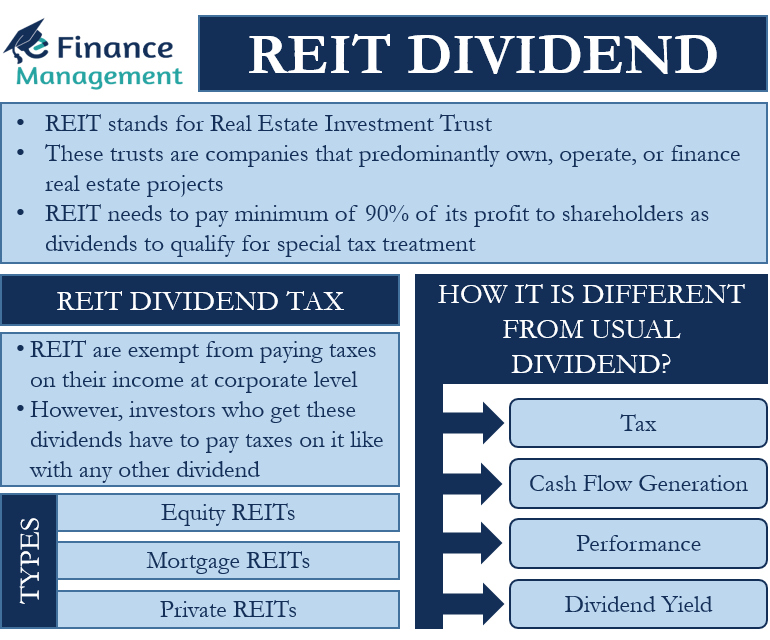

Meaning of REIT Dividend

The full form of REIT is Real Estate Investment Trust. These trusts are companies that predominantly own, operate, or finance real estate projects. The primary objective of these Trusts is to generate a stable and regular income by involving or associating with income-generating real estate. Such companies are very popular among investors because they distribute consistent and large dividends. In fact, a REIT needs to pay a minimum of 90% of its profit to the shareholders as dividends in order, to qualify for special tax treatment. So it is the Dividend from these trusts that makes a REIT different from ordinary dividend-paying stocks. Moreover, it is not just the amount of dividend that a REIT pays that makes them different, but their tax treatment of dividends also differs from other companies.

REIT Dividend Tax

When it comes to a tax on these dividends, there are two aspects of it.

- First is how a REIT is taxed on the dividends it pays.

- And second is how REIT investors are taxed on the dividends they get and the capital gains they make.

As we know, all profit-making corporate entities need to pay taxes on their income. However, these REITs are exempt from paying any taxes on their income at the corporate level. Of course, REITs need to qualify and follow the norm for the purpose. This is the biggest advantage of REIT. This helps to avoid double taxation on the dividends distribution from these trusts.

This taxation advantage is in the following forms:

- They need not pay the corporate taxes on their earnings.

- They can claim the amount of dividends paid as deductions from their income.

Requirement to Qualify a REIT Dividend

In order to claim these tax exemptions, a REIT needs to qualify by meeting these requirements –

- The first and foremost is that it has to fulfill the definition of REIT- investment in environmental projects.

- The distribution of dividends has to be from the earnings of such projects.

- And lastly, it has to distribute at least 90% of its earnings as dividends. Of course, there can be minor changes in these requirements from country to country.

Even though REITs do not have to pay taxes on the dividends they pay, the investors who get these dividends have to pay taxes on them like with any other dividend.

However, most such dividends do qualify for one type of deduction, which is beneficial for investors. Since most REITs distribute the majority of their income, they come under the “pass-through” businesses category. Due to this, REIT dividends qualify for a tax deduction. Taxpayers receiving an income from a pass-through business can get 20% of such income as a deduction from total income.

How Its Different from Usual Dividends

Following are the differences between a dividend from a REIT and from other usual companies:

Tax

As we have discussed above, the biggest difference between the two is the avoidance of double taxation.

Cash Flow Generation

An investor knows that the company is generating cash flows from its real estate investments to pay dividends with a REIT. However, with other dividend-paying stocks, investors need to do research on the company’s products or services to ascertain the source of their cash flows.

Performance

For dividends from other stocks, the performance of the company is extremely important. Dividends will be forthcoming only when the company earns sufficiently and has the necessary cash flow to distribute the dividends. This means if a company fails to make enough profits, it may or may not give dividends. Even though REIT dividends also depend on the performance, there are more chances of a REIT paying dividends even in adverse conditions than from regular stock. This is because of the important qualifying criteria wherein the REIT has to distribute 90% of its income.

Dividend Yield

The average dividend yield of the S&P 500 stocks is 1.9%, but the average equity REIT pays around 5%.

Types of REIT Dividends

A point to note and know here is that there is not only one type of REIT. REITs are of multiple types. Generally, it is the performance of a REIT that determines the amount of dividend it distributes. However, the performance can vary with the type of REIT. All REITs invest in real estate but in different ways.

- For instance, there are equity REITs that directly invest in the real estate/own and operate income-producing real estate. Generally, Equity REITs are called REITs.

- The next is the mortgage REITs (mREIT) that loan money to the property owner.

- We can further subclassify REITs who invest only in residential properties, commercial properties, warehouses, or even data centers.

- There are further classification as public non-listed REITs, or Private REