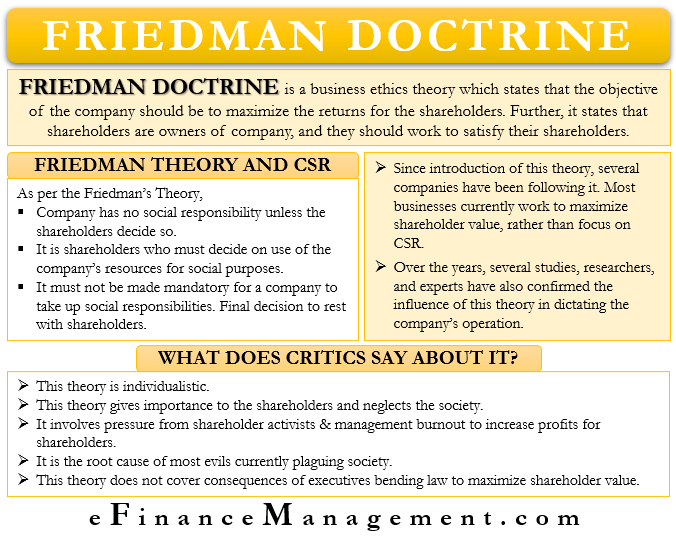

Friedman Doctrine or the Shareholder Theory relates to business ethics. As per this theory, the objective of a company should be to maximize the returns for the shareholders. The only business of the business is to do business and make money.

Milton Friedman, an American economist, came up with this theory in 1970. The theory, which appeared in the New York Times in 1970, suggests that a company does not have any social responsibility toward society. Instead, their most significant commitment is towards their shareholders.

Friedman argues that executives are merely employees of the owners. Hence, they must provide quality service to the owners first. Moreover, shareholders are company owners, and they should work to satisfy their shareholders.

Friedman Doctrine also notes that shareholders must make key business decisions. Or, an outsider must not make decisions that can affect the shareholders.

Friedman Doctrine and Social Responsibility

As per the Shareholder Theory, a company has no social responsibility unless the shareholders decide so. The theory states that the authority to determine social responsibility should rest with the shareholders, not the managers or executives.

Also Read: Shareholders Vs Stakeholders

Also, it is the shareholders who must decide on using the company’s resources for social purposes. Social responsibility, such as offering social amenities, is usually capital-intensive. Thus, they impact the financial resources of a firm. Hence, it is the shareholders who get to decide how to use financial resources.

According to Friedman, it must not be made mandatory for a company to take up social responsibilities. Instead, the final decision should rest with the shareholders.

Along with social responsibility, this theory also covers many other crucial topics, such as the role of directors, appraisal and measurement, compensation, and more.

Influence of Friedman Doctrine

Whenever there is a question like what are companies for, Friedman Doctrine is the first answer. Also, every business school book states that the goal of a company is to maximize shareholder value.

Since its introduction, several companies have been following the Shareholder Theory. Most businesses currently work to maximize the shareholder value rather than focus on CSR (corporate social responsibility).

Also Read: Agency Theory in Corporate Governance

Such companies have a goal to increase profits because this is what matters most to the shareholders. Also, when allocating resources, the executives of such firms give preference to maximizing shareholder value.

Over the years, several studies, researchers, and experts have also confirmed the influence of this theory in dictating the company’s operation. For instance, Harvard University professors Joseph Bower and Lynn Paine found evidence that the theory influences the financial community and the owners.

Criticism

Friedman Doctrine is hugely popular and relevant even after 50 years of its inception. However, it has got criticism as well. From the perspective of society, this theory is individualistic. Those against the theory believe it lacks on almost every front, be it financial, economic, legal, moral, or social.

The critics argue that this theory gives importance to the shareholders and neglects society. They believe that along with the shareholders, a company also needs a community to be successful. It is because a company eventually sells its products to the community. Moreover, the goodwill that a company creates in the community helps it to be successful. Thus, an entity has a responsibility towards society as well.

Moreover, the Friedman Doctrine has also received criticism for enriching a few corporate at the expense of the community. Even Paine and Bower, who support this theory, believe the doctrine comes with a few negative side effects. These include pressure from shareholder activists and management burnout to increase the profits for the shareholders.

Many also argue that maximizing shareholders’ value is the root cause of most evils currently plaguing society. These evils are racial inequality, economic inequality, hostile takeovers, climate change, and more.

Another criticism is that this theory does not cover the consequences of executives bending the law to maximize shareholder value. As per the theory, a company must operate within the law to make profits for the shareholders. However, there are several cases where executives bypass or bend the rules to make more profit.

Final Words

Companies still closely follow Friedman Doctrine and believe that maximizing returns for the shareholders will benefit society as well. Things, however, are slowly changing. The Business Roundtable, a group of CEOs of top companies, recently reached a consensus on doing away with the sole focus on the shareholders. Instead, they agree to make decisions that benefit all the stakeholders.

Business Roundtable represents 181 CEOs of the biggest firms representing about 30% of the total market cap. Their decision comes as a significant change for the CEOs who thus far focused only on profit maximization. However, it will be interesting to see how far these CEOs have now changed their focus from shareholders to stakeholders. So, the current consensus of business leaders, investors, policymakers, and leading members of the academic community is toward stakeholder capitalism.