What is the Term Structure of Interest Rates?

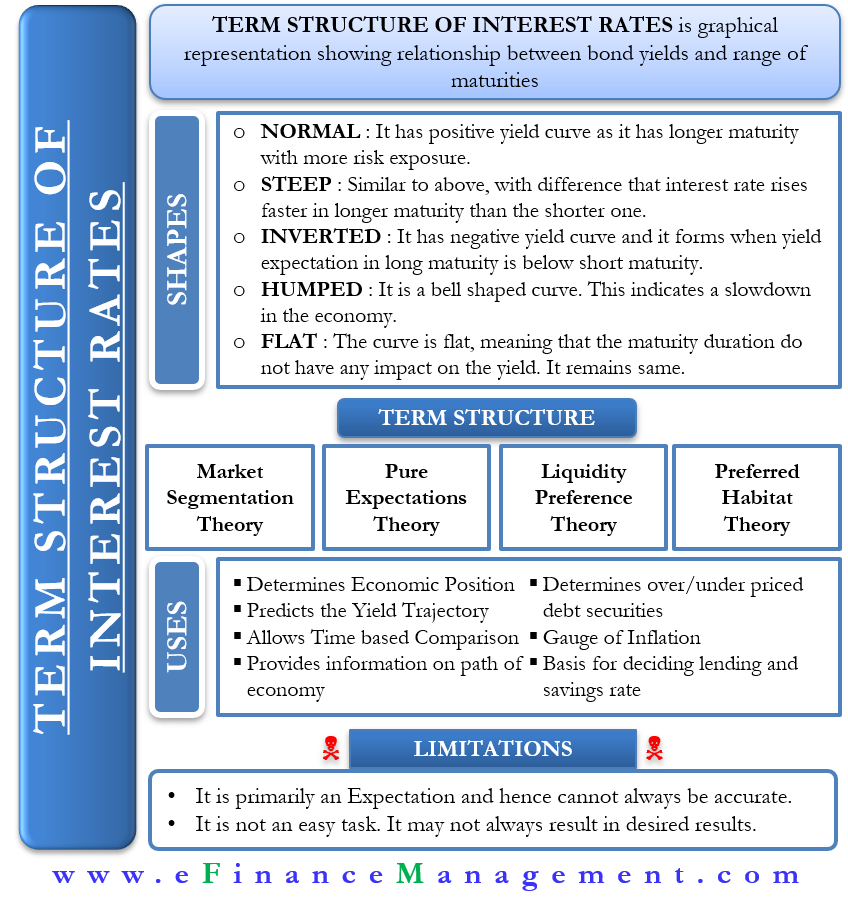

The term structure of interest rates or the yield curve is basically a graphical representation showing the relationship between the bond yields or the yield to maturity (YTM) of bonds and a range of maturities. Bonds that are plotted on the graph are of the same quality, or we can say having the same risk profile. A point to note is that this graph does not plot the coupon rates against the maturities. The spot curve does this.

Shapes/Types of Yield Curve

The term structure of interest rates graph can take five shapes:

Normal

A normal yield curve, also known as a positive or upward-sloping yield curve, is the most common and expected shape. In a normal yield curve, longer-term bonds have higher yields compared to shorter-term bonds. This reflects the expectation that investors require higher compensation for the added risks and uncertainties associated with longer-term investments. It implies that the market anticipates economic growth and inflation in the future.

Steep

A steep yield curve is characterized by a significant difference in yields between short-term and long-term bonds. Longer-term bonds have higher yields compared to shorter-term bonds. A steep yield curve typically indicates a positive economic outlook, with expectations of economic growth and potentially higher inflation in the future. It suggests that investors are demanding higher compensation for the risks associated with longer-term investments.

Inverted

An inverted yield curve, also known as a negative or downward-sloping yield curve, occurs when short-term bonds have higher yields than long-term bonds. In other words, yields decrease as the maturity of the bonds increases. An inverted yield curve is often seen as a potential indicator of an economic recession. It suggests that investors are seeking the safety of long-term bonds and anticipate lower future interest rates, possibly due to expectations of economic contraction.

Humped

We can also call it a bell-shaped curve. This type of curve is very rare and indicates a slowdown in the economy. It indicates that the yield on the bonds with medium-term maturity is more than the yield from those with long and short-term maturities.

Flat

In a flat yield curve, the yields on short-term, intermediate-term, and long-term bonds are relatively similar or close to each other. There is little or no significant difference in yields across different maturities. This suggests that investors are not demanding significantly higher compensation for investing in longer-term bonds compared to shorter-term bonds.

Term Structure of Interest Rates Theories/Yield Curve Theories

There are a few theories that explain the concept behind the shape of the yield curves:

Market Segmentation Theory

The market segmentation theory posits that the bond market is segmented into different maturity sectors, and investors have specific preferences for particular maturity ranges. This theory argues that the supply and demand dynamics within each segment drive the yields of securities in that segment, resulting in variations in yields across different maturities. In other words, the shape of the yield curve is determined by the relative supply and demand imbalances within each maturity segment.

