Accounting is like keeping track of money for businesses. It is important for all types of companies, no matter how big or small they are or what industry they are in. It involves various important tasks for managing and sharing financial information with stakeholders. Whether you are a business owner, investor, creditor, manager, or simply interested in understanding the role of accounting in business operations, this guide will provide you with a comprehensive overview of the functions and significance of accounting. So, let’s dive in and explore the world of accounting and its multifaceted functions that drive financial management and decision-making.

Meaning of Accounting

Accounting is like keeping a detailed record of all the financial transactions. It’s a way to keep track of how much money is being earned, spent, and owed. This information is then organized, analyzed, and presented to different people who have an interest in it, like investors, lenders, and managers. It encompasses a range of functions, including recording transactions, financial reporting, budgeting, analysis, and compliance with accounting standards and regulations.

Functions of Accounting

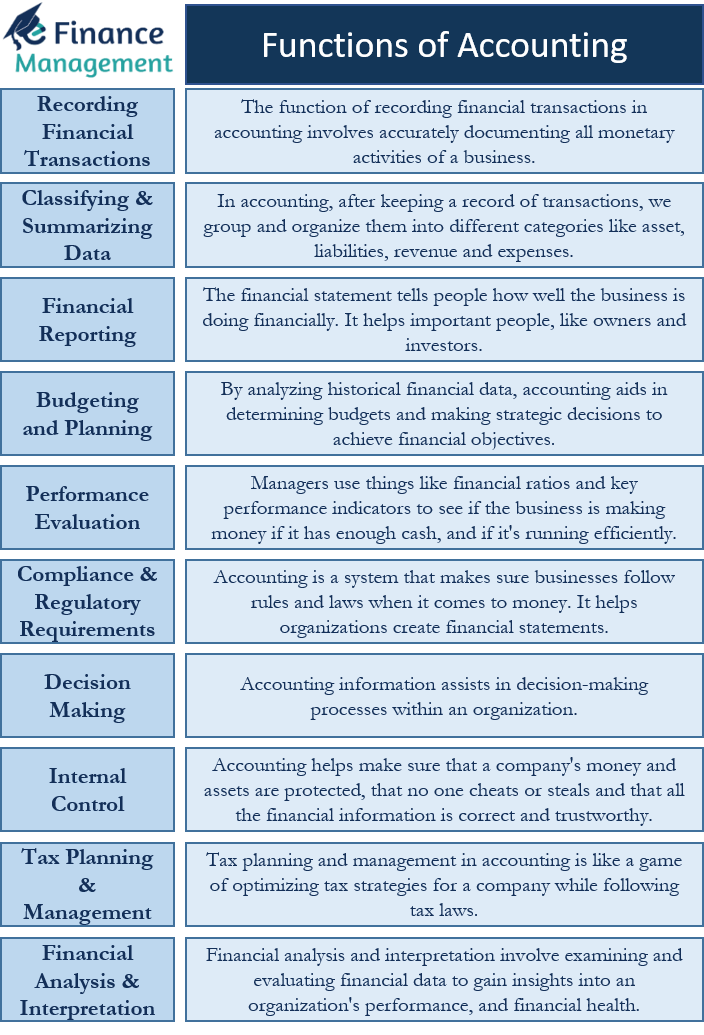

Accounting serves various functions within an organization. The primary functions of accounting include:

Recording Financial Transactions

Accounting is like keeping track of all the money stuff for a business. It means writing down every time the business gets money from sales or spends money on purchases, expenses, or investments. This function ensures that all financial activities are accurately documented and can be referred to for future analysis.

Classifying and Summarizing Financial Data

In accounting, after keeping a record of transactions, we group and organize them into different categories like money earned, money spent, things we own, and money we owe. This helps us understand our finances better. We use financial statements such as the balance sheet, income statement, and cash flow statement to organize and present this information. It’s like putting all your toys into different boxes so you can find them easily later.

Also Read: What is Accounting?

Financial Reporting

Accounting is like creating a report card for a business or organization. The financial statement tells people how well the business is doing financially. It helps important people, like owners and investors, make smart choices by giving them all the information they need to know about the business’s money situation.

