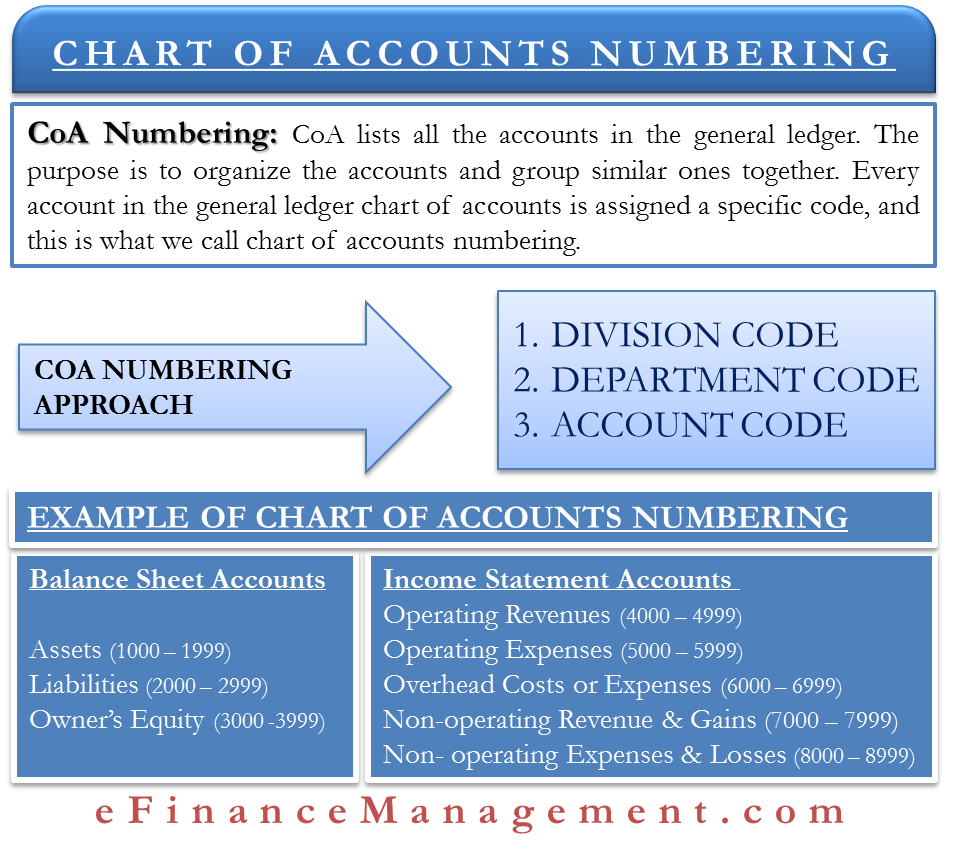

A Chart of Accounts lists all the accounts in the general ledger. The purpose is to organize the accounts and group similar ones together. Every account in the general ledger is assigned a specific code, and this is what we call a chart of accounts numbering. The chart of accounts is very crucial for a company’s accounting system.

Understanding the chart of accounts and its purpose is a must for numbering. We recommend reading the chart of accounts article prior to beginning with the chart of account numbering.

You can see it as a cabinet system, where each cabinet has a different set of files. Each set of files contains a different set of accounting information. To differentiate the cabinet or to easily identify which cabinet contain which file, we number files in a particular series. This is what companies do in the chart of account numbering.

CoAs are easily customizable to reflect the company’s operations. However, a company must prepare them according to the Generally Accepted Accounting Principles (GAAP) and Financial Accounting Standards Board (FASB) guidelines.

Also Read: Chart of Accounts Example

Chart of Accounts Numbering Approach

Division Code

It is usually a two-digit code that defines the specific company division within an organization. A company could define its divisions on the basis of its products, different geographies, etc. A company with a single division does not require division coding. This code is usually a two-digit number but can be three digits depending on the number of divisions a firm has.

Department Code

Like the division code, the department code is usually a two-digit code. It defines various departments within a division. A division will usually have various departments such as accounting, production, engineering, and so on. In order to identify the departments in a division, an account manager can use two to three-digit codes.

Account Code

These are the codes defined for the ledgers. Most organizations keep this as a three-digit code and assign these to the accounts such as assets, liabilities, expenses, revenue, and so on.

