moreover, their financial statements should be such that people in every corner of the world can understand them and compare them with other companies. It is very important that all firms follow the same accounting standards for preparing their financial statements to ensure this. And this is where GAAP comes in. GAAP serves as the standard while preparing financial statements. Many people, however, use the terms GAAP and GAAS interchangeably to mean the same thing. But this is wrong as the two terms are very different and mean two different things. Thus, it is very important to be aware of the differences between GAAS vs GAAP.

GAAP vs GAAS – Meaning

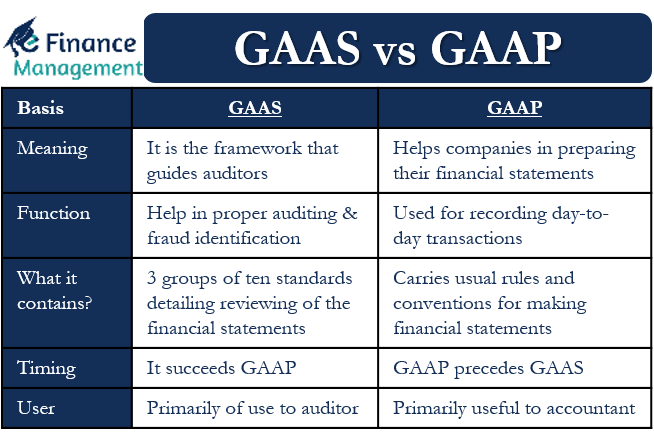

GAAP stands for Generally Accepted Accounting Principles, and as said above, it helps companies in preparing their financial statements. Or, we can say that GAAP guides on the accounting aspects of the transaction or what treatment a particular transaction should get. Companies in most countries follow these standards. This helps to ensure transparency and uniformity in the accounting standards.

GAAS, on the other hand, stands for Generally Accepted Auditing Standards, and it is the framework that guides auditors. The GAAS standards assist auditors in preparing a transparent and reliable audit report on the companies. Moreover, these standards ensure that auditors don’t miss any material information.

The use of GAAS also means that auditing is of the highest quality and that reports from different auditors are comparable. Despite serving as guidelines, the GAAS does give auditors some level of independence as well. It basically lays down methods and procedures for auditors to audit companies.

Also Read: Importance of GAAP

Overall, we can say that GAAS assists in maintaining professionalism from auditors and ensuring audit reports are transparent and unbiased.

Now that you know what the two terms mean let’s take a look at the differences between GAAP vs GAAS.

GAAP vs GAAS – Differences

These are the differences between GAAP vs GAAS:

Function

The primary function of GAAP is to assist firms in making their financial statements. Also, businesses need to use GAAP to record their day-to-day transactions and create accounting policies.

In contrast, the main job of GAAS is to help auditors properly audit companies. Another function of GAAS is to ensure reports are accurate and complete. It also helps auditors in identifying frauds.

What it Contain?

GAAP carries usual rules and conventions, and conventions for making financial statements. GAAS, on the other hand, carries three groups of ten standards detailing reviewing of the financial statements. Together, the three groups assist in evaluating the company’s accounting practices and reporting standards.

Timing

When talking about the process of preparing financial statements, GAAP precedes GAAS. This is because the accountant first needs to make the financial statements using the GAAP guidelines. Only after the financial statements are complete can auditors move ahead to audit the statements using the GAAS guidelines.

Also Read: GAAP

Moreover, GAAP continues to help businesses throughout the year or accounting period. However, GAAS gets useful only at the end of the accounting period or when a firm has to get its financial statements audited.

Users

GAAP is primarily useful to accountants for carrying out accounting works. GAAS, in contrast, is primarily of use to auditors. If the auditors find any discrepancy or dispute or want any clarification, then they may take the help of the company accountants.

Usefulness

Only after accountants prepare the financial statements on the basis of GAAP can the statements go to auditors for the check. And only after auditors’ approval the financial statements are made available to third parties. These third parties include shareholders, creditors, financial institutions, investors, etc.

Final Words

Both GAAP and GAAS are extremely crucial to the accounting world. GAAP helps prepare the financial statements, while GAAS helps verify those. We can say that these two concepts complement each other. This is because if a company strictly follows the GAAP for its financial statements, then it becomes very easy for the auditors to evaluate and approve it on the basis of GAAS. And if auditors don’t follow GAAS guidelines, it could make it difficult for them to evaluate the GAAP-based statements. In all, we can say that GAAP and GAAS together make life easy for companies, investors, and all stakeholders.

Frequently Asked Questions (FAQs)

a) General Administrating Accounting System

b) Generally Accepted Accounting Standards

c) Generally Accepted Auditing Standards

d) None of the above

c) Generally Accepted Auditing Standards

a) Generally Accepted Accounting Principles

b) Generally Accepted Auditing Principles

c) None of the above

a) Generally Accepted Accounting Principles

GAAP works as guidelines in recording transactions and preparing financial statements, while GAAS are the standards that help auditors while conducting audits and preparing reports for the same.

Functions of GAAP:

1. Helps in making financial statements

2. Helps in recording day-to-day transactions

3. Assist in creating accounting policies

Functions of GAAS:

1. Helps in properly conducting the audit

2. Ensures complete and accurate reports

3. Fraud identification