Almost all investments carry risk, and in general, the greater the risk more is the reward. The two most popular measures of risk are beta and standard deviation. Both these measures help in determining the risk, but which of the two is better is a debatable question. Many would say beta is better, but not all will agree with it. In this article, we will discuss which of the two is better, and if the beta is better, then why is beta better than the standard deviation in measuring risk.

To understand which of the two is better, we need to understand what these two measures are and what are differences between them.

Beta and Standard Deviation

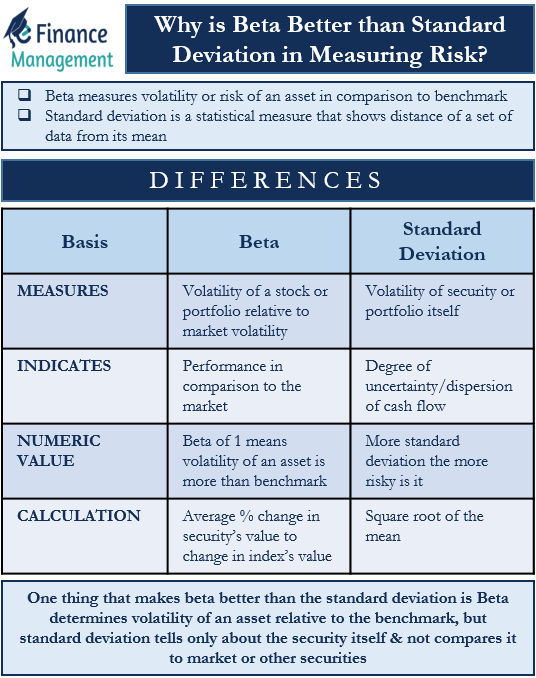

Beta measures the volatility or risk of an asset (or a basket of assets) in comparison to the benchmark. A point to note is that beta is a relative measure, and it doesn’t depict a security’s individual behavior. For example, we can calculate the beta of a stock by comparing the return of a stock with the return of the index, such as NASDAQ 100. Thus, beta shows the performance of the stock in comparison to the market. A beta of 1 means the stock’s return is in accordance with the performance of the market. And a beta of below one suggests the asset in question is less volatile than the benchmark.

Standard deviation is a statistical measure. It primarily shows the distance of a set of data from its mean. In other words, it is the dispersion of return from the mean. For a portfolio, the standard deviation depicts the volatility on the basis of the returns spread over a time period. The general rule is more the standard deviation; the more is volatility and risk in an investment. Or we can say that security showing a higher standard deviation is more volatile in comparison to others.

Beta vs. Standard Deviation: Differences

Following are the differences between beta and standard deviation:

What it Measures?

Beta shows the volatility of a stock or portfolio relative to the market volatility. Standard deviation, in contrast, helps to determine the volatility of the security or portfolio itself.

Also Read: Beta Coefficient in Finance

What does it indicate?

The standard deviation shows the degree of uncertainty or dispersion of cash flow. On the other hand, beta indicates the risk or volatility of a security relative to the benchmark or how the security performs in comparison to the market.

Numeric Value

A beta of 1 means the volatility of an asset (or basket of assets) is more than the benchmark. And a beta of below one implies the volatility is less than the benchmark. In contrast, the more the SD, the more risky an investment is.

Is Less Better?

In the case of a bullish market, a lower beta could mean that the security or portfolio would give less than the market return. A lower standard deviation, on the other hand, means the investment is less riskier.

Calculation

Standard deviation is basically the square root of the mean of the SD. Beta, on the other hand, is the average % change in the security’s value in comparison to the change in the index’s value.

Why is Beta Better than Standard Deviation in Measuring Risk?

Now that we know what beta and standard deviation are and how they are different, we are ready to answer which of the two is better.

Though both are popular measures of volatility, there is one thing that makes beta better than the standard deviation. Beta determines the volatility of an asset relative to the benchmark. But the standard deviating tells only about the security in question and not how it compares to the market or other securities.

In contrast, one point that makes standard deviation better than beta. Standard deviation tells about the total risk of a security, i.e., both systematic and unsystematic risk. But beta tells only about the systematic risk. Systematic risk (market risk) is attributed to the entire market, and one can’t eliminate it. But Unsystematic risk is the risk attributable to a specific industry or security. We can diversify this risk through proper diversification.

Both beta and standard deviation have one point each in their favor. So, we can conclude that both are important measures of risk. We can, however, say that beta is a better measure for those who want to focus only on the systematic risk and the performance of a security relative to the market. And the standard deviation is better for those who focus on the total risk (both systematic and unsystematic) and only the given security.