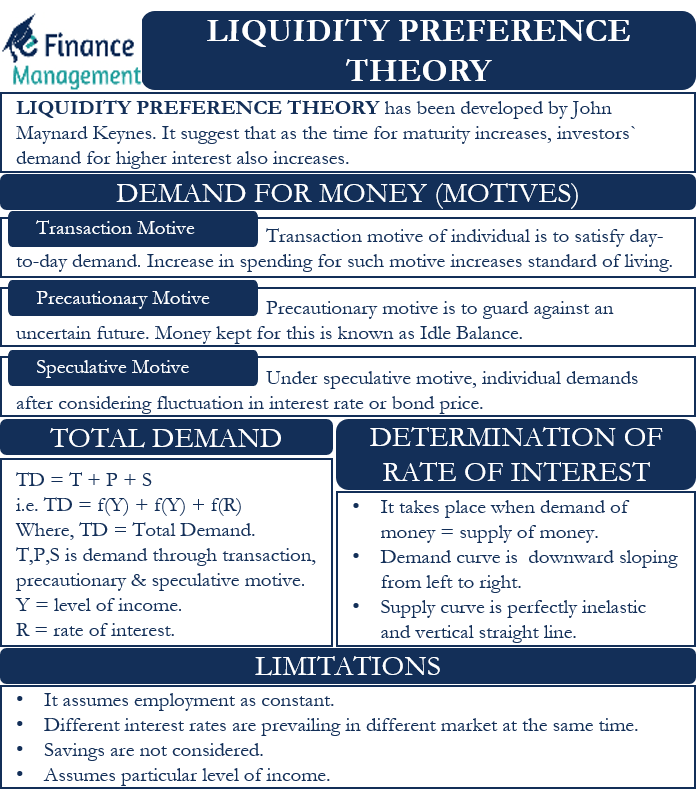

Liquidity Preference Theory: Meaning

Liquidity Preference Theory is a theory that suggests that investors demand higher interest rates or additional premiums for medium or long-term maturities and investments. According to this theory, the risk increases with maturity. In such a situation, investors should aim for higher interest rates because short-term investments are more liquid than medium or long-term investments. Simply put, interest rates directly indicate the price of the money. Therefore, other things remaining constant, demand and supply of money determine the interest rate. Moreover, there is an age-old saying in the financial and investment world that “one bird in the hand is worth two in the bush.” And this fully confirms and justifies the preference for liquidity and an increase in premiums or interest rates as maturity increases.

Understanding Liquidity Preference Theory

John Maynard Keynes developed the Liquidity Preference Theory in 1936. And this theory gives immense importance to the liquidity factor of investment. According to this theory, short-term investments provide a lower interest rate because they provide liquidity to investors. Moreover, medium and long-term investments lead to higher interest rates because of their illiquid nature. Short-term investments mature from or within a year of the deposit by providing liquidity, in contrast to medium and long-term investments that mature after 3-10 years and are illiquid in nature.

According to John Maynard Keynes, the demand and supply of money determine interest rates. Individuals prefer to hold liquid cash in their hands rather than invest it by preferring liquid cash. Thus, according to Keynes, interest rates are a reward for not having liquidity in their hands, and the consideration goes hand in hand with the ideology that cash is the most liquid asset.

Demand for Money (Motives)

Liquidity Preference Theory measures liquidity in relation to demand for money or other liquid instruments. And according to Keynes, there are three main reasons (motives) for demand for money. These motives are as follows:

Also Read: Liquidity Premium

Transactions Motive

This is a fundamental motive for the individual’s demand for money. Here, in order to satisfy all daily needs, the individual requires money with a transaction motive. By transaction motive, the individual requires money to buy food and maintain the standard of living. Moreover, higher spending with a transaction motive leads to an increase in the standard of living. Thus, to maintain the standard of living, individuals need sufficient cash in hand. Most people with higher earning capacity require more money to satisfy daily needs. According to John Maynard Keynes, demand through transaction motive is inelastic to interest rates and elastic to income level. As a result, the Transaction Motive is a function of income levels and is expressed as follows: –

T = f (Y)

Where,

T = Demand through Transaction Motive

Y = Level of Income

Simply put, the demand for cash with a transaction motive is for paying current expenses.

