Debit and credit are two sides of the same accounting entry. These are the fundamental “effect” of each financial transaction. For maintaining correct accounting records, you must have full knowledge of what is debit and what is credit. The left-hand side will show the debit amounts, whereas the values on the right-hand side will be credit amounts.

The accounting system categorizes all sorts of accounts into five different kinds. They are assets, liabilities, owner’s equity, income, and expenditure. And every transaction will affect two accounts where one account gets debited and the other account will simultaneously get credited. This keeps the entries in balance. And, hence meet the criteria of the accounting equation, that is, “Asset = Owner’s Equity + Liabilities”. It is the double-entry system of accounting.

Debit & credit are shortly mentioned as Dr. and Cr. respectively. Every transaction has two effects. So for every debit, there is a corresponding credit of an equal amount. In order to understand debit and credit entries, it is important to understand what are the different account types and rules for debit and credit in each account type.

Golden Rules of Accounting

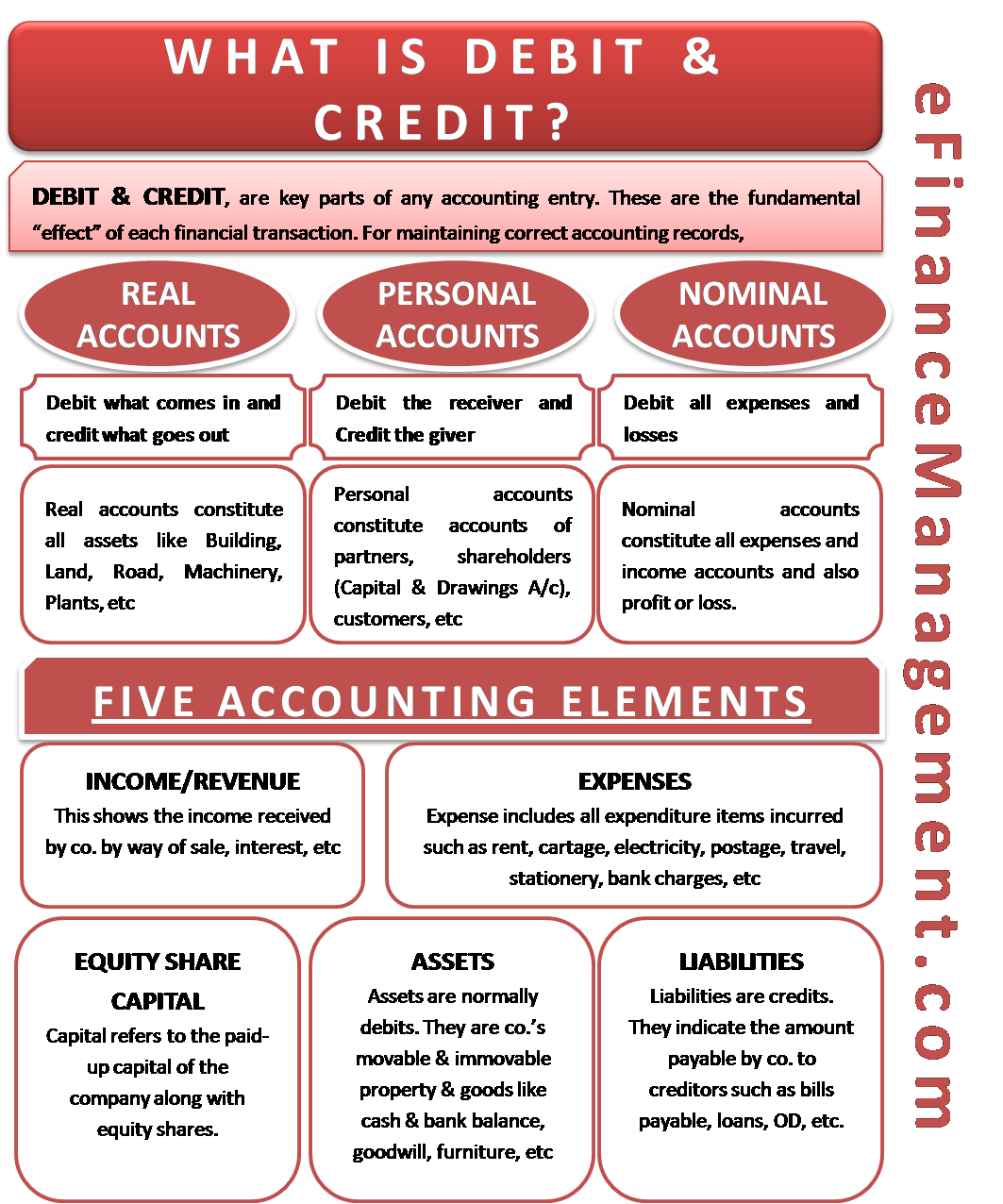

There are three “account types.” All accounts have been classified into either real, personal or nominal accounts. The rules for entering transactions into these groups of accounts are as follows:

Also Read: Double Entry System of Bookkeeping

Real Accounts

| “Debit what comes in and credit what goes out“ |

Real accounts constitute all assets like buildings, land, roads, machinery, plants, constructions, furniture, and other equipment. When they are purchased, you debit the respective account with the amount. And you credit the cash account or creditors account for the same. While you credit the account with its value when it is sold or removed by debiting the cash account or debtor account.

