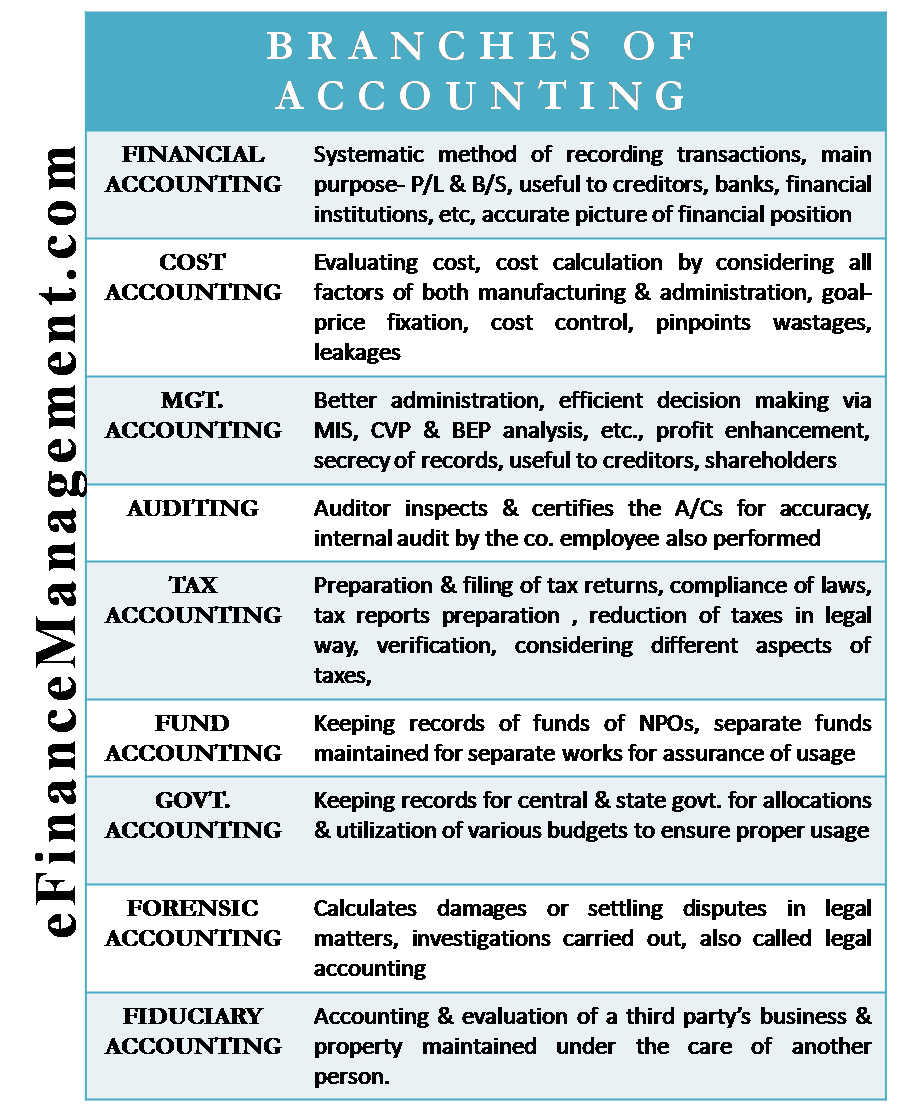

Different branches of accounting came into existence, keeping in view various forms of accounting information needed by different classes of people. They may be owners, shareholders, management, suppliers, creditors, taxation authorities, government agencies, etc. There are three main accounting branches: financial accounting, cost accounting, and management accounting. Other accounting branches are a result of commercial development and emerging needs of business reporting the world over.

Various Branches of Accounting

Financial Accounting

Financial accounting is a systematic method of recording any business transactions according to accounting principles. It is the original form of the accounting process. The primary purpose of financial accounting is to calculate the profit or loss of a business during a period and provide an accurate picture of the business’s financial position as on a particular date.

The Trial Balances, Profit & Loss Accounts, and Balance Sheets of a company are based on the application of financial accounting principles. These are useful for creditors, banks, and financial institutions to assess the company’s financial status.

Further, taxation authorities can calculate the tax based on these records only. These are just the primary help you can get from this accounting. Besides these, there are many other things, like knowing about bank balances, account receivables balances, account-wise summary, bank reconciliation, etc. The list is actually endless.

Browse through the category – financial accounting for more topics under this branch of accounting.

Cost Accounting

Cost accounting deals with evaluating the cost of a product or service offered. It calculates the cost by considering all factors, including manufacturing and administrative, that contribute to output production. The objective of cost accounting is to help the management fix the prices and control the cost of production. It also pinpoints any wastages, leakages, and defects during manufacturing and marketing processes. Possibly, these short descriptions about the accounting branches may give an overlapping understanding of each branch of accounting.

