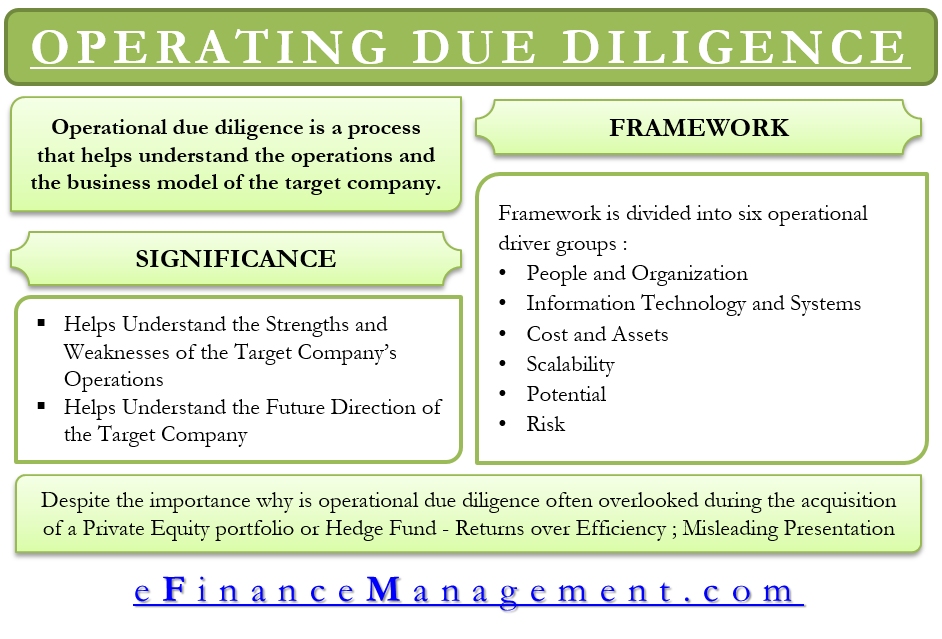

As part of overall due diligence, the operational due diligence process helps to understand the operations and the business model of the target company. During a merger or an acquisition, it is in the interest of the acquirer to ensure that the target company is a good fit for the buyer. Studying the business model and operations of the company helps in making this decision.

Significance of Operational Due Diligence

Like any other due diligence, operational due diligence focuses on gauging risk exposure. Analysis of the operational area of the target company is crucial to any merger or acquisition due to the following reason –

Helps to Understand the Strengths and Weaknesses of the Target Company’s Operations

Operations are the base of any company. Suppose a company is making the world’s best cookie, but the cookie is not reaching the market on time due to operational inefficiency. Will it ever be profitable?

During operational due diligence, the acquirer aims to recognize the strengths and weaknesses in the operations base of the target company and then make the buying decision. The buyer considers the weaknesses to check the risk and if he can eliminate those risks by some value addition in the M&A deal.

Helps to Understand the Future Direction of the Target Company

Operational due diligence helps understand the pace and direction of the target company. By understanding the operational drivers of the target company, such as competencies, capabilities, potential, efficiency, etc., the buyer gets well equipped with data to determine future profitability. Therefore we can conclude that operational due diligence helps in making the buying decision.

A Framework of Operational Due Diligence

We can divide the framework of operational due diligence into six operational driver groups, namely – people and organization, IT and systems, cost and assets, scalability, potential, and risk. These group drivers are further subcategorized into operational drivers. Let’s look at these in detail –

People and Organization

Operations mean the workings of the company. The company cannot work by itself; the people in the organization does the work. This makes the investigation of the target company’s people and organization the most important area of operational due diligence. This area includes the following drivers –

- Employee Capabilities – This driver involves the assessment of an employee’s education, skills, and work experience. It also assesses the management’s leadership skills, reliability, integrity, and transparency.

- Organization Structure – Study of target company’s organizational structure, roles and responsibilities of employees, hierarchy and department classifications, functions, inter-department communication, decision-making process, and SWOT analysis.

- Personnel Infrastructure – This area is all about human resource management. How much salary each does an employee get? What benefits do they get? What is the reward structure? And what is the employee growth structure? Are plans in place to upskill, train and educate current employees? Etc.

- Corporate Culture – The culture of a company is very subjective in nature. However, it is important to understand the culture of the target company to determine the fit with the acquirer.

Information Technology and Systems

In IT due diligence, investigates the entire IT infrastructure of the target company. In contrast, in this driver group of operational due diligence, the investigation is conducted on the technology aiding the operations of the target company. The drivers under consideration are as follows –

- Data – Is there sufficient data storage facility in the target company? Is the data safe and protected? Are the recovery systems in place in case of data lost?

- Systems – The systems of the target company are investigated. These include – software, network structure, interconnectivity, firewalls, business systems, etc.

