What is Accounting Worksheet?

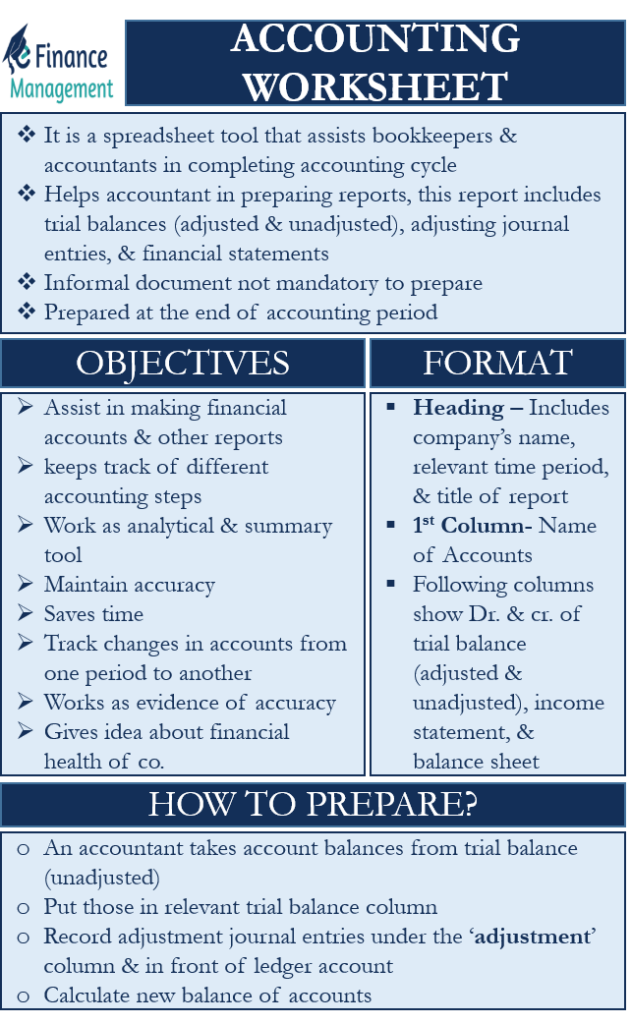

Accounting Worksheet is basically a spreadsheet tool that assists bookkeepers and accountants in completing the accounting cycle. Or, we can say that it helps accountants to get ready the year-end reports. These reports include trial balances (adjusted and unadjusted), adjusting journal entries, and financial statements.

The primary objective of preparing these sheets is to ensure the financial accuracy of the accounting reports. Also, it helps to ensure that the entries are correctly posted, as well as to track the changes in accounts from one period to another.

We can say that this worksheet is a large table of data. It is an informal document that isn’t intended for outsiders or third parties. This document is not mandatory to prepare, or we can say it is an optional intermediate step for accountants. Accountants usually prepare it at the end of the accounting period.

Objectives/Benefits of Accounting Worksheet

Following are the objectives of preparing the accounting worksheet:

- The main objective is to assist in making financial accounts and other reports.

- It helps to keep track of different accounting steps and, thus, helps to reduce errors.

- It can also work as an analytical and summary tool. This is because the worksheet shows how the accounts were initially posted to the ledger and what all adjustments were made to it before moving it into the financial statements.

- The worksheet helps to maintain accuracy, as well as saves time.

- It helps to track changes in accounts from one period to another.

- Accountants may give the worksheet to outside auditors as evidence of the accuracy of the accounts.

- It ensures that an accountant doesn’t forget to post adjusting entries.

- The worksheet also gives an idea of the financial health of a company.

Drawback

Talking about the drawbacks, there aren’t many. The only drawback is that these worksheets may carry errors or formula inaccuracies as they aren’t linked to the accounting database and are maintained manually.

