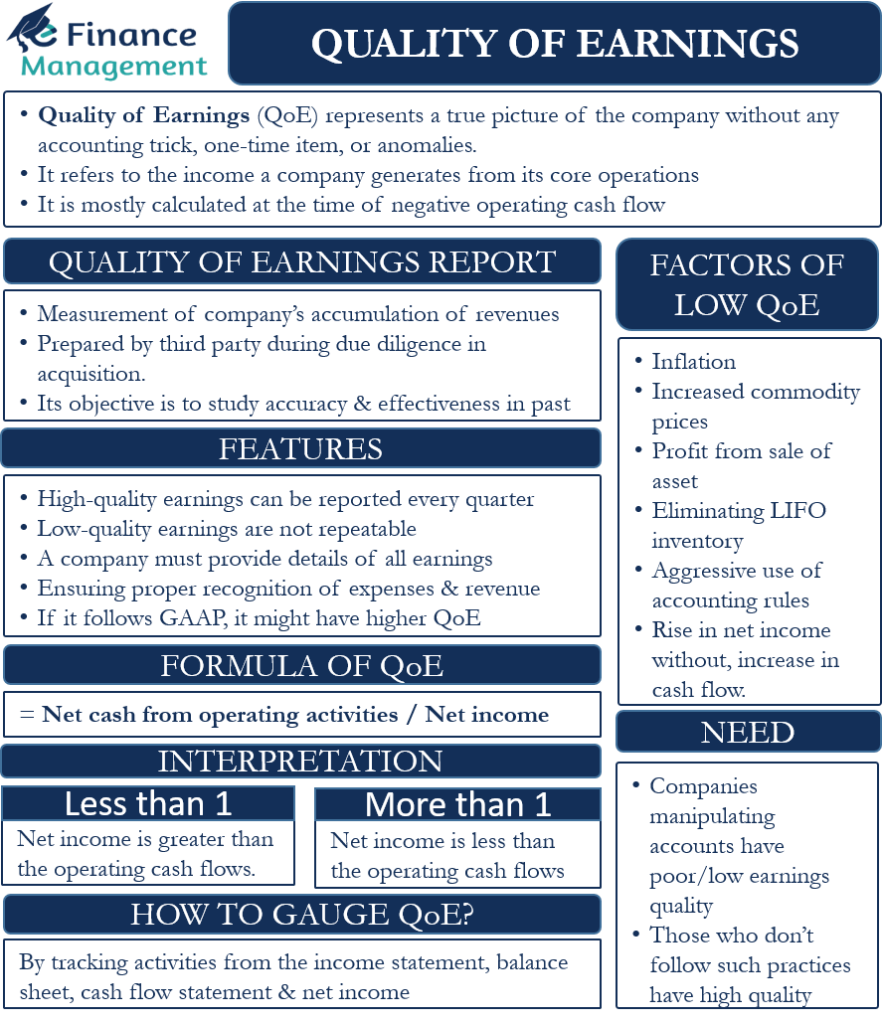

Quality of Earnings (QoE) represents a true picture of the company without any accounting trick, one-time item, or anomalies. Or, we can say it refers to the income that the company generates from its core operations. Often it is seen that net income does not represent the true financial picture of a company. It may happen that a company reports a massive net income, but its operating cash flows are negative. One can’t say that the company is financially sound in such a case. Thus, to get the true position in these cases, we calculate the quality of earnings.

What’s the Need?

It is easy for the company to manipulate earnings numbers by using a myriad of accounting conventions. Some manipulate earnings to lower their tax liability, while others do to make the company look better to investors and analysts.

A company can also manipulate earnings measures, such as price-to-earnings ratio (PE) or earnings per share (EPS). By buying back shares, a company can reduce the number of shares outstanding. This way, it can boost the EPS even if the net income is not growing. When EPS goes up, the PE comes down, suggesting that the stock is undervalued. This, in turn, could push the stock prices up by deceiving investors into believing that the company is financially sound.

Thus, companies that manipulate accounts have poor or low earnings quality. And, those that don’t follow such practices have a high quality.

Quality of Earnings Report

Basically, the QoE report measures how a company accumulates its revenues, including recurring or nonrecurring and cash or non-cash. We can say that this measure is primarily concerned with the income from the core operating activities of a business.

Independent third-party firms usually prepare such a report during due diligence in an acquisition. The report includes the detail of all the components of the company’s revenue and expenses. Its main objective is to study the accuracy and the effectiveness of the past earnings and verify the future projections.

The report usually includes the following components;

- Analysis of past earnings.

- Classifying revenue under different heads, such as by-product, by the customer, and more.

- Classification of fixed and variable costs.

