Investment Decisions

Investment decisions are the decisions taken in respect of the big capital expenditure projects. Such expenditures may involve investment in plants and machinery, vehicles, etc. A common characteristic of such expenditures is that they involve a stream of cash inflows in the future and an initial cash outflow or a series of outflows.

Financial management is not only concerned with the sourcing of funds, effective utilization of such funds is equally important to successfully achieve the corporate objective of ‘wealth maximization. Effective utilization of funds can be achieved by investing them in productive activities or assets. Such decisions of selecting the right avenue of investment for a relatively longer term are called investment decisions.

Business assets can be broadly classified into two categories, namely short-term or current assets and long-term or fixed assets. Investment decisions are mainly concerned with the latter, i.e., fixed assets, which generally involve big cash flows and big initial capital investment. Investment decisions are also known as capital investment decisions because of the involvement of huge capital requirements.

A steel manufacturer was considering an investment in new plant and machinery, a service-oriented company was thinking of introducing new and improved organization-wide software, and a pharmaceutical company was thinking of buying patents for certain drugs. Such circumstances involve big investment decisions. A wrong decision can make things worse than one can expect at any of these stages. Such decisions are very long-term decisions and involve a huge investment of money, human resource, and other assets. So, it’s not a frequent situation for a business, and the right decision-making is very essential. Else, circumstances can be horrible for all concerned with them.

Now, the question is how to make sure that the decision is correct and rational. In a profit-oriented organization, it is simple to decide on the objective of investing. The decision would be considered appropriate if it is a profitable investment and enhances the wealth of the shareholders. Capital budgeting techniques are utilized to do investment appraisals for such investments.

There are some capital budgeting techniques that assist an entrepreneur in deciding whether to invest in a particular asset or not. The analysis is based on the cash flows generated by using those assets and initial or future outlays required for the acquisition of the asset. Such investment techniques or capital budgeting techniques are broadly divided into two criteria:

Discounting Cash Flow Criteria

Discounting cash flow criteria has three techniques for evaluating an investment.

- Net Present Value (NPV)

- Benefit to Cost Ratio

- Internal Rate of Return

Non-Discounting Cash Flow Criteria

Non-discounting cash flow criteria have two techniques for the evaluation of investment.

- Payback Period

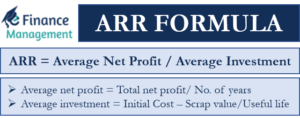

- Accounting Rate of Return