Systemic and Systematic risk both represent the risk that exists in the financial markets. However, both terms refer to a different type of risk. Nevertheless, people often use the two terms interchangeably, probably because the spelling of the terms is quite similar. To ensure that we use these two terms correctly, it is crucial that we understand the differences between Systemic Risk vs Systematic Risk.

Before detailing the differences between Systemic Risk vs Systematic Risk, it is important that we understand what the two terms mean.

Systemic Risk vs Systematic Risk – Explanation

Systemic risk is essentially the risk that an event could trigger the downturn of an industry or economy. This event is at the corporate level. A good example of this risk was the financial crisis of 2008 when the collapse of the Lehman Brothers company led to the financial crises that affected many countries around the world.

On the other hand, systematic Risk is the risk that is already present in the market. We call it “undiversifiable risk” or “market risk.” No investor can escape this risk because it affects not only one stock or industry but instead the overall market. Such risks persist and result from several factors, such as the economic situation, interest rates, the political situation, and more.

For example, suppose an investor invests a significant amount of money in airline stock. In that case, there is a systematic risk that they will suffer large losses if that stock or industry underperforms. An investor cannot completely avoid such a risk, but they can reduce it by diversifying their investment.

Now that you know what the two risks mean let’s look at the differences between Systemic Risk vs Systematic Risk.

Systemic Risk vs Systematic Risk – Differences

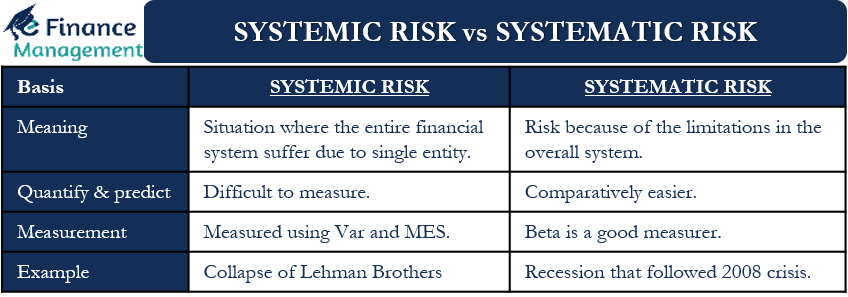

Following are the differences between Systemic Risk vs Systematic Risk:

Meaning

Systemic risk is the situation wherein the entire sector or industry stream gets affected and suffers even by the downturn or collapse of a single big entity in the sector/industry. And that will adversely impact the entire financial system due to one single company. Systematic Risk is the risk because of the limitations in the overall system. Or we can say that this risk is part and parcel of investing in the financial ecosystem, running the business, and so on.

For example, a large bank that provides large amounts of credit without adhering to standards could lead to systemic risk. In contrast, weakness in fiscal or monetary policy, the political situation, and other things could result in systematic risk.

Quantify and Predict

It is difficult to measure and predict systemic risk. Because the extent of impact and collapse of one or many institutions/entities can not be predicted. But measuring and estimating systematic risk is relatively easier as it happens at a broader scale and affects the overall economy.

Measurement

We can measure systemic risk using a few techniques. These techniques are VaR (Value at Risk) and MES (Marginal Expected Shortfall). MES measures how the risk taken by a company increases the overall risk of that industry.

Also Read: Systematic Vs Unsystematic Risks

Beta is a good measure of systematic risk. For example, if the beta of a portfolio is equal to or greater than 1, then that portfolio has more systematic risk. Because the risk will be more than what the market will face, and if the beta is less than 1, then that portfolio has a less systematic risk as it will move/affect less than the market.

Example

The collapse of Lehman Brothers is an example of systemic risk. After the company filed for bankruptcy in 2008, its impact was felt by the financial system because Lehman Brothers was a massive financial services company. Thus, its collapse sent shockwaves through the entire financial system, including other countries.

The recession that followed the 2008 financial crisis is an example of systematic risk. At the time, most investors saw their investments decline dramatically, and the impact was felt across all asset classes, including real estate, U.S. Treasury securities, and others.

Similar conditions we have faced in the year 2020 due to the spread of the Covid-19 pandemic. Large-scale closure, lockdown, and disruption lead to the economic crisis across the world. This is again an example of Systematic Risk.

Final Word

We now know the differences between Systemic Risk vs Systematic Risk. However, it is important to note that investors cannot avoid both types of risk. However, they can prepare their portfolios for such risks. Preparing beforehand will help investors to minimize losses. Diversification is the best strategy to manage both risks. Moreover, diversification is possible for mitigating Systemic Risk. However, Systematic Risk mitigation is a little difficult as compared to Systemic Risk, though possible by investing in different asset classes.

Frequently Asked Questions (FAQs)

Since systemic risk is the result of the actions of a single company, the causes can be:

a) Banks’ policies.

b) Decline in asset prices.

c) Market crisis

d) Sabotage or any major casualty for the company.

No, because systematic risk affects not only one sector but also the economy as a whole and cannot be eliminated.

Beta is a measure of systematic risk, while VaR Value at Risk & MES is used to measure systemic risk.