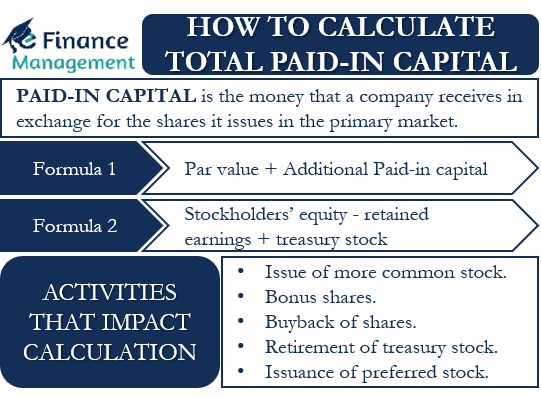

Paid-in Capital is the money that is received by the company from the public and investors at large for the issuance of its shares. As we know, every company has to raise the capital for its activities, and that needs to be partially or fully funded by Equity and Debt. Whatever money is arranged through the issuance of shares is called the Share Capital or Paid-in Capital. A point to note here is that the Paid-in capital does not include the ongoing sale of shares in the secondary market among the investors and existing shareholders. A Paid-in capital includes both common stock and/or preferred stock. Though Paid-in capital appears an easy concept, people often get confused when they try to calculate it. Usually, the confusion is regarding the items that come in calculating Paid-in capital. This article will cover how to calculate the total Paid-in capital.

Paid-In Capital And Additional Paid-In Capital

Before we detail how to calculate total Paid-in capital, it is important that we know that Paid-in capital is different from additional Paid-in capital. The paid-in capital includes both the stock’s par value and the premium for the stock. It also includes the cash or other assets that the shareholders would have offered to the company for getting the shares. The premium for the stock is the price at which a company sells stock above the stock’s par value. This premium or price above the par value is what we call additional paid-in capital. Briefly, the amount paid by the shareholders and investors over and above the face value of the stocks is the Additional Paid-in Capital.

We can also call Paid-in capital as contributed capital. The Paid-in capital boosts a firm’s stockholders’ equity. So, we can say that it is part of the subscribed share capital. And, in the balance sheet, Paid-in capital is shown as part of the Shareholders’ or Stockholders’ Equity. Paid-In Capital remains the critical and very important source of finances for any company. This is used for project execution as well as for setting off the business losses.

One can easily calculate the total Paid-in capital by going through just the company’s balance sheet. And we can calculate Paid-in capital in two ways. Both the ways are discussed below;

How to Calculate Total Paid-in Capital

Formula 1

A simple formula of paid-in capital is: Par value Plus Additional Paid-in capital (APIC)

The below steps will help us to calculate the total Paid-in capital using the available information from the balance sheet.

- Stockholders’ Equity

First of all, one has to look into the “Stockholders’ Equity” section on the liabilities side of the balance sheet.

- Values and descriptions of the items

Now, one needs to look for the values and descriptions of the items – Common Stock and Preferred Stock. We need to note down their values which would be next to their descriptions.

- Add Dollar Amount

After that, add the dollar amount of these two items. This will give us the company’s total issued share capital at the stock’s par value

- Items that gave premium or additional amount

Now, look for items that will give the premium amount or additional amount paid by the shareholders for the stock. To get that, one has to look for “Paid-in Capital in Excess of Par Value” for the Common Stock and Preferred Stock. Now we need to note down their dollar amounts/values.

- Additional Pain-In Capital

Thereafter, add the values/amount of the two we got from the fourth step. And this is the amount or value of the Additional Pain-In Capital.

- Add total par value and additional paid-up capital

Now add the numbers you got from steps three and fifth, i.e., add the total par value of the issued stock and additional Paid-in capital. The resultant number will be the total Paid-in capital.

Example

Let’s make it more clear to understand the calculation through an example.

Suppose Company A issues 100 shares having a face value of $10, at $25 per share. In this case, each share sells at a premium of $15.

In this case, the total par value of the shares will be $1,000 (100 * $10).

The additional Paid-in capital will be $1,500 (100 * 15)

So, the total Paid-in capital will be: $1,000 Plus $1,500 or $2,500.

Formula 2

Another formula to calculate paid-in capital is: Stockholders’ equity Less retained earnings Plus treasury stock

Retained earnings are the profit that a company retains in the business. The treasury stock refers to the stock that a firm re-purchases from the investors. A point to note is that the treasury stock is negative for the balance sheet because it lowers shareholder equity. But, it is positive for the Paid-in capital because it is part of the already issued shares, and it represents the shares that a company purchases with retained earnings.

Example

Let’s understand this with the help of an example.

Suppose Company A has stockholder equity of $50,000, retained earnings of $20,000, and treasury stock of $5,000.

The total Paid-in capital in this case will be: $50,000 Less $20,000 Plus $5,000 = $35,000.

Activities That Impact Paid-in Capital Calculation

Since Paid-in capital is all about stock, it is clear that most stock-related activities will impact the calculation of Paid-in capital. Primarily, the following activities impact the Paid-in capital calculation:

Issue of More Common Stock

If a company feels the need for more funds during a year, it can sell more shares to investors. This would increase the Paid-in capital of the business.

Bonus Shares

These are the shares that a company issues for free to the existing shareholders. The regulations across the countries generally provide for the specific resources from where the issuance of bonus shares can take place. And these resources are free reserves, securities premium accounts, or a capital redemption reserve account. If a company issues bonus shares, the Paid-in capital will rise due to the issuance of additional paid-up shares. But, the free reserves (or any other account) balance will reduce to this extent. It is important for us to know bonus shares don’t impact the total shareholders’ equity Block value.

Buyback of Shares

The shares that a firm re-purchases come in the shareholders’ equity at the cost of purchase. Such shares come under the item’ treasury stocks.’ If a company sells the treasury stocks over their purchase price, then the difference amount (or profit) from sale is credited in paid-in capital. But, if the sale is below the purchase price, then we deduct that loss from the retained earnings. And, if the sale of the treasury stock is at the purchase price, then we restore the shareholders’ equity to the pre-share-buyback level.

Retirement of Treasury Stock

When a company retires the treasury stock, it needs to reduce the par value of those shares from the paid-in capital. Consequently, the balance in the additional share capital account will also stand reduced.

Issuance of Preferred Shares

Similar to the issue of the common stock, the issue of more preference shares increases the balance of the Paid-in capital.

Final Words

So, now we know that all we need is the balance sheet information to calculate the total Paid-in capital. We can calculate the Paid-in capital using any of the above two formulas. Both would give the same results.