Personal Accounts

| “Debit the receiver and credit the giver“ |

Personal accounts constitute the accounts of an owner, partners, shareholders (capital and drawings account), customers and suppliers (debtor or creditor), etc. When a payment is made to somebody, you debit the receiver of that payment and credit cash or bank as money is paid using cash or by means of cheque. When money or cheques are received, you credit the person who is paying you, and you debit the cash or bank.

Nominal Accounts

| “Debit all expenses and losses and credit all incomes and gains“ |

Nominal accounts constitute all expenses and income accounts and also profit or loss. You debit the expenditure account whenever some expenditure is incurred and credit the income account whenever income is received.

Five Accounting Elements

The modern accounting principle consists of five accounting elements. They are assets, liabilities, income or revenue, expense, and equity or capital. All financial transactions are classified according to the nature of the transaction and grouped into the above five groups of accounts.

Also Read: T Accounts

Let us look at the uses of debits and credits to understand their accounting effect on these accounting elements.

- Assets: Assets have a debit balance. They constitute the company’s movable and immovable property and goods. When an asset is purchased, the company debits its account and when some asset is sold, it is posted on the credit side of the account.

- Liabilities: Liabilities have a credit balance. When the company incurs any liability, its balance increases and is hence posted to the credit side of the account. While it debits the account when it releases or pays off its liabilities.

- Equity/Capital: Capital refers to the paid-up capital of the company. This constitutes the company’s funds invested in the business. It is a liability because it has been taken from the owner/shareholders of the company. It will always have a credit balance. And its effect on debit and credit is similar to that of a liability

- Income/Revenue: This group of accounts shows the income received by the company by way of the sale of goods or services or by any other form of interest received, profit on the sale of assets, commission, etc. These also have a credit balance. Any reduction in such accounts will lead to debiting the account.

- Expenses: Expense includes all expenditure items incurred such as rent, cartage, electricity, postage, travel, stationery, bank charges, salary, wages, etc. These accounts have a debit balance and payment of expenses will have a credit effect.

Example Explaining Credits and Debits

Each credit and debit entry requires a correct perception of the nature of a transaction. To make the picture clear, let us have an example and see how the transaction affects each of the above 5 accounting elements by following the rules of the “real, personal, and nominal” account as discussed above.

A and B start a computer business. A invests cash of $60000, and B invests $30000. Therefore, the total capital introduced in the business is $90,000. They pay rent in cash for the office as $1000. They purchase furniture for $500 in cash. Procured 10 computers worth $800 each on credit from Mr. C. But they sell 3 extra computers out of 10 for $900 each in cash. They pay the electricity bill of $200 by borrowing from the bank.

| Effect on: |

||||||||||

| Capital | Assets | Expenses | Incomes | Liabilities | ||||||

| Dr. | Cr. | Dr. | Cr. | Dr. | Cr. | Dr. | Cr. | Dr. | Cr. | |

| Capital Introduced | 90,000 | 90,000 (cash) | ||||||||

| Paid Office Rent | 1,000 (Cash) | 1,000 | ||||||||

| Furniture Purchased | 500 (Furniture) | 500 (Cash) | ||||||||

| Purchased Computers on Credit | 8,000 (Computer) | 8,000 (Creditors) | ||||||||

| Sold Extra Computers | 2,700 (Cash) | 2,400 (Computer) | 300 (Profit) | |||||||

| Paid Electricity Bill | 200 | 200 (Bank Loan) | ||||||||

| Total | 000 | 90,000 | 101,200 | 3,900 | 1,200 | 000 | 000 | 300 | 000 | 8,200 |

Once you clearly understand the effects, this is how the balance sheet would look like, which you can understand better after reading about the balance sheet and types of accounts (Ignoring Depreciation):

| Balance Sheet | |||

| Liabilities | Amount ($) | Assets | Amount ($) |

| Capital | 90000 | Furniture | 500 |

| Profit/(Loss) | -900 | Cash | 91200 |

| Bank Loan | 200 | Computer (Stock) | 5600 |

| Creditors | 8000 | ||

| 97300 | 97300 | ||

Summary

Correct debits and credits are essential for the books of accounts to be proper and reliable. A wrong debit and credit entry can lead to wrong ledgers, resulting in a mismatch in the trial balance and the balance sheet. Hence, for the preparation of accurate financial statements, due care must be taken to ensure error-free entries.

Sometimes, i find it is really so complicated to understand about this thing . i mean debit and credit

I have difficulties I request a tutor.

What is that debit cards accounting

the balance sheer is incorrect as on the liabilities side: share cap is 90,000, loss is 900 (1200 exp-300 profit from sale) and creditors amount to 8200 therefore total 97300/-

on the asset side Cash is 91200(90000-1000-500+2700) stock is 5600(8000-2400) furniture is 500 total 97300/-

Hi Jayshree,

Thanks for noticing and pointing out the error. We have made required changes in the post.

you explained very well the funda of debit and credit.

Thanks.

good for beginners like me

can you explain in simple words why earning money is called a debit?

when you give money to the bank remember the bank owes you, then it is a credit but when the bank gives you money it debits your account. Same applies when you recieves money from anyone

Thank you my gray area has been covered now