Definition of Systematic Risk

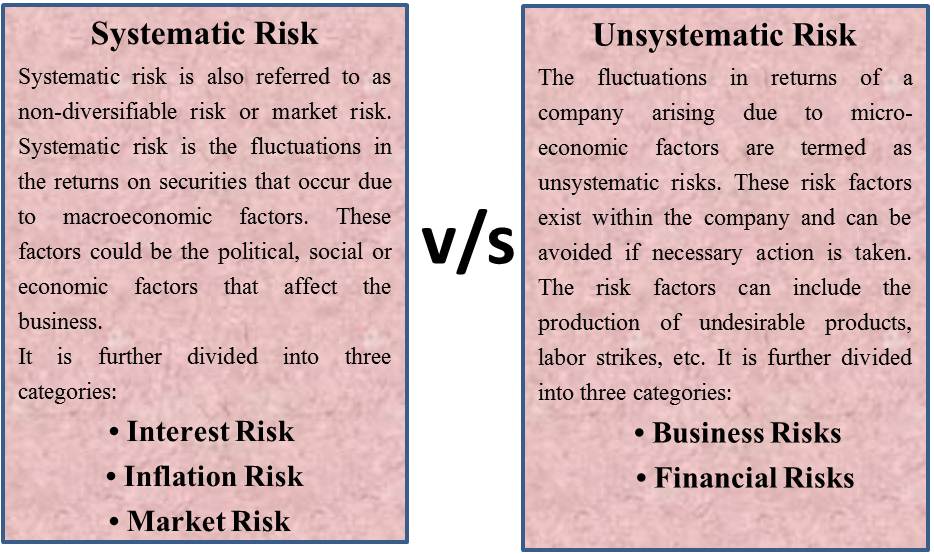

Systematic risk is also referred to as non-diversifiable risk or market risk. Systematic risk is the fluctuations in the returns on securities that occur due to macroeconomic factors. These factors could be the political, social, or economic factors that affect the business. Systematic risk can be caused due to unfavorable reasons such as an act of nature like a natural disaster, changes in government policy, international economic components, changes in the nation’s economy, etc.

Systematic risk is further divided into three categories:

- Interest Risk

- Inflation Risk

- Market Risk

Definition of Unsystematic Risk

Unsystematic risk, also named non-systematic risk or diversifiable risk, is the fluctuations in returns of a company arising due to macro-economic factors. These risk factors exist within the company and can be avoided if necessary action is taken. The risk factors can include producing undesirable products, labor strikes, etc.

Unsystematic risks are further divided into two categories:

After gaining an insight into systematic and unsystematic risk, let’s look at the differences between the two.

Key Differences Between Systematic and Unsystematic Risk

The basic differences between systematic and unsystematic risk are explained in the following points:

Meaning

Systematic risk refers to the probability of loss linked with the whole market segment, such as changes in government policy for a specific industry. In contrast, risks associated with a particular industry is referred to as unsystematic risks like labor strike.

Nature

Systematic risk occurs due to uncontrollable factors such as natural calamities instead of the unsystematic risk, which is due to controllable factors such as the production of undesirable products.

Factors

Systematic risk occurs due to macroeconomic factors such as social, economic, and political factors. In contrast, the unsystematic risk arises due to micro-economic factors such as labor strikes.

Affects

Systematic risk distresses a large number of organizations in the market or an entire industry sector. Whereas unsystematic risk distresses a particular company.

Protection

Systematic risk can be eradicated through several ways, like asset allocation or hedging. However, the unsystematic risk can be eradicated through portfolio diversification.

Categories

Systematic risk is divided into three categories, namely, interest risk, market risk, and purchasing power risk. While unsystematic risk is divided into categories, namely business and financial risks.

Systematic risk + Unsystematic risk = Total risk

After understanding the systematic and unsystematic risk systems, let’s look at the examples for both to get a clearer view.

Table of Differences

| Basis | Systematic Risk | Unsystematic risk |

|---|---|---|

| Meaning | Associated with a whole market segment | The risk associated with a particular industry |

| Nature | Uncontrollable | Controllable |

| Factors | Due to macroeconomic factors | Due to microeconomic factors |

| Affects | Lots of organizations are affected | One specific company is affected |

| Protection | Through asset allocation/hedging | Through portfolio diversification |

| Categories | 3 Types: Interest risk, market risk & inflation risk | 2 Types: Business risk & financial risk |

Example of Systematic Risk

The Great Recession of 2008 proves to be a key example of systematic risk. People who had invested in all kinds of securities saw the values of their investments fall due to the market-wide economic event. The great recession affected various securities in diverse ways. Thus, investors who held stocks were affected in adverse ways as compared to those with wider asset allocations.

Examples of Systematic Risks

Examples of systematic risk are listed below:

- Tax reforms

- Interest rate hikes

- Changes to law

- Natural disasters

- Political instability

- Flight of capital

- Changes in foreign policy

- Currency value changes

- Failure of banks

- Economic recession

Example of Unsystematic Risk

Unsystematic risks are majorly related to errors in entrepreneurial judgment. For example, a technology corporation might undertake market research and expect a rise in demand for smaller cell phones and digital watches in the coming year. For that, production lines are altered, and capital is dedicated to smaller devices.

However, the company realizes that consumers would be more inclined toward bigger phones and watches in the next year. Thus, the inventory and machinery obtained by the company later sell at a major loss or remain unsold. This will, in turn, harm the stock prices of the company. Thus, all the other firms in the technology sector might perform well while this company will backtrack due to poor entrepreneurial foresight.

Examples of Unsystematic Risks

Examples of unsystematic risk are listed below:

- Competitive risk

- Compliance risk

- Errors in entrepreneurial judgment

- Strategy risk

- Outcomes of legal proceedings

- Reputational risk

- Investing risk

- Inherent risk

- Liquidity issue

- Flawed business model

- Labor strikes

Conclusion

In financial management, the avoidance of both systematic and unsystematic risk can prove to be difficult. External factors are involved in causing systematic risk; these factors are unavoidable and uncontrollable. Moreover, they affect the entire market but can be partially constrained through asset allocation and hedging. Unsystematic risk is caused by internal factors and can be controlled and avoided, up to a great extent, by means of portfolio diversification.

Frequently Asked Questions (FAQs)

The various examples of unsystematic risk are competitive risk, strategy risk, outcomes of legal proceedings, etc.

Examples of systematic risk are tax reforms, interest rate hikes, failure of banks, etc.

Systematic risk can be defined as the risk which is beyond the control of the management. Further, it affects all the companies across the industry segments in general.

Diversification reduces the overall volatility of the stock portfolio. The price movements of individual stocks at the aggregate level may average out and may not be so sharp. Hence, diversification definitely reduces the market risk but can not completely eliminate it.

Examples of diversifiable risk are competitive risk, compliances, etc.

An increase in non-diversifiable risk would affect the market more than it affects the returns on stocks.

Quiz on Systematic Vs Unsystematic Risk

Let’s take a quick test on the topic you have read here.

RELATED POSTS

- Unsystematic Risk – Meaning, Types, Advantages, and More

- Financial Risk – Meaning, Types, Management And More

- Differences Between Qualitative Risk Analysis and Quantitative Risk Analysis

- Business Risk – Meaning, Causes, How to Reduce and More

- Market Risk

- Business Risk vs Financial Risk – All You Need to Know