Beta is one of the most crucial measures of risk. When we usually talk about beta, we are talking about levered beta. This beta basically depicts the impact of both equity and debt (leverage) components. Though leveraged beta is most commonly used in the financial industry, you may have heard of analysts unlevering and relevering beta. So why do we unlever and relever beta?

To understand why do we unlever and relever beta, we need to separately look at unlevered and relevered beta.

Why do we Unlever Beta?

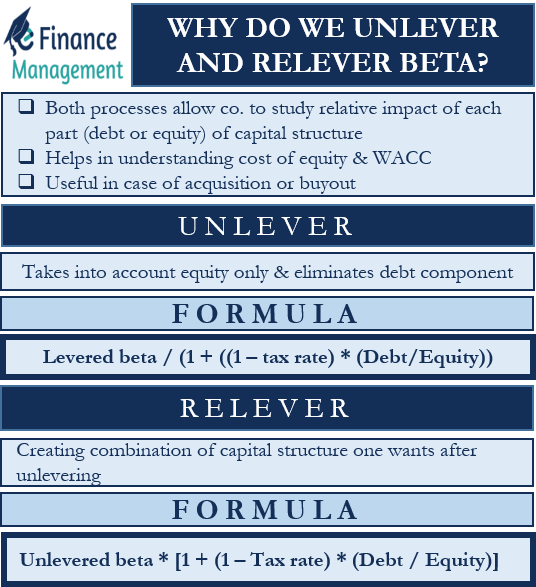

As said above, beta (or levered beta) studies the impact of both equity and debt on the volatility of the stock. So, unlevered beta eliminates the impact of the debt component (or leverage). It means that an unlevered beta takes into account equity only, or we can say it removes the financial effects of leverage.

Unlevering beta eliminates any positive or negative impact of having debt in the company’s capital structure. So by comparing unlevered beta with the unlevered beta of other companies, investors can get a clear idea of the equity risk they are assuming.

Suppose a company takes on more debt, increasing its debt-to-equity ratio. Now, a bigger portion of the earnings will go towards servicing the debt. This would concern the investors about the company’s future earnings prospects making the stock more risky. Now, if investors want to look at the company’s potential as it had no debt, then they can use the unlevered beta. The unlevered beta treats the company as if it had zero debt.

Also Read: Unlevered Beta

Another use of this beta is to compare firms with different debt levels in their capital structure. To calculate the unlevered beta, we need to know the levered beta, debt-equity ratio, and the corporate tax rate. Below is the formula to calculate unlevered beta:

Unlevered beta = Levered beta / (1 + ((1 – tax rate) * (Debt/Equity))

Unlevered beta is usually less than or equal to the levered beta. Another name for this beta is the asset beta.

Why do we Relever Beta?

After we unlever beta, we can relever it for any combination of capital structure we want. For instance, if we want to get the beta with 20% debt, then we first need to unlever the beta, then relever it for 20% debt.

We can reveler the beta using the below formula:

= Unlevered beta * [1 + (1 – Tax rate) * (Debt / Equity)]

Example

Company A is in the real estate industry. The average beta of the comparable firms in the industry is 0.9, and the average debt-to-equity ratio of the comparable firms is 0.5. Suppose Company A has a debt-to-equity ratio of 0.25 and a tax rate of 30%. Now, we will use this information to get the unlevered and relevered beta.

First, we need to calculate the unlever beta using the formula above:

= 0.9 / [1 + (1 – 0.3) * (0.5)] = 0.67

Now we have to re-lever beta using the unlevered beta (above) and the debt-to-equity ratio of Company A. Putting the values in the formula for the re-levered beta:

Also Read: Unlevered Beta Calculator

= 0.67 * [1 + (1 – 0.3) * (0.25)] = 0.79

Now, Company A can use this re-levered beta, the risk-free rate, and the market risk premium to come up with the cost of equity.

Why do we Unlever and Relever Beta?

Now that we know what is unlevering and relevering beta, we are in a position to answer – why do we unlever and relever beta?

Unlevering and relevering beta is very similar to de-assembling and then re-assembling of capital structure. Both processes allow the company to study the relative impact of each part of the capital structure. Also, it helps in understanding the cost of equity and the WACC (weighted average cost of capital).

Talking about their most important use, unlevering and relevering of beta, is very useful in case of acquisition or buyout. This is because, after the acquisition or buyout, the capital structure of a firm usually changes. So, unlevering and relevering help the acquiring firm to study the potential of the target firm with different capital structure combinations.

In case of a buyout, the target’s firm current capital structure doesn’t really matter to the acquiring firm. So, the acquiring firm first unlevers and then relevers beta to determine the impact of multiple debt levels. Such calculations allow the acquiring firm to get the optimal or desired capital structure.