What are Liquidity Ratios?

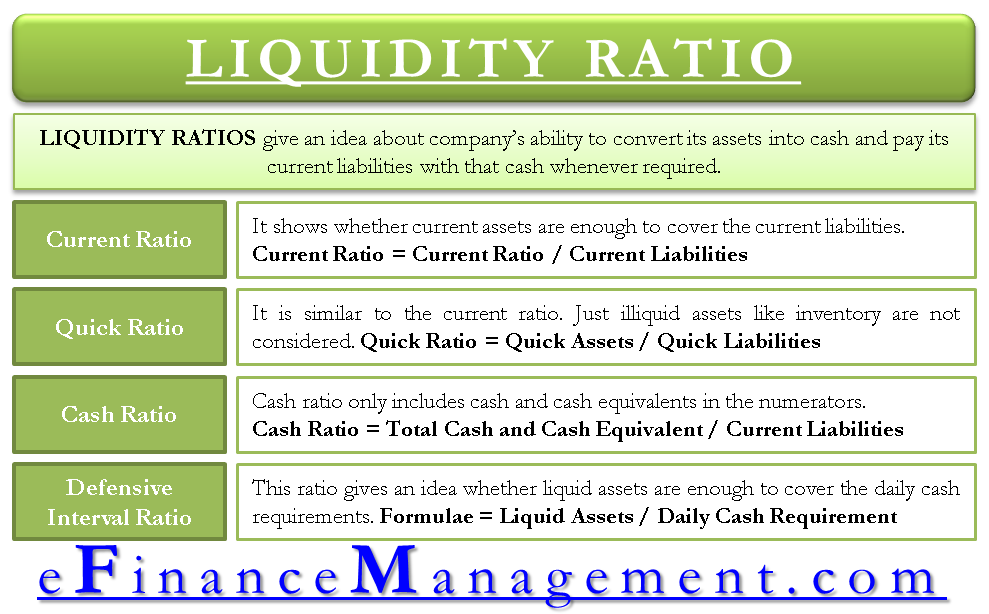

Liquidity ratios give an idea about a company’s ability to convert its assets into cash and pay its current liabilities with that cash whenever required. In simple language, they indicate the company’s ability to pay its short-term obligations whenever they are payable. These ratios focus on the company’s short-term survival, while solvency focuses on long-term survival.

Every organization has some level of cash requirement for keeping its operations functional. Companies that are able to meet their cash requirement from a source with minimum cost would maximize value for shareholders. Hence, the level of cash and liquidity of assets is very crucial for the survival of any organization. Liquidity is how easily a company can convert its asset into cash. Liquidity ratios help in analyzing such cash requirements.

Types of Liquidity Ratios

The followings are the different liquidity ratios a company uses:

Current Ratio

It is found by dividing current assets by current liabilities. It shows whether current assets are enough to cover the current liabilities.

| Current Ratio = Current Assets / Current Liabilities |

Learn more about it at CURRENT RATIO.

Quick Ratio / Acid Test Ratio

It is similar to the current ratio. However, it does not consider illiquid assets like inventory, forming part of current assets. Inventory can only be liquidated when there are buyers for the same. It won’t be easy to sell inventory in an economic downturn or emergency.

| Quick Ratio = Quick Current Assets / Quick Current Liabilities |

Refer to QUICK RATIO for more.

Cash Ratio

The cash ratio only includes cash and cash equivalents in the numerators. Cash and cash equivalents include cash and marketable securities.

| Cash Ratio = Total Cash & Cash Equivalents / Current Liabilities |

Read more at CASH RATIO.

Cash to Income Ratio

The cash to income ratio compares operating cash flow for each dollar of operating income. Operating income, here, can be replaced by the EBIT as both the terms are very similar to each other.

| Cash to Income Ratio = Cash flow from Operations (CFO) / Operating Income |

Keep reading CASH TO INCOME RATIOS.

Defensive Interval Ratio

A defensive interval ratio can be found by dividing liquid assets with estimated daily cash requirements. The daily cash requirement can be estimated from the past patterns of cash requirements. This ratio gives an idea of whether liquid assets are enough to cover the daily cash requirements.

| Defensive Interval Ratio = Liquid Assets / Estimated Daily Cash Requirements |

Keep reading DEFENSIVE INTERVAL RATIO.

Uses of Liquidity Ratios

Liquidity ratios are very useful for analyzing the liquidity position of the company. These ratios are for external as well as internal analysis. Analysts compare the liquidity ratios of one firm to another firm or the industry for comparative analysis. They are very useful to short-term creditors or lenders. Creditors have lent some amount to the company, and they would want to know whether the company will be able to pay that back in time or not. Also, they are used internally by the company itself to compare its liquidity position with the previous year. It gives an idea about changes in the liquidity position of the company.

The comparative analysis will be less reliable if companies are of different industries, locations, or sizes. It should be used to compare companies of the same nature.

Refer to RATIO ANALYSIS for other types of ratios.

good job

So insightful, I loved it. Thanks for this masterpiece.