A chart of accounts is a list of all the general ledgers (accounts) organized in groups and sub-groups of accounts. This is the heart of the whole accounting system of any company. In any accounting software, after introducing a company, the first step is defining a chart of accounts so that locating general ledgers for recording each transaction becomes effortless.

What is the Purpose of Creating a Chart of Accounts?

Let’s first understand what is the purpose of accounting. The end result of accounting is to generate financial statements such as the Income Statement and the Balance Sheet for reporting to its stakeholders. There are pre-defined formats issued by reporting authorities under different statutes. The purpose of creating a chart of accounts is to organize the accounting activity in such a manner that it serves all the reporting requirements of all the stakeholders.

Explanation with Example

Let’s take an example, ABC Company has its bank accounts with Citi Bank and Standard Chartered Bank. Look at the table below, these two banks have general ledgers configured under the account group of ‘Bank Accounts’ which are further configured in the hierarchy beginning with:

Assets > Current Assets > Cash and Cash Equivalent > Bank Accounts.

| Chart of Accounts | Group and Ledgers |

|---|---|

| – ASSETS | Main Group |

| – Current Assets | Sub Group |

| – Cash and Cash Equivalents | Sub Group |

| – Bank Accounts | Sub Group |

| – Citi Bank Ac No. 54654832 | General Ledger (Account) |

| – Standard Chartered Ac No. 85858115 | General Ledger (Account) |

| + Cash and Petty Cash | Sub Group |

In the above example, we have only drilled down current assets up to the bank accounts for the sake of understanding. All the accounts a company creates will be part of any of these groups and sub-groups. So, the chart of accounts is the comprehensive list of all the accounts (general ledgers) a company has grouped in the above manner.

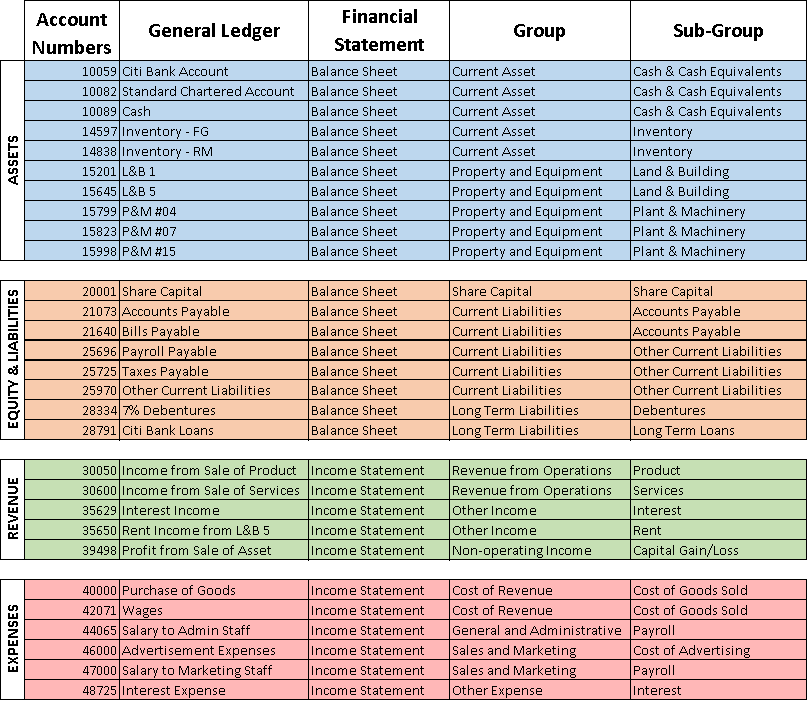

The above table provides a raw explanation of how these ledgers get configured for the purpose of reporting. Now, let us look at another example of a chart of accounts to get a basic idea about its numbering.

The first column shows the numbers assigned to each ledger (shown in the second column). These numbers are the main elements of a chart of accounts. The third column determines the financial statement under which these will be configured after getting clubbed under the group and sub-group as shown in the 4th and 5th columns.

Continue reading Chart of Accounts Numbering to learn more about how a company organizes its chart of accounts.

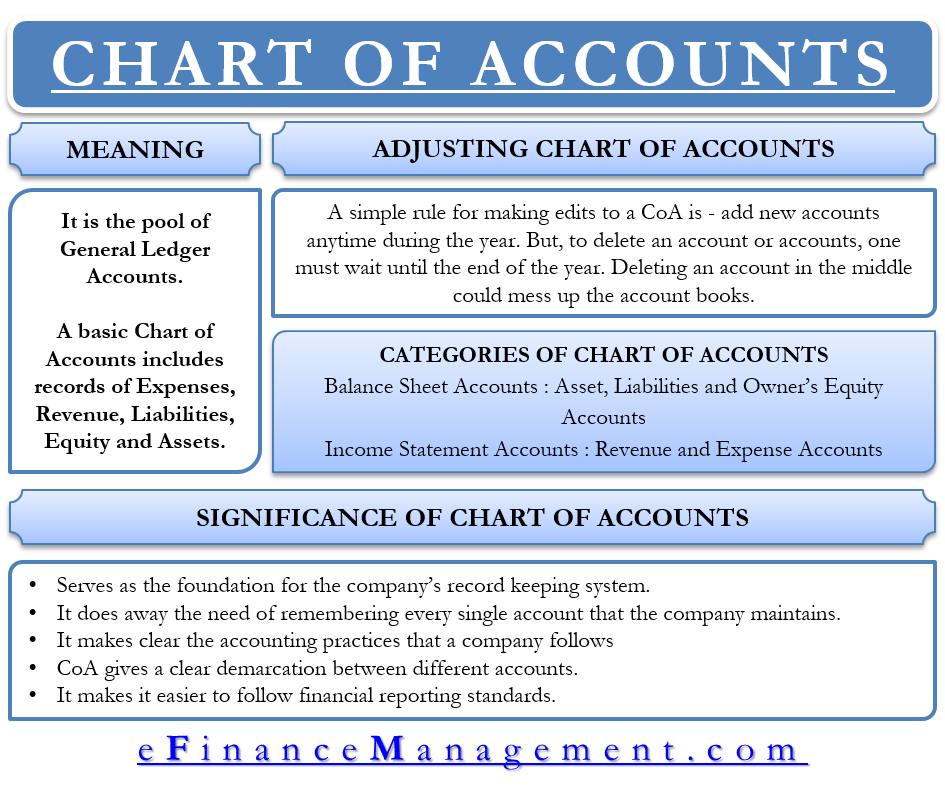

Significance of Chart of Accounts

- It serves as the foundation for the company’s record-keeping system.

- CoA works as the map of the entire financial accounting that the company is following.

- A logical and properly structured chart of accounts makes it easy for an accountant to identify the right ledgers while recording transactions.

- It makes it easier to follow financial reporting standards.

this is excellent article

well done

This is an excellent article. Well done