For instance, a multi-division company would have a chart of accounts numbering in the following manner: ZZ-AA-123.

- The ZZ represents division.

- AA is for the department.

- 123 is for accounts (general ledgers).

If the company is a single division with multiple departments, the number pattern could be something like AA-123. Finally, a small business with no departments at all could have only a three-digit code assigned to its accounts, such as 123.

What Should be the Code?

The code depends on the complexity of the business and the details that the accounting manager wants from the financial reporting system. These codes are usually numeric but could be alphanumeric as well. There is no strict rule on the code pattern, but usually, the numeric codes work best because of the simplicity of feeding it into the normal keyboard.

After setting the coding pattern, the companies move on to assigning the numbers to the division, department, and accounts.

Accounts and their Numbers

Let’s focus on account codes in this section. In the chart of accounts, companies usually list accounts in the order they appear in the financial statements. The first is the balance sheet accounts, followed by the income statement. Many companies, however, structure the chart of accounts in a way that all departments have the same set of expense accounts. The management always wants the numbering to be consistent so as easily compare the performance of different years.

When an accounts manager lists the accounts in the CoA, there should be a numbering system to ensure easy identification. While bigger businesses usually stick with four or five-digit numbers, small businesses use three-digit numbers. A company may leave additional space at the end for future transactions.

Following are the usual accounts that get the numbering.

Assets

Assets usually fall into two categories – current assets and fixed assets. One can easily convert current assets into cash, such as checking accounts, savings account, money market, accounts receivables, inventory, and so on. Current assets normally get the codes from 10000 to 14999, but again there are no hard rules for the same. Fixed assets, on the other hand, get codes from 15000 to 17999. The range for intangible assets could be 18000 to 19999. The table below is an example of how companies number their assets.

| Account Group Description | Account Number | |

| From | To | |

| ASSETS | ||

| Current Assets | ||

| Cash & Cash Equivalents | 10000 | 10999 |

| Accounts Receivable | 11000 | 13999 |

| Inventories | 14000 | 14999 |

| Property and Equipment | ||

| Land & Building | 15000 | 15999 |

| Plant & Machinery | 16000 | 16999 |

| Furniture | 17000 | 17999 |

| Intangible Assets | ||

| Trademark | 18000 | 18999 |

| Patent | 19000 | 19999 |

Equities & Liabilities

Similar to the numbering done for assets, liabilities also get numbering on the basis of current and non-current liabilities. Look at the table below to know how companies number the accounts under equities & liabilities.

| Account Group Description | Account Numbers | |

| From | To | |

| EQUITIES & LIABILITIES | ||

| Share Capital | 20000 | 20999 |

| Accounts Payable | 21000 | 24999 |

| Other Current Liabilities | 25000 | 27999 |

| Long Term Liabilities | 28000 | 29999 |

Revenues

| Account Group Description | Account Numbers | |

| From | To | |

| Revenues | ||

| Revenue from Operations | 30000 | 35999 |

| Other Income | 36000 | 39999 |

Expenses

| Account Group Description | Account Numbers | |

| From | To | |

| EXPENSES | ||

| Cost of Revenue | 40000 | 42999 |

| Service and Others | 43000 | 43999 |

| General and Administrative | 44000 | 45999 |

| Sales and Marketing | 46000 | 46999 |

| Research and Development | 47000 | 47999 |

| Other Expenses | 48000 | 48999 |

| Provision for Income Taxes | 49000 | 49999 |

Best Practices

A company can improve the chart of accounts numbering by following the below points;

Consistency

One must try to create a chart of accounts that would not change frequently. This allows the company to compare the results over a multi-year period

Numbering

Avoid concurrent numbers for your accounts because you may have to add more accounts in the future. If you don’t make provisions for future accounts now, you may not be able to add new accounts in the correct order.

Easy Consolidation

If a company has subsidiaries, then it should make them follow the same pattern for the chart of accounts. This makes it easier to consolidate the results of all companies.

Periodical Review

It is important that a company reviews the chart of accounts from time to time. This will allow the company to weed out unused accounts and consolidate duplicate accounts. Such a periodical review helps the company keep a check on the number of accounts.

Also, refer to our article Chart of Accounts Example to get the essence of the whole numbering process.