Further, to understand the line of difference, we suggest reading – Cost Accounting vs. Financial Accounting – All You Need to Know.

Management Accounting

This branch of accounting provides information to management for better administration of the business. It helps in making important decisions and controlling of various activities of the business. The management can make decisions efficiently with the help of various Management Information Systems such as Budgets, Projected Cash Flow and Fund Flow Statements, Variance Analysis reports, Cost-Volume-Profit Analysis reports, Break-Even-Point calculations, etc.

Management accounting and financial accounting are not to be confused with each other. Both are different. Management accounting serves the management’s needs in decision-making regarding minimizing the cost factor and enhancing profit-making. On the other hand, financial accounting serves the needs of shareholders, creditors, and financial institutions to ascertain the company’s financial position. Management accounting records are kept secret for the use of management only. As a result, they are not made public.

For more details, you may refer to Management Accounting vs Cost Accounting.

Besides the above-mentioned three branches of accounting, there are many other branches that are in practice and very useful for various purposes, as mentioned below:

Auditing

Auditing is a branch of accounting where an external certified public accountant, known as an Auditor, inspects and certifies the accounts of the business for their accuracy and consistency. Sometimes internal auditing is also practiced where an employee of the same company or external personnel audits the accounts regularly and aids the management keep accurate records for audit purposes.

In most countries, the auditor who certifies the accounts is the company’s statutory auditor. These auditors have to be at an arm’s length distance with the company. This means they should not be able to get direct benefits from the company. On the other hand, the company should not be in any way related to these auditors. So that they can independently inspect and report about the status of their accounts. In listed companies, shareholders appoint these auditors. At the same time, the management of the company appoints internal auditors. These statutory auditors are responsible for reporting the right state of affairs to the shareholders of the company.

Tax Accounting

Tax Accounting deals with taxation matters. Its functions include preparing and filing various tax returns and dealing with their legal implications. Tax accountants help minimize tax payments and help financial accountants prepare financials for tax reporting to various authorities.

Tax accounting involves consultancy regarding the effect of taxes on different aspects of business, minimizing tax through legal ways, and also verifying the consequences of tax payable on business. We usually call this practice as tax planning. There is a big difference between tax planning and tax evasion. Broadly, tax planning means trying to minimize tax liability within legal boundaries. Whereas tax evasion is a crime. When a company enters into practices to evade tax, the tax authorities may put them in trouble.

Fund Accounting

It deals with keeping records for funds of non-profit business entities. Most importantly, separate fund accounts are maintained for separate works like welfare schemes of different natures to ensure proper funds utilization. If such an entity has raised ‘x’ funds for helping educate children and ‘y’ funds for widow women. Fund accounting ensures that the funds for the designated causes are utilized for the same purpose without any deviations.

Government Accounting

This branch of accounting is prevalent in Central Government (National Government) and State Government budget allocations and utilization. Keeping records ensures proper and efficient utilization of the various budget allocations and the safety of public funds.

Forensic Accounting

Forensic Accounting, also known as legal accounting, enables calculating damages or settling disputes in legal matters. It involves deep investigations and carrying out recalculations to evaluate the accounting. Such accounting techniques normally come into play when there are suspects of fraud or mismanagement inside an entity.

Fiduciary Accounting

It is the accounting and evaluation of a third party’s business, and property maintained under the guardianship of another person. To further clarify, assume there is a company that has filed for bankruptcy. In such situations, the whole function of accounting goes under the guardianship of a person or set of people who are not directly related to the company. We are referring to such a branch of accounting as fiduciary accounting.

Responsibility Accounting

As the name responsibility accounting suggests, here a person is assigned the responsibility of costs and budgetary control. It defines various responsibility centers such as cost centers, profit centers, investment centers, etc. It is, therefore, responsible for the internal accounting of these centers.

Quiz on Branches of Accounting

This quiz will help you to take a quick test of what you have read here.

can i get the importance of these branches of accounting ?

Not clear words in you tube videos its video is good ? helps for studies CMA

Everything is very open with a precise clarification of the challenges. It was definitely informative. Your website is extremely helpful. Thanks for sharing!

of course, I like your web site and I will certainly come back again.

please what about the significant of these branches of account?

what is human resource accounting?

Thanks, Sanjay and this blog very interesting

Sorry , which one is accounting information

hi please send the pdf of inflation accounting and it types

it is an humble request

thanks you

Is there any difference between branches of management accounting and branches of Accounting

Yeah, Management Accounting itself is a branch of accounting.