The time value of money is one of the most important concepts of finance. It is very crucial to understand and implement to make wise investment decisions. It states that having money in hand right now is more valuable than getting the same amount of money in the future. Therefore, from an investment or business perspective, the money can be used to invest or expand the business to generate more money. Thus, money holds the potential to generate income in the future.

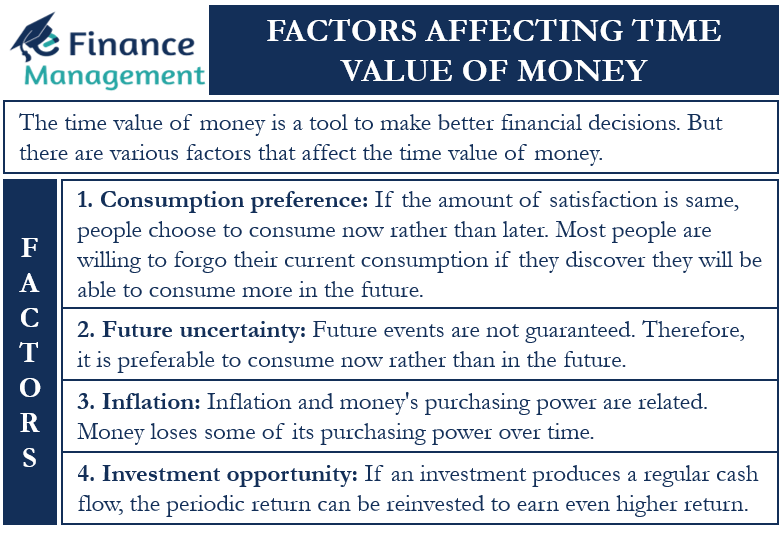

The time value of money can also be used as a tool to make better financial decisions. It helps in assessing the debt position of a business and is also used for determining the future value of a potential investment. It also helps in comparing multiple projects which are similar in nature. Therefore, it helps in the evaluation of risk and return on various investment opportunities. But there are various factors that affect the time value of money. Let us have a look at those factors.

Factors affecting Time Value of Money

The following are the various factors that affect the time value of money.

Consumption Preference

If the amount of satisfaction is the same, people choose to consume now rather than later. Most people are willing to forgo their current consumption if they discover they will be able to consume more in the future. Their decision to forgo current spending is mostly driven by a higher rate of return that is greater than the required rates of return. Even though they are not concerned about the benefits of the future, some people believe that since the future is unclear, it is best to consume now.

Future Uncertainty

Future events are never guaranteed. What will occur in the future is unknown and no one can predict future events accurately. The financial environment of an economy goes through major changes over time. Therefore, if the present consumption rate is higher, it is preferable to consume now rather than in the future. People prefer to offset uncertain future financial flow with reliable cash flow.

Also Read: Determinants of the Time Value of Money

Inflation in Economy

Inflation and money’s purchasing power are related. Money loses some of its purchasing power over time. Every economy experiences inflation, yet the rate varies from one country to the next. If there is higher inflation then the required rates of return of investors are higher. For a higher inflationary economy, consumers prefer current consumption rather than future consumption. Hence, the time value of money has a negative relationship with inflation. The value of the currency goes down when the general price level rises, which means consumers’ purchasing power declines and the future value of a sum of money falls.

Investment Opportunity

Reinvestment is a concept that the time value of money takes into account. If an investment produces a regular cash flow, the periodic return can be reinvested to provide an even higher return. Whatever the current cash flow may be, if it arrives now, it can be invested to produce future cash flow. The projected cash flow exceeds the cash flow at present.

RELATED POSTS

- Importance of Time Value of Money

- Interest Rate is a Sum of Real Risk-Free Rate and Compensation for 4 Types of Risks

- How is a Timeline Useful in the Time Value of Money?

- Compounding vs Discounting – All You Need to Know

- Present and Future Value

- Discount Factor Formula – How to Use, Examples and More