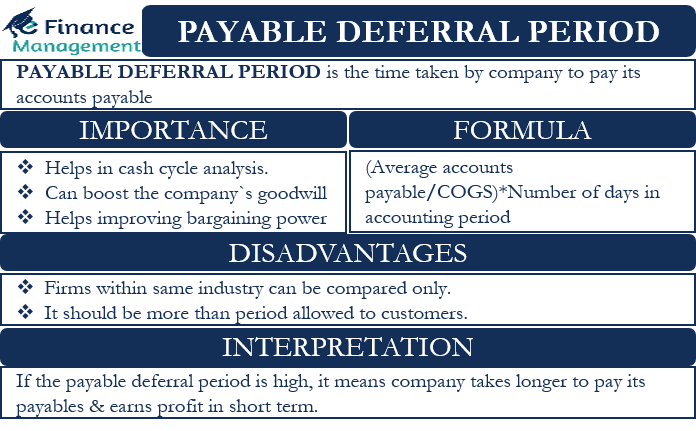

The payable Deferral Period is the time a company takes to make payments to its suppliers. It is a financial ratio that considers accounts payable and the days on which they remain unpaid, to calculate the average time it takes a company to pay those bills and invoices. For example, a payable deferral period of 10 days means that the company needs about ten days to repay the suppliers. Another term used to indicate this concept is Days Payable Outstanding (DPO).

Generally, an analyst or the company itself calculates this ratio quarterly or annually. It primarily indicates how well a company manages its cash flows. If, for example, a company takes too much time to pay suppliers, it means that it keeps cash to itself for longer or faces a liquidity squeeze. If a company keeps its money, it can use it for other productive purposes. Or it may invest the money for a very short period of time to earn interest.

Formula for Payable Deferral Period

Following is the formula to calculate DPO:

= (Average Accounts Payable / Cost of Goods Sold) x Number of Days in the Accounting Period

Average Accounts Payable = (Opening Accounts Payable Balance plus Closing Accounts Payable Balance)/2

The Cost of Goods Sold (COGS) = Opening Stock Plus Purchases Less Closing Stock

The number of days in the Accounting Period is 365 days for a year and 90 days for a quarter.

An example will help us better understand this concept and the calculation of DPO or the Payable deferral period.

Company X has average accounts payable of $100,000 for a quarter. It has an opening inventory of $250,000 and a closing inventory of $100,000. A total of $1,000,000 was purchased during the quarter, including cash purchases of $700,000.

First we have to calculate the COGS. It will be $1,150,000 ($250,000 + $1,000,000 – $100,000)

Now DPO for the quarter 8 days ($100,000 * 90 days) / $1,150,000

Interpreting Payable Deferral Period

Let us now understand what a high or low DPO figure means in terms of a company’s financial health:

Generally speaking, a high DPO is good for a company. This means that a company takes longer to pay creditors. In this case, the company can use the money available for short-term productive purposes, such as investments. However, suppliers may not be satisfied with a high DPO and may refuse to offer better credit terms. Furthermore, suppliers may not offer a discount that they offer to companies making timely payments.

Also Read: Days Inventory Outstanding

On the other hand, it may also mean that suppliers have given the company better credit terms. Or they agree that the company pays them too late. Another interpretation of a high DPO is that the company is not able to manage its money. Or it does not have enough cash to repay the suppliers on time.

If a company has a low DPO, this could mean that it is not making effective use of the credit term. Conversely, the company is not able to negotiate well with suppliers for an extended credit period and establish its financial credentials well.

Importance

The payables deferral period is a critical efficiency ratio that helps analyze and manage the cash cycle analysis and management. Furthermore, for calculating the cash conversion cycle (CCC), DPO is an important and integral part of the formula. CCC calculates the time it takes a company to convert inputs into cash inflows. This CCC considers the entire cash time cycle, including debtors, creditors, inventory, sales, expenses, etc.

A high or low DPO can be interpreted in different ways, so it is very important to compare this ratio with the industry average to get the right interpretation.

Also Read: Days Sales Outstanding

A company’s DPO could also increase a company’s goodwill. If a company has a high DPO, suppliers can view it as a less valuable company and impose credit restrictions.

There is no ideal or desirable DPO number, as with all other financial indicators. This is a relative term, and this number varies according to the industry and the level of bargaining power of a company. For example, a local food retailer has less bargaining power than Walmart. Moreover, a DPO value for a company can vary from year to year depending on the economy and performance of the sector.

However, a company must try to maintain a balance between cash outflow and cash inflow. Let’s say a company allows its customers to pay within 50 days, but the company pays its suppliers within 30 days. This could lead to a situation of cash crunch. And the company could end up bearing significant financial costs. Therefore, it is important that the DPO period is always more than the credit period a company grants its customers.

Limitations of Payable Deferral Period

A DPO value helps when comparing two or more companies, but there is no desirable number when it comes to a healthy DPO. So the comparison has to be made with companies operating in the same industry.

Another limitation of a DPO is that it can vary considerably by industry. It can also vary within the industry if one company has more bargaining power than others. The size of the company also makes it possible.

Final Words

The payables deferral period is a very critical benchmark for a company. It helps them in managing their cash flows efficiently. However, a company should not consider the DPO period as just a number but should compare it with other companies in the industry and the industry average. Furthermore, rather than just looking at the DPO, a company must consider the full cash conversion cycle. By analyzing this cycle, a company could make better cash flow management decisions.

Read other TYPES OF EFFICIENCY RATIOS

FAQs

The payable deferral period determines the time taken by the organization to make payments to its accounts payable. A higher deferral period is good for the organization. It implies that the organization takes a long time to make payments of its payables, i.e., it uses the cash it has available to generate short-term revenue. However, creditors may not offer better credit terms.

The main disadvantage of the deferral period is that it varies from industry to industry, so companies operating in the same industry can and should only be compared with each other.

The payable Deferral Period helps to calculate and analyze the operational cycle of the organization, i.e., in how much time the cash is converted back into cash. It also indicates what is the standard credit period the company is able to enjoy from its suppliers.

Excellent