The time value of money is one of the core topics of finance. It states that the value of a sum of money is more in the present than in the future because of the money’s possible earning potential. The time value of money is also known as the present discounted value. But the question here is what determines this time value of money. In this article, we will be learning about the determinants of the time value of money.

Determinants of the Time Value of Money

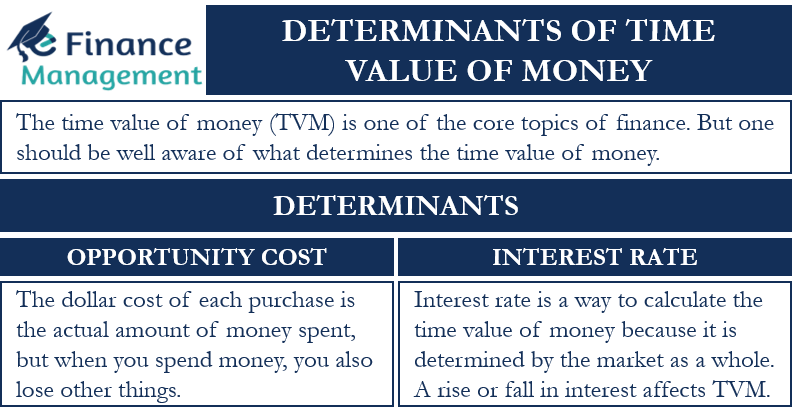

There are two key factors that are used to determine the exact time value of money for a given amount. These two factors are opportunity cost and interest rate. Let us discuss both these factors to better understand them and calculate the accurate time value of money:

Opportunity Cost

The “dollar cost” of each purchase is the actual amount of money spent, but when you spend money, you also lose other things. Additionally, you forfeit the opportunity to use that money for something else; this is referred to as the “Opportunity Cost.”

People who have a very low time value of money have a very easy time saving because it makes little difference whether they buy something now or tomorrow, making delaying purchases easier. Every time a purchase is postponed until later, there is a small increase in the amount of money in their bank account; postponing enough purchases for an extended period of time results in a large bank account and the opportunity to acquire large items.

Also Read: Factors affecting Time Value of Money

On the other hand, people with very high time values of money have a much harder time-saving. The majority of people have greater time values of money, so it’s crucial to adopt specific savings tactics and goals to amass wealth before you have the opportunity to do so.

Interest Rate

Interest rates work as a way to calculate the time value of money because they are determined by the market as a whole. Investors will purchase more bonds if the interest rate is greater. Thus, the US Treasury will try to sell 30-year bonds to them. If the markets are growing, investors see a lot of other investment opportunities that could pay a high return. So, they force the interest rate on bonds to go higher. If the economy is shrinking, there are fewer good potential investment opportunities. Also, more investors are willing to settle for bonds at lower interest rates.

Therefore, interest rates in the economy have a direct connection to the time value of money. As interest rates rise or fall they highly impact the time value of money and investment decisions.

RELATED POSTS

- Interest Rate is a Sum of Real Risk-Free Rate and Compensation for 4 Types of Risks

- Importance of Time Value of Money

- Compounding vs Discounting – All You Need to Know

- How is a Timeline Useful in the Time Value of Money?

- How is the Interest Rate related to the Required Rate of Return, Discount Rates, and Opportunity Cost?

- Discount Factor Formula – How to Use, Examples and More