The certainty equivalent method is one of the most famous investment methods, especially for risk-averse investors. This method is used to earn a guaranteed return on the investment while foregoing the possible higher return on the investment in the future. Hence, the investors choose a fixed rate of return on their investment against the opportunity cost of bearing additional risk and earning a possible higher return in the future. Investors use this method to reduce the risk of their investments. The certainty equivalent method comes with both advantages and disadvantages. Let’s see an example to get a better understanding and proceed further.

For example, let’s assume that treasury bonds or T-bonds offer a fixed rate of return of 2.5% on investment. In comparison, the average return on S&P 500 is 8%. If the investor applies the certainty equivalent method, they will invest in the fixed-rate bond instead of investing in S&P 500. The investor chooses to earn a low but fixed-rate return rather than investing in an opportunity with a higher return and risk. Therefore, the risk is reduced, and the investor’s income potential has also fallen along with it. Now, let’s learn about the advantages and disadvantages of the certainty equivalent method.

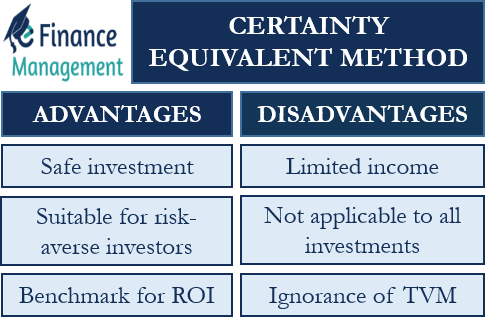

Advantages of the Certainty Equivalent Method

Safe Investment

One of the most apparent benefits of this method is that it is a very safe investment for investors. The return on such investment is fixed and not volatile like normal equity investments. This method conveys the true potential of return on investment without taking any additional risk. Hence, this investment is very safe and reliable for all investors.

Suitable for Risk-Averse Investors

A risk-averse investor accepts lower returns with known risks rather than going for higher returns with unknown risks. Risk-averse investors do not prefer to take additional risks in their investment choices. This makes the certainty equivalent method one of the most suitable investment techniques for risk-averse investors. It offers a guaranteed amount of return on its investment with no additional risk, because of which it becomes one of the most attractive investment options for risk-averse investors.

Benchmark for Return on Investment

The investments using the certainty equivalent method are often used as benchmark return on investment. It can be seen as a testament to the minimum return that can be earned on an investment. The guaranteed return is taken as a risk-free rate. And further used to calculate the return on other investments for taking additional risks.

Disadvantages of the Certainty Equivalent Method

Limited Income

Using the certainty equivalent method can seriously damage the income or return earning opportunity for investors. It certainly helps in reducing investor risk, but it comes at the cost of sacrificing a possible higher return on the investment. Therefore, it limits the overall income the investors receive, making it less attractive for many investors.

Ignorance of the Time Value of Money

The time value of money is often ignored or not adhered to in the certainty equivalent method. The time value of money is used to calculate the adequate amount of return on investment. Investors often accept a fixed and immediate return that is lower than the overall potential return on the investment. This means that investors might earn a return that may be lower than the earning potential of investment as per the time value of money. Therefore, the value of the return received by investors is not equivalent to the actual value of money in the future.

Does not Apply to all Investments

The concept of the certainty equivalent method cannot be used on all types of investments or for all investors. Risk-averse investors mostly use this method on investments with a guaranteed or fixed rate of return. Hence, this method is not very useful for a risk-neutral or risk-seeking investor who is comfortable with taking additional risk in exchange for the possibility of a higher return in the future.