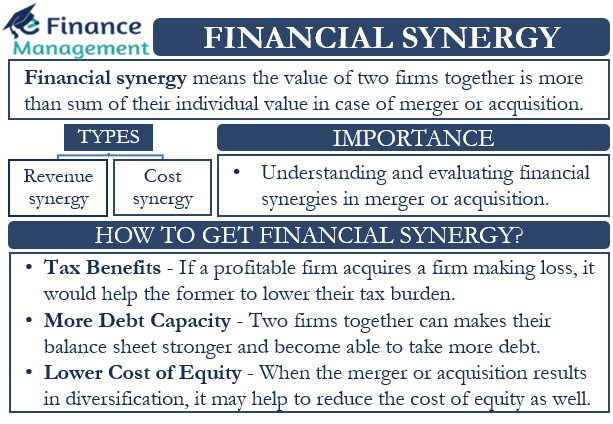

Financial synergy is a term that one would usually come across in the case of a merger or acquisition. Mergers and acquisitions happen mostly to achieve a better value. Hence, financial synergy simply means that the value of two firms together is more than the sum of their individual value. Or, we can say that the value that two firms create when they come together is more than if they were to operate separately. When this happens, we call it to be financial synergy or synergies.

One way to represent this synergy is using the following equation: V(A+B) > V(A) + V(B)

This means the value of A and B together is more than the sum of individual values of A and B. As we say, the sum of parts carries more value than the parts on a standalone basis.

The value of the new entity could increase because of betterment in the financial metric. This metric could be debt, earnings, and revenue. For example, the new entity is able to generate more revenue because of a larger client base.

One simple example of understanding the concept of this synergy is when taking a loan. If one small company approaches a bank to get a loan, the bank may charge more interest and may put stringent conditions. But, if this company merges with another small company, it would create a relatively bigger entity. This would make it easier to take a loan, and the bank also may charge lower interest.

Also Read: Cost Synergy – Meaning, Example, and Issues

How to Get Financial Synergy?

The new entity can have financial synergy due to more cash flows, tax benefits, lower CoC (cost of capital), a drop in cost due to streamlined operations, talent and technology harmonies, and more. Let us understand some of these in detail:

Tax Benefits

Companies can use existing tax laws to reap tax benefits, such as by using losses to lower taxes. If a profitable firm acquires a firm making loss, it will help the former to lower their tax burden. Also, one firm can use the depreciation charges of the other firm to lower the tax burden.

More Debt Capacity

When two firms come together, their cash flows, revenues, and earnings get more stable. This makes their balance sheet stronger, and thus, they may be able to take more debt or have more debt capacity. Moreover, the new firm would also be able to attain better interest rates and loan terms from the borrower.

Lower Cost of Equity

When the merger or acquisition results in diversification, it may help to reduce the cost of equity as well. This generally happens when a big company acquires a small one or a public firm acquires a private one operating in another industry. Even in the case of the same industry, lower competition from the acquisition of rivals, an increase in market share, and more customer base may also eventually result in a lower cost of equity.

Importance of Financial Synergy

Understanding and evaluating financial synergies are very important when considering a merger or acquisition. Because that may affect and make a huge difference in the success of a merger or acquisition, thus, an acquiring firm may even be ready to pay a premium for the target company if it believes that the acquisition or merger would result in considerable financial synergies.

Though we use financial synergies in a positive connotation, it could be negative as well. For instance, the bigger company may have to spend more costs on the other company, such as changing the management team, adding more systems in place, and more.

Other Types of Synergies

There are two more types of synergies:

Revenue Synergy

As the word implies, revenue synergy results in more revenues. Usually, the two companies that come together are not direct competitors but still deal in the same product. For instance, Company A sells new laptops, and Company B sells second-hand laptops. By coming together, the two companies will be able to achieve revenue synergy.

Cost Synergy

As the word suggests, cost synergy would result in cost savings for both companies. Taking the same laptop example, the two companies achieve cost synergy as well. This is because they are able to access the market of another company at no additional cost at all, and the resources can be put to best use now for both companies. Aggregation and volume drive the operational cost reduction.

Final Words

Financial synergy is very useful when evaluating mergers and acquisitions. Properly estimating and evaluating this synergy could play a decisive role in deciding whether or not a company should acquire or merge with another company.

Frequently Asked Questions (FAQs)

An entity can have financial synergy due to more cash flows, tax benefits, lower CoC (cost of capital), a drop in cost due to streamlined operations, talent and technology harmonies, and various other options.

It can be represented using the following equation:

V(A+B) > V(A) + V(B)