- Classification of one-time and recurring expenses.

- Analysis of assumptions for the cash flow projections and scenario analysis.

- Analysis of change in revenue and expense due to management changes.

- Recommendations and observations by the third-party firms.

There are many examples of acquisition that fails during the due diligence process. Several major scandals, such as Enron and Worldcom, are good examples of poor earnings quality misled investors. Note that it is not mandatory for either the acquirer or the target company to follow the recommendations in a QoE report.

Features

- A company can report high-quality earnings quarter after quarter. Low-quality earnings, however, are not repeatable due to one-time events or items.

- In the quality earnings report, a company must provide details of all sources of earnings. Also, it should mention the changes, if any, it expects in these sources.

- A company must follow conservative accounting practices to ensure proper recognition of the expenses and that revenue is not artificially inflated.

- The more closely the company follows generally accepted accounting principles (GAAP), the higher its QoE is likely to be.

How to Gauge Quality of Earnings?

One can gauge the quality of earnings by tracking activities from the income statement to the balance sheet and cash flow statement. However, the one item that analysts focus more on is the net income. It is the point of reference that tells analysts how well the company is performing. If the income is higher than the last year and is more than the analysts’ estimate, then it is a good sign.

But, how reliable these numbers are is something that the quality of earnings tells. The analyst starts from the top in the income statement and works their way down. For instance, the company’s sales growth may be the result of loose credit terms. An analyst can look at the balance sheet and cash flow statement to get more details on it. The revenue tied to the accounts receivable does not have much value.

Also Read: EBITDA

If a company has a high net income, but its cash flows are negative. Then, an analyst can look for variations between the operating cash flow and net income. It is possible that the boost in net income is due to factors other than sales.

Another item to look for is the one-time transactions or the nonrecurring income or expenses. For example, a company may be able to postpone a debt expense by arranging a future balloon payment. Such an arrangement will increase the net income for the current period but may be of concern to the investors.

Other items that can help gauge the quality are:

- Reserve balances

- Disclosure of related-party transactions

- Transparency of disclosures

- Details of one-time or nonrecurring items

- Consistency in accounting policies

- Assumptions

Low-quality of Earnings

A company is said to have high-quality earnings if it reports an increase in profit because of improved sales or cost reductions. An increase in sales due to a marketing campaign is also a sign of the high quality of earnings.

On the other hand, if the change in earnings is due to outside sources, then the company can have low-quality earnings. One can attribute low-quality earnings to the following factors;

- Inflation

- Increase in commodity prices

- Profit from the sale of the asset

- Eliminating LIFO inventory layers

- Aggressive use of accounting rules

- A rise in net income without a corresponding increase in cash flow.

Suppose Company XYZ reports an increase in sales of 30%, while its operating expenses were down 5%, and net income rose by 20%. Another Company, ABC, reports flat sales, no change in expenses but an increase of 30% in the net income. Many may say that Company ABC is better as its net income rose by 30%. However, in terms of quality of earnings, Company XYZ is better as its growth is due to better core operations. To check such a thing from a company’s financial statements, let’s introduce you to a metric – “Quality of Earnings Ratio.”

Quality of Earnings Ratio (QoE Ratio)

The quality of earnings is a ratio of net cash from operating activities to net income. Both these figures are available in financial statements.

How is the Quality of Earnings Ratio Computed?

Calculating earnings quality is entirely subjective. Its accuracy depends on the expertise of the person or agency calculating it. We can say that the measure of earnings quality is the degree to which a company generates earnings from core operations rather than external forces. Still, there is a formula to calculate it.

Formula

The formula for quality of ratio is dividing the net cash from operating activities by the net income. This formula gives the quality of the earnings ratio rather than the absolute figure.

Quality of earnings ratio = Net cash from operating activities / Net income

We can get the net cash from operating activities from the cash flow statement, while the net income figure is there in the income statement.

Interpretation of the Ratio

Quality of Earnings Ratio Significantly less than 1?

If the ratio is less than one, it means net income is greater than the operating cash flows. This will suggest that the company might be using accounting techniques to inflate net income.

Quality of Earnings Ratio greater than 1?

On the other hand, if the ratio is greater than one, it would mean net income is less than the operating cash flows, suggesting a better QoE.

Final Words

For investors, high-quality earnings matter more as a company is more likely to repeat such a performance in the future. This, in turn, would mean more cash flows for investors and high stock prices for the company. The quality of earnings ratio is a useful tool to overcome a few limitations of ratio analysis.

Thanks for this,

You have a clear perspective on this.

Cheers!

Thanks for this Sanjay – really helpful overview to get me thinking about the insights that his type of analysis can provide.