- Tools – IT tools include everything that helps maintain the IT infrastructure. These include hardware, communication devices, program tools, etc.

The goal here is to ensure that the IT and systems are in place to run smooth operations in the company.

Read more about other Types of Due Diligence here.

Cost and Assets

- Cost – Cost is one of the major drivers in operational due diligence. A business can be easily summed up in its cost-benefit analysis. If the cost rides too high, the company loses its competitiveness in the market. Cost analysis in operational due diligence analyses fixed and variable costs such as – raw material, labor, electricity, tooling cost, management costs, selling and distribution costs, etc.

- Assets – Let’s understand this driver with an example. Suppose a company manufactures and sells potato chips. Its manufacturing line has a capacity of 10,000 kg chips per day. One Monday morning, the fryer of the production line malfunctioned and broke down. It took one and a half-day to repair the fryer. The direct loss to the company is 15000 kg chips, and the indirect loss is delays in delivery and customer dissatisfaction. This example clearly describes the importance of assets in the operations of a company. Therefore, the acquirer investigates the quality and maintenance of the operational assets of the target company.

Scalability

Operations of a company can help understand the future path of the company. When the acquirer is making a buying decision, he wants to know how fast and how big the target company can get for him to earn a good return on investment. For this, the operational due diligence aims to understand the following drivers –

- Competencies and capabilities – Does the target company has competencies and capabilities to scale, for example – efficient sales staff to increase sales, efficient production department to match quality production of the increased sales, effective management to lead the company, etc.

- Technologies – Technologies are as important as competencies and capabilities. The question asked is, does the company have the technology – manufacturing or otherwise, to scale rapidly, or can it update its current technology?

Potential

Potential is an operational driver that can make or break the buying decision. By definition, the potential is a mix of latent qualities or abilities of the target company that may develop and lead to success in the future. During an M&A transaction, the acquirer is looking for future success. Thus the potential of the target company is very important. Potential comes from the following two drivers –

- Rationalization – This driver considers if the acquirer can restructure some operations in the target company. That can result in significant cost reduction. Reduction in cost directly leads to competitive advantage.

- Efficiency – On the flip side, efficiency is another driver that can prove to provide an extreme competitive advantage. A very good example to understand efficiency is Zara’s efficient supply chain. Zara is a world-famous clothing retailer. It has a record time of adapting design, manufacturing, and distribution within two weeks of the original design first appearing on the catwalk. While other retailers prepare for months to stock for one season, Zara’s thrives in an extremely competitive market due to its operational efficiency. The question that the acquirer asks – does the target company has any such operational efficiency? If not, is there a potential for development in the near future?

Risk

The final goal of any due diligence is to identify the risks in the merger and eliminate them. The principle is the same for operational due diligence. The risk drivers include factors such as risks of material, assets, or goods; manufacturing quality and capacity; customer satisfaction, and financial performance.

Operational Due Diligence in Private Equity and Hedge Funds

There are some instances when the target company is private equity or a hedge fund. It is very easy to overlook operational aspects in these acquisitions because the buyer focuses on the past returns that the portfolios have provided. However, operational due diligence in such M&A transactions has gained immense momentum due to prominent past failures. Some glaring examples include the failure of Amaranth Advisors and the Bayou Hedge Fund Group.

Here a question arises –

Despite the importance, why is operational due diligence often overlooked during the acquisition of a Private Equity portfolio or Hedge Fund?

There are multiple reasons –

Returns over Efficiency

Firstly, it is important to understand that a rather major chuck of operational efficiency comes from the human touch. To conduct a thorough operational due diligence, the acquirer has to dive in and understand employee experiences and problems. It is very easy to avoid this step because the performance of private equity or hedge fund is calculated based on returns on its portfolio. If, for example, a hedge fund is generating an 18% portfolio when the general return in the market is 5%, the acquirer will be biased and forget the issue of operational efficiency.

Misleading Presentation

Generally, fund managers are earning commission on the income they earn for their investors. Even though they earn a fixed salary, their major income comes from commissions. Therefore these fund managers are biased to exhibit operational issues that put them in a better position to attract and retain investors. If the acquirer is not careful and takes the reports on the fund manager of the target at face value, they tend to make mistakes.

So one might question, why to not invest in a hedge fund that is generating 18% returns for their investors? Who cares about operations?

The answer lies in history. It is very easy to generate high returns with very little discipline in a bullish market. Even when the general market yield is 5%, an intelligent but undisciplined fund manager can easily earn extra returns on investment by using the most basic tools. The discipline of operational due diligence comes into play when the markets are bearish. In the global meltdown of 2008, so many hedge funds shut down. Because they weren’t in a discipline in their operations, their business model was not as strong as it should have been.