Precautionary Motive

According to John Maynard Keynes, this is the second motive for the demand for money. Individuals demand money with a precautionary motive in order to protect themselves from an uncertain future. Because the future is uncertain, and there could be sudden natural or man-made disasters. In such a situation, in order to protect themselves, individuals demand money with precautionary intentions. And money held under precautionary motive is known as ‘Idle Balance.’ These uncertain situations demand cash outflow, so individuals demand money for the same. According to John Maynard Keynes, precautionary demand is inelastic to the interest rate and elastic with regard to income levels, like the transaction motive. As a result, the precautionary motive is a function of income levels, and the expression of the same is as follows: –

P = f (Y)

Where,

P = Demand through Precautionary Motive

Y = Level of Income

Simply put, asking for cash with a precautionary motive protects against uncertain future conditions.

Speculative Motive

A speculative motive is the third motive for the demand for money. Under this motive, individuals demand money by considering fluctuations in interest rates or bond prices. If interest rates are lower or bond prices are lower, there is a high demand for money with speculative motives and vice versa. If interest rates are lower, these individuals hold / hoard their money and invest later when interest rates are higher. As a result, under speculative demand for money, there is an inverse relationship between interest rates and demand for money, and the expression of speculative motive is as follows: –

S = f (R)

Where,

S = Demand through Speculative Motive

R = Rate of Interest

Simply put, the demand for cash with a speculative motive is to generate profits by changing the investment scenario and the value of the instruments.

Therefore, the above three motives are the reasons for the liquid funds held by the individuals.

Total Demand

The aggregate demand for money or the function of liquidity preference would be the sum of all three motives transaction, precautionary and speculative).

TD = T + P + S

TD = f (Y) + f (Y) = f (R)

Total Demand = f (Y, R)

Where TD is the Total Demand, which is the function of Income (Y) and Interest Rate (R).

Supply for Money

According to John Maynard Keynes, the supply of money is largely fixed and determined by the country’s central bank. Therefore, according to the theory of liquidity preference, the supply is perfectly inelastic and graphically represents a straight vertical line.