Pure Expectations Theory

This theory suggests that the shape of the yield curve is determined by investors’ expectations of future interest rates. According to the expectations theory, a positively sloped yield curve indicates expectations of rising future interest rates, while a flat or inverted yield curve implies expectations of stable or declining rates. This theory assumes that investors are risk-neutral and only consider expected returns when making investment decisions.

Liquidity Preference Theory

Liquidity preference theory is also a type of Expectations Theory. However, it assumes that investors have a liking for short-term bonds more than for long-term bonds. This is because uncertainty is more with long-term bonds, and they are also less liquid. And, if investors go for a long-term bond, they demand a premium for the extra risk.

Preferred Habitat Theory

Building upon the market segmentation theory, the preferred habitat theory suggests that investors have a preferred maturity range but may be willing to move outside of it if adequately compensated. This theory recognizes that investors have certain preferences for particular maturities (habitats), but they may be incentivized to invest in other maturities if the risk-return tradeoff is favorable.

Importance of Yield Curve

Here are the various reasons why the yield curve is considered important:

Economic Health

Based on the shape of the yield curve as discussed above, helps in determining the economy’s current and future position. The shape of the yield curve provides insights into the overall health and expectations of the economy. A normal or upward-sloping yield curve, where long-term rates are higher than short-term rates, is often indicative of a healthy and expanding economy. In contrast, an inverted yield curve, where short-term rates exceed long-term rates, can be a warning sign of an impending economic downturn.

Market Expectations

The treasury yield curve serves as a benchmark for other market instruments. The yield curve reflects market expectations regarding future interest rates. Investors and financial institutions closely monitor the yield curve to gauge potential changes in monetary policy. If the yield curve indicates rising interest rates, it may suggest that investors anticipate higher inflation or a tightening of monetary policy by central banks.

Risk Assessment

The yield curve plays a vital role in assessing the risk associated with different investments. Typically, longer-term bonds carry higher interest rates to compensate for the increased risk of holding debt over an extended period. By analyzing the yield curve, investors can make informed decisions about balancing risk and reward in their investment portfolios.

Credit Conditions

The yield curve also influences credit conditions within the economy. Banks and lending institutions often use the yield curve as a benchmark for setting interest rates on loans. Changes in the yield curve can affect borrowing costs for consumers and businesses, impacting their ability to access credit and invest in new projects.

Yield Spread Analysis

The yield curve enables the analysis of yield spreads, such as the difference between short-term and long-term interest rates. Yield spreads provide insights into market sentiment and can be indicators of potential market volatility or changes in investor risk appetite. For example, a narrowing yield spread may indicate increased economic uncertainty or a potential economic slowdown. A general rule of thumb is closer the yields, the more confident the investors are in the other bond. Also, the spread usually widens during recessions and contracts during an economic recovery.

Factors Influencing Yield Curve

Different factors impact the movement on either end of the yield curves. Short-term interest rates – or “the short end” of the yield curve – are influenced by the expectations for the U.S. Federal Reserve policy or, in general, what the government will do in the future. When the Fed is expected to raise the interest rate, the short-term rates rise, while the rates drop when a cut is expected.

Long-term bonds – or the “long end” of the curve – are also, to some extent, affected by the Fed policy expectations. Other factors, however, also play a role in the movement of long-term yields. Such factors are the outlook for economic growth, inflation, supply and demand, and investors’ overall attitudes toward risk.

Usually, factors like low inflation, depressed risk appetites, and slower growth support the price performance of long-term bonds. Or, we can say cause the yields to fall. While higher inflation, elevated risk appetites, and higher inflation cause the yield to rise. Together, all these factors help to shape the direction of long-term bonds.

Limitations

The following are the limitations of the term structure of interest rates:

- The term structure of interest rates is primarily estimation and hence, may not always be accurate.

- Matching maturities to hedge against yield curve risk is not a simple task. Thus, it may not always result in a desirable result.

U.S. Treasury Yield Curve

This is the benchmark for the interest rates in the economy as it represents the yield of risk-free fixed-income investments. Banks and other financial institutions use this curve to decide on saving and lending rates. Federal Reserve’s federal funds rate is the most important factor affecting the U.S. Treasury Yield Curve.

Usually, this curve is upward-sloping because investors want more interest rates for investing in securities with a longer duration. This yield curve can be inverted occasionally, indicating an upcoming recession. An inverted yield curve forms when the long-term yields drop below the short-term yields.

Final Words

Treasury securities are the most common yield curve as they are risk-free and thus help decide the yield for other debts. The shape of the yield curve may change after a while. And investors who are accurate with their predictions of the changes in the term structure of interest rates benefit from the corresponding changes in bond prices.

RELATED POSTS

- Convexity – Meaning, Graph, Formula, Factors, and Example

- Spot and Forward Interest Rate

- Types of Interest Rates

- Investment Grade Bond – Meaning, Benefits, and More

- How is the Interest Rate related to the Required Rate of Return, Discount Rates, and Opportunity Cost?

- Nominal Yield: Meaning, Formula, Example, Components, and Spread