Hyperinflation: Meaning

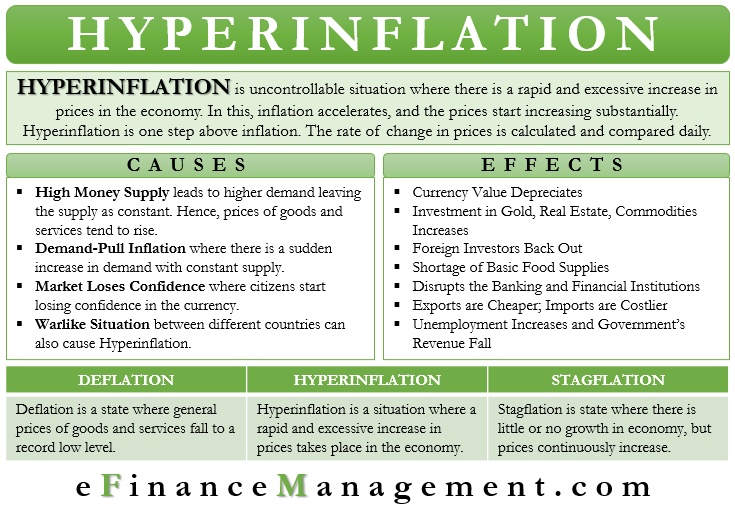

Hyperinflation is a situation where a rapid and excessive increase in prices takes place in the economy. It is an uncontrollable situation where actually inflation accelerates, and prices start increasing substantially. As the term says, ‘Hyperinflation’- is a continuous increase in inflation. In economic terms, Inflation is a price rise of goods and services. While Hyperinflation is one step above inflation, it is a situation of extensive price rise of basic goods and services. Since the rate of price rise is unusual and quite high, some writers have indicated that the price may rise as high as a rate of 50% in a month.

The inflation rate is calculated monthly, i.e., where prices of goods and services are calculated and compared over a month’s period. On the other hand, in Hyperinflation, since the rate of price rise is quite high, sometimes the rate of change is calculated and compared daily. Generally, in this, the price increases by 5%-10% on an everyday basis. In the state of Hyperinflation, the most vulnerable and most affected countries remain the developing countries, as per the conclusion of various studies conducted by the experts.

Causes of Hyperinflation

Below is the list of non-exhaustive causes of Hyperinflation:

Higher Money Supply

Inflation works on the basic mechanism of demand and supply. When the supply of money increases, the amount of disposable money with citizens of the country also increases. As a result, citizens tend to spend more money and also ask for more goods and services. In this situation, the supply of goods and services is constant, but demand increases. However, since the production capacity remains the same, the prices of goods and services tend to rise. And this leads to inflation.

In the case of Hyperinflation, the country’s government increases the money supply in the system by printing more money. Along with printing more money, if the government has not taken enough steps to increase the Gross Domestic Product (GDP) of the country, this can lead to Hyperinflation. Consecutive economic growth steps should also support the increase in the money supply.

Also Read: Inflation

When manufacturers realize a high disposable income with consumers and not enough economic growth supported by the government, additional capacities are not there. They start charging very high prices. Since there is more money in circulation and high disposable income among the citizens, they start overspending and splurging it more. Thus, this vicious circle of continuous price rises daily ultimately leads to a Hyperinflation state.

Thus an increase in the money supply without increasing GDP is one of the major causes of Hyperinflation.

Demand-Pull Inflation

Hyperinflation can occur because of demand-pull inflation, where there is a sudden increase in demand with Constant (same) supply leading to a price rise. High demand can be attributed to increasing exports, increasing both government & citizens’ spending, etc. Such High demands can cause shortages and ultimately lead to Hyperinflation.

Market Loses Confidence

The third cause is that the citizens start losing confidence in the currency. They either shift to a barter system or some international currency. This is one of the biggest failures for the country’s government, where the domestic currency’s authenticity is questioned.

Warlike Situation

The war between different countries can also cause Hyperinflation. Depression in the economy can also attract Hyperinflation.