Determination of Rate of Interest

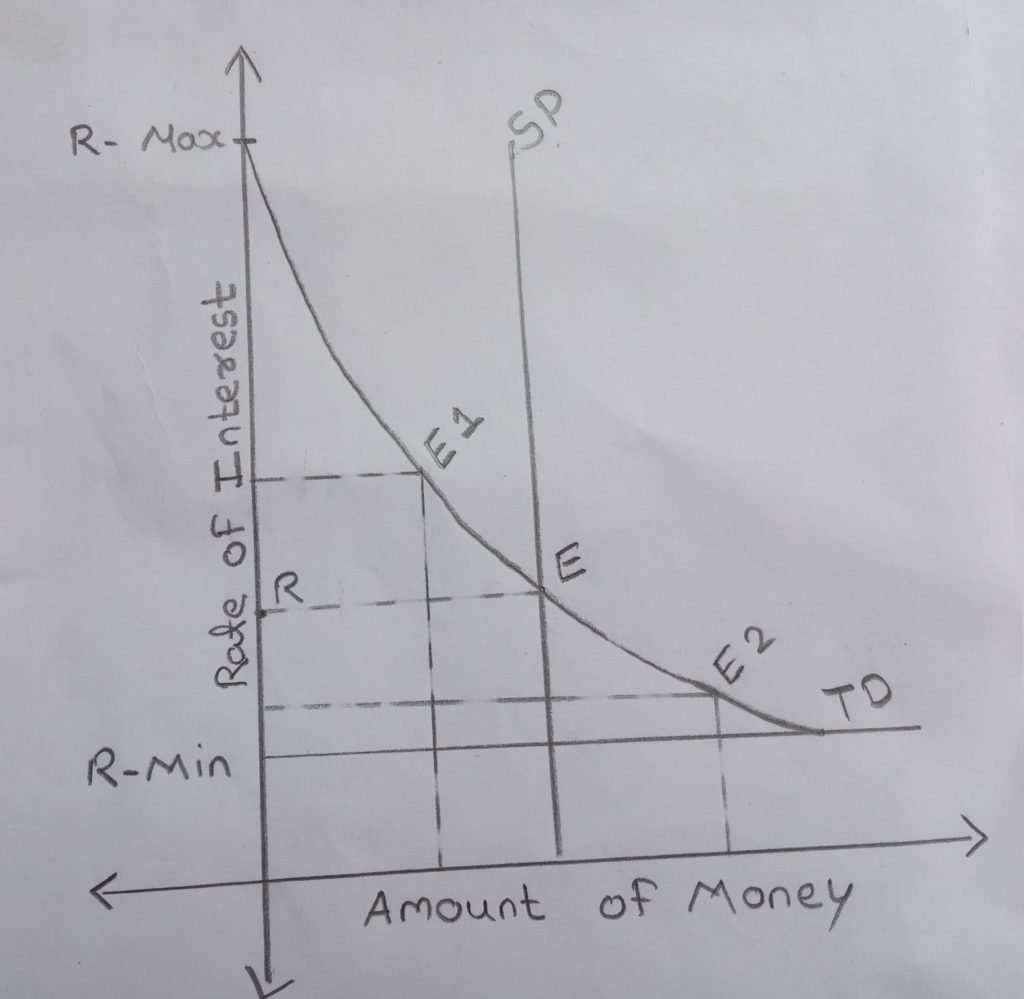

The interest rate is determined at the point where the demand for money is equal to the supply of money. And in the graph of the determination of the interest rate, the TD curve is downward sloping from left to right. This is due to the opposite link between the demand for money and the interest rate. Whereas the Supply (SP) curve is perfectly inelastic and represents a vertical straight line. Let’s understand this with a graphical representation:-

Interpretation

As shown in the figure above, the X-axis measures the amount of money, and the Y-axis the interest rate. In the figure, TD is the demand curve of money, and SP is the supply curve of money. And the point at which the demand for money equals the supply of money is denoted by E. At point E, both curves intersect each other and determine the interest rate R, and the interest rate R is the equilibrium interest rate.

At point E1, the supply of money is higher than the demand for money, and so individuals buy more securities. The interest rate begins to fall back to point-R (equilibrium level) in such situations. Similarly, at point E2, the demand for money is higher than the supply of money, and therefore individuals will begin to sell securities. As a result, the interest rate will rise to equilibrium level R.

If we look at the figure above, there is a liquidity trap, and the range between R-Min and R-Max is known as a liquidity trap, so the interest rate only fluctuates under this trap.

Limitations of Liquidity Preference Theory

- One of the biggest limitations of the liquidity preference theory is that it assumes that the employment rate is constant. In reality, the employment rate is not constant, and it is constantly changing.

- The second criticism is that this theory assumes a certain level of income.

- The third criticism is that this theory claims that it is either cash or investment in bonds. In today’s scenario, many people have cash at their disposal for liquidity purposes and investments in bonds. This theory completely ignores the scenario of receiving interest benefits for some funds and receiving liquidity benefits for the remaining funds.

- The fourth criticism is that different interest rates exist in different markets simultaneously, which the liquidity preference theory completely ignores.

- According to the experts, liquidity preference is not the only criterion for interest rates. This theory also does not take into account so many real elements. This ignorance is the fifth criticism.

- The savings done by individuals is not considered under this theory.

These criticisms are non-exhaustive in nature.

Conclusion of the liquidity preference theory

Notwithstanding many criticisms of the Liquidity Preference Theory, it is useful for identifying the effect of demand and the supply of money on interest rates. It shows the relationship between the motives of people with income and interest rates. It also asserts that monetary policy is not effective in the economy because of a liquidity trap during the depression in the economy. At the same time, however, we need to understand and assess that liquidity is not the only factor that drives the money supply or interest rates. There are so many other factors to consider before making a decision.