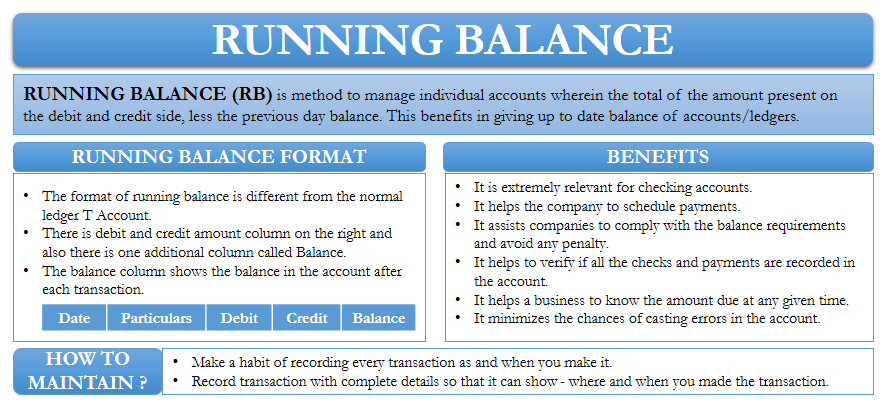

Period basis balancing or period balancing is the usual way to maintain ledgers. However, accountants can also use a running balance to manage ledger accounts. Running balance (RB) is the simplest way to manage individual accounts. It is the total of the amount present on the debit and credit side, less the previous day’s balance.

One significant benefit of using RB is that you stay up to date with the balance of that account. Your checking account or credit card account may be on a running balance. One may also use this balance to maintain individual ledger accounts.

You may also come across a running balance account in your daily life, such as your local grocery store, bar, etc. For instance, if you buy food items from a local grocery store, and instead of paying every time, you pay some funds regularly or weekly, then that store will likely have an RB account on you. It will record your purchases and the payment you make to know the balance you owe.

Running Balance Format

The format of RB is different from the usual T account format that we use for ledgers. In this, there is a debit and credit column on the right. Also, there is one additional column that shows the balance of that account after each transaction. The column for the date and description is on the left. There may be other columns depending on the need.

Also Read: Closing Entries

Below is an example of a running balance amount.

| Date | Particular | Dr. | Cr. | Balance |

| 1/7/2020 | Opening Balance | $15,000 | $15,000 | |

| 1/7/2020 | Rent | $2,000 | $13,000 | |

| 3/7/2020 | Salaries | $4,000 | $9,000 | |

| 7/7/2020 | Sales | $8,000 | $17,000 | |

| 12/7/2020 | Purchases | $3,000 | $14,000 | |

| 15/7/2020 | Repairs | $1,000 | $13,000 |

Running Balance – Benefits

There are many benefits of maintaining accounts on running balance. It is extremely relevant for checking accounts. For a business, it is essential to know its account balance after every transaction. It helps the company schedule payments. Also, it assists companies in complying with the balance requirements and avoiding any penalties.

It also allows the business to verify if all the checks and payments are recorded in the account. Monitoring the RB is also essential if the objective of the company is to lower the debt amount or keep the debt amount under a specific limit.

For a credit card, having a checking account helps verify the transactions with the actual payments made. Also, it provides the cardholder with information on the amount due or how much credit they have before the limit is hit.

Maintaining an RB account of customers helps a business know the amount due at any given time. It means that whenever a customer wants to make a payment, there is no wastage of time in calculating the unpaid amount. Moreover, it also minimizes the chances of casting errors as the balance amount is available after each transaction.

Also Read: Accounting Cycle

How to Maintain Running Balance Account?

You can easily maintain a running balance account yourself. It would allow you to track your expenses and verify accuracy by comparing them with third-party records. To accurately maintain such an account, you need to take care of a few things:

First: make a habit of recording every transaction as and when you make it.

Second: you should record the transaction with complete details, such as description and date. It will help you remember where and when you made this transaction.

How to Ensure Accuracy?

The best way to ensure the accuracy of the RB is to provide accurate records. If the numbers you enter are correct, along with the relevant debit and credit, then the running balance will be accurate as well.

Another way to measure the accuracy at any time is to subtract the total of the debit side from the credit side. The resultant number must be equal to the balance at the time.

Nowadays, there is accounting software that helps in creating running balance accounts. Moreover, this software also helps in using this information to prepare financial statements. You can easily maintain this balance account in excel as well.

Final Words

A business can use a running balance format for every ledger account. Companies, however, use a mix of periodic and running balance methods. The latter is more useful for accounts with more number of transactions, such as cash and bank balances.

Frequently Asked Questions (FAQs)

Running balance is an easy way to manage individual accounts. It is a sum of debit and credit amounts less the previous balance.

The benefits of maintaining such accounts are:

1. Helps in scheduling payments

2. Keeps the debt amount under a specific limit

3. Helps in verifying transactions with the actual payments

4. Helps a business to know the amount due from customers

5. Minimizes the chances of casting errors

Step 1: Record every transaction as and when it takes place.

Step 2: Keep the complete details of transactions, such as description and date, for verification.

Quiz on Running Balance