Budgeting and Planning

Accounting is really important when it comes to making plans and deciding how to use money. It helps businesses figure out how much money they might make in the future, what they want to achieve financially, and how they can use their resources wisely. It’s like being the captain of a sports team who decides how much practice time each player should get, and how to use the team’s resources to win the game. By analyzing historical financial data, accounting aids in determining budgets and making strategic decisions to achieve financial objectives.

Performance Evaluation

Accounting helps us understand how well a business is doing. Managers use things like financial ratios and key performance indicators to see if the business is making money if it has enough cash, and if it’s running efficiently. This information helps the bosses and people who have a stake in the business (like owners and investors) see if the business is doing well or if it needs to change things.

Accounting serves as a fundamental framework for assessing the performance of a business. Various financial analysis tools, such as financial ratios, key performance indicators (KPIs), and other metrics, are utilized to evaluate profitability, liquidity, efficiency, and other crucial aspects of the organization’s operations. By leveraging this information, management and stakeholders can effectively gauge the success of the business and implement any required adjustments to enhance performance.

Also Read: Branches of Accounting

Compliance and Regulatory Requirements

Accounting is a system that makes sure businesses follow rules and laws when it comes to money. It helps organizations create financial statements based on agreed-upon accounting principles. These statements need to meet the standards set by groups like GAAP or IFRS and be shared with the SEC or tax authorities.

Decision Making

Accounting information assists in decision-making processes within an organization. Accounting helps management make smart decisions about investments, pricing, and other business choices by giving them important information about costs, revenues, and financial consequences. This data allows managers to understand the financial impact of different options and make well-informed judgments that support the organization’s goals and objectives.

Internal Control

Imagine that you have a big piggy bank where you keep your money. You want to make sure that your money is safe and that no one steals it. So, you create some rules and systems to keep everything in order. This is just like what accounting does for businesses. Accounting helps make sure that a company’s money and assets are protected, that no one cheats or steals and that all the financial information is correct and trustworthy. It includes procedures like segregation of duties, regular audits, and the implementation of accounting software and systems to maintain control over financial activities.

Tax Planning and Management

Tax planning and management in accounting is like a game of optimizing tax strategies for a company while following tax laws. Accountants are like experts who help companies figure out the best ways to save money on taxes. They do this by finding deductions and credits the company can use, and coming up with plans to pay less in taxes overall. This function helps businesses maximize tax savings, maintain compliance, and allocate resources effectively.

Financial Analysis and Interpretation

Financial analysis and interpretation involve examining and evaluating financial data to gain insights into an organization’s performance, and financial health. Accounting provides the foundation for conducting such analysis by organizing and summarizing financial information in a standardized format. In order to understand how well a business is doing, we can use different methods like comparing numbers and comparing to other businesses. These methods help managers, and investors know if a business makes enough money, has enough cash, and is efficient. This knowledge helps them make good decisions, find ways to improve and know if the business is doing well financially. Financial analysis and interpretation are essential for strategic planning, identifying growth opportunities, and evaluating the effectiveness of financial management strategies.

Conclusion

Accounting is used in many important ways in managing money for a business. It helps with things like keeping track of money coming in and going out, making plans for the future, and figuring out how to spend money wisely. Accounting is like the financial report card for a business. It shows valuable information about how well the business is doing financially. It helps people in charge of the business to make smart choices. In addition, accounting makes sure that businesses follow the rules and do things correctly. In a nutshell, accounting is crucial for a business to run smoothly and be successful.

Frequently Asked Questions (FAQs)

The purpose of financial reporting is to communicate the financial performance and position of an organization to stakeholders, such as investors, creditors, and management.

Accounting helps organizations develop financial forecasts, set financial goals, and allocate resources effectively by analyzing historical financial data and providing insights for budgeting and planning decisions.

Accounting provides information on revenues, expenses, assets, and liabilities, enabling organizations to effectively manage their financial resources, monitor cash flow, and make informed financial decisions.