Effects of Hyperinflation

Currency Value Depreciates

In the state of Hyperinflation, the currency depreciates at a record low in the FOREX market. All the negative triggers in the economy and the financial market make the public quite uncertain and scary about the domestic currency’s real value. In other words, all sorts of confidence and belief break loose for the value and stability of the domestic currency. In such a situation, Citizens of the country try to invest in more stable assets or financial security and may divert their investments to out of the country.

Investment in Gold, Real Estate, Commodities Increases

As the citizens don’t have confidence in the domestic currency, they try to put their money in more solid assets or financial securities. In a Hyperinflation situation, gold or, say, bullion becomes the most trusted and liquid asset. Thus the demand for gold increases in this situation. Real estate and Commodities are also more stable than currency. As a result, citizens start investing more in such areas.

Foreign Investors Back Out

Generally, it takes at least one year or so to get out of the spiral of Hyperinflation. Thus foreign investors are the first ones to take out their investment and back off. Unless they are not reimbursed with an extra interest rate that would balance the depreciating currency, they don’t prefer staying.

Shortage of Basic Food Supplies

As Hyperinflation expands its roots in the country, the citizens of the country start pilling and stocking of basic food supplies. This stocking up even creates more shortages leading to price rises. So the spiral price rises vicious circle sets in.

Disrupts the Banking and Financial Institutions

As Hyperinflation depreciates the local currency, the value of loans and advances made by the banks almost loses its value. The value of loans and advances was much higher than their current market value. The deposits also decrease as citizens stop investing. As a result, these banks and financial institutions lose cash and, at times, turn bankrupt.

Exports are Cheaper; Imports are Costlier

In this situation, the most beneficiary companies are exporting companies. As the currency has depreciated a lot, the exports become cheaper for the importing countries, so the volume goes up. These exporting companies still can play with their prices, thereby increasing their profits. In contrast to this, the imports of the country become more costly. Domestic companies halt their imports due to depreciated domestic currency. The high cost of production would have already played their havoc on the current demand.

Unemployment Increases and Government’s Revenue Fall

At times, Hyperinflation causes domestic unemployment to increase to a record high. With the downturn in the business and GDP growth, the government resources also start reducing and may get squeezed a lot. Thus, tax revenues fall for the government during this time, making it cashless.

Deflation Vs. Hyperinflation Vs. Stagflation

Deflation is a state where the general prices of goods and services fall to a record low level. It means the prices are way lower than the actual value. It is when inflation is 0%.

Stagflation is a state where there is little or no growth in the economy, but the prices are continuously increasing. It is a state with almost stagnant economic growth, no more employment opportunities coupled with high inflation. Central banks and the affected Countries make all-out efforts to avoid getting trapped in this situation.

Hyperinflation is completely different from both Deflation and Stagflation. But each one of them is having its own flaws, causes, and effects. The best for an economy is a slight inflationary condition in the economy. It means that the country is growing, GDP is growing, investment and capacity building is happening, fresh employment opportunities are there, etc. Thus a little inflation is always good; extremes on both sides are devastating and will impact the long-term outlook.

Real-examples of Hyperinflation

- Germany has faced a major Hyperinflation around 1923 after the end of World War I.

- China faced Hyperinflation in the year 1940, where the highest inflation rate of 320% was there.

- In recent times, in 2006, Zimbabwe was hit by the Hyperinflation of the highest 1730%. The unemployment rate had exceeded 70%.

Thus above-mentioned were a few examples of countries that faced Hyperinflation. Many counties have gone through this vicious cycle.

Conclusion of Hyperinflation

The Central Banks and the country’s monetary regulatory authority take preventive actions to ensure the country does not reach Hyperinflationary levels. Once the country is in a Hyperinflationary stage, it becomes very difficult to come out. The Federal Reserve of the United States and Central Banks of other countries keep monitoring the situation and uses and tweak monetary policies to take control of inflation. If the respective country takes care of its money supply and economic growth, Hyperinflation can be easily avoided.