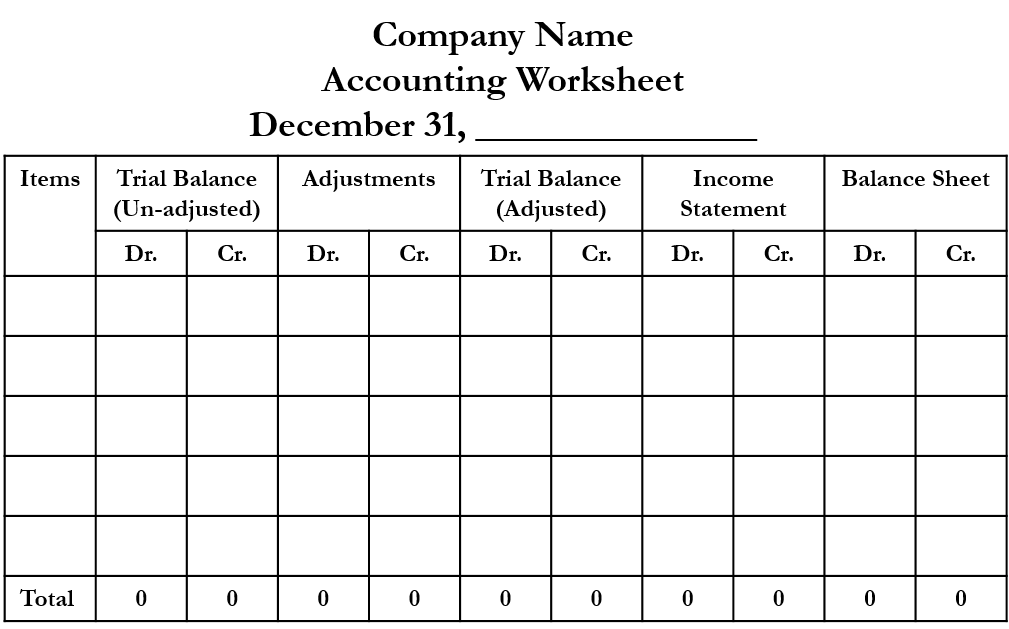

Format of Accounting Worksheet

Since an accounting worksheet is mainly for internal purposes, its format can be flexible. Or, we can say that companies can customize their format to fit their needs.

Similar to the trial balance, an accounting worksheet also carries a heading. This heading includes the company’s name, relevant time period, and the title of the report.

A usual worksheet lists the name of accounts in the first column. And the following columns show the debit and credit of the trial balance (adjusted and unadjusted), income statement, and balance sheet.

To be specific, this worksheet usually has five sets of columns, starting with the unadjusted trial balance accounts and ending with the financial statements. Each column is further subdivided into debit and credit. And the totals of each column come at the bottom.

How to Prepare?

As said above, except for the first column (account name column), all other columns are subdivided into debit credit columns.

Now, an accountant needs to take the account balances from the trial balance (unadjusted) and put those in the relevant trial balance column on the worksheet.

Similarly, an accountant needs to record the adjustment journal entries under the ‘adjustment’ column and in front of the relevant ledger account.

Next, an accountant needs to calculate the new balance of the accounts by taking the balance of each account in the unadjusted trial balance column and the adjustment entry for that account. This gives the balance of that account in the adjusted trial balance. Now an accountant can use this for preparing financial statements.

Moreover, both the debit and credit columns of the adjusted trial balance should match. This would ensure the arithmetical accuracy of the adjusting entries.

In a nutshell, we can say that an accountant transfers unadjusted trial balances from the software to the worksheet. Then the unadjusted trial balance is adjusted in the worksheet to find out the impact of possible adjusting entries. From here, if all things are okay, the accountant posts the entries into the financial statements.

Accounting Worksheet Example

Let’s take a simple example to understand the preparation of an accounting worksheet.

Company A is in the business selling TVs. It makes an accounting spreadsheet before preparing the financial statements. During an accounting year, Company A needs to make two adjustments. The first is for the advance payment of rent of $1,500. And second is for a $2,000 depreciation expense. The accountant has already transferred the account balances from the trial balance into the worksheet under the column ‘Trial Balance.’

Company A worksheet for the year ended December 31, xxxx

|

Account Name |

Trial Balance |

Adjusting Entries |

Adjusted Trial Balance |

Income Statement |

Balance Sheet | |||||

|

Debit |

Credit |

Debit |

Credit |

Debit |

Credit |

Debit |

Credit |

Debit |

Credit | |

|

Land |

$25,000 |

$25,000 |

$25,0000 | |||||||

|

Machine |

$15,000 |

$15,000 |

$15,000 | |||||||

|

Accumulated Depreciation |

$15,000 |

$2,000 |

$17,000 |

$17,000 | ||||||

|

Prepaid Rent |

$1,500 |

$1,500 |

$1,500 | |||||||

|

Accounts Payable |

$20,000 |

$20,000 |

$20,000 | |||||||

|

Cash |

$10,000 |

$1,500 |

$8,500 |

$8,500 | ||||||

|

Depreciation |

$2,000 |

$2,000 |

$2,000 | |||||||

|

Cost of goods sold |

$75,000 |

$75,000 |

$75,000 | |||||||

|

Other Expenses |

$6,000 |

$6,000 |

$6,000 | |||||||

|

Total |

|

|

|

|

|

|

|

|

|

|

In the above example, we have considered only a few accounts for simplification purposes. In the real world, we need to take all the accounts in the worksheet. Once we take all accounts, the debit and credit side of Trial Balance, Adjusting Entries, and Adjusted Trial Balance should come equal.

For the income statement, the difference in the debit and credit columns means a profit (or loss). After we transfer this profit (or loss) to the relevant debit or credit column of the Balance Sheet, the debit and credit sides of the Balance Sheet should also match.

Final Words

The accounting Worksheet is a crucial tool to ensure the accuracy of accounting entries. It is an internal document that assists in the preparation of financial statements. A point to note is that all the accounts in a company’s accounting records come in at least one column in the worksheet. This helps in preventing most accounting errors. Though it is not compulsory for a company to prepare this worksheet, preparing it undoubtedly makes it easy to prepare financial statements.