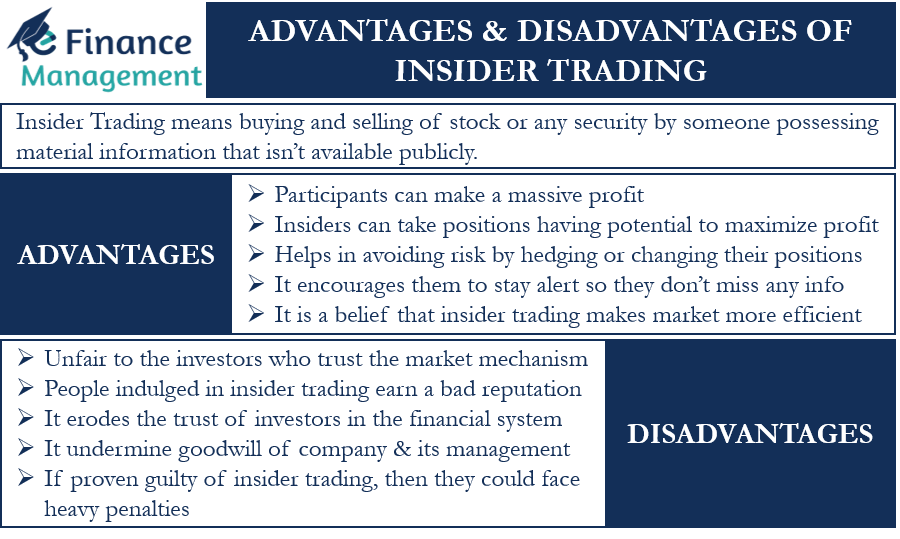

Insider trading means buying and selling stock or any security by someone possessing material information that isn’t available publicly. A point to note is that insider trading doesn’t necessarily have to be from an insider, such as someone from management, directors, and employees. Rather such trading from an outsider will also be termed insider trading. Outsiders could be investors, brokers, and fund managers. Though insider trading is illegal, there are a few points in favor of it. In this article, we will take a look at the advantages and disadvantages of insider trading.

Advantages of Insider Trading

Insider trading is advantageous mainly to the entities participating in it. Let’s take a look at the advantages of insider trading:

- The biggest advantage is that participants can make a massive profit. By using secretive information that isn’t available publicly, insiders can take positions that have the potential to maximize their profits.

- It helps investors or traders to reduce or avoid risk by hedging or changing their positions on the basis of insider information. Since insiders have access to extra information, they can take decisions accordingly. For instance, if someone gets insider information that the company will post a big loss, he or she will sell or short the stock to reduce risk and maximize the returns.

- To others, the practice of insider trading encourages them to stay alert so that they don’t miss any information. Market participants know that if they get hold of any secretive information, it could get them big rewards. The reward could be a fat bonus or promotion in office.

- Many believe that insider trading makes the market more efficient. This is because non-public information also gets reflected in the stock price. When insiders buy or sell security using secret information, the stock price will move up or down. This could serve as a signal to other investors regarding the sentiments for that specific stock. This would result in a stock price correction.

- If any fund house or institutional investor has access to non-public information, then it could benefit a large number of small investors.

Disadvantages of Insider Trading

The following are the disadvantages of insider trading:

- It is very unfair to the investors who trust the market mechanism for buying and selling securities.

- Those who indulge in insider trading earn a bad reputation. And, if they are proven guilty of insider trading, then they could face heavy penalties. They can face jail time as well.

- Insider trading is not good for the overall financial markets. It erodes the trust of the investors in the financial system. Also, it undermines the goodwill of the company, as well as its management.

- Some market participants can use insider information to manipulate the stock market.

Final Words

Insider trading does offer numerous benefits to those practicing it. The major benefits include lower risk and more rewards. These benefits, however, are usually short-term and specific to those practicing it. In the long-term, insider trading could result in potential consequences for those practicing it, as well as erode confidence in the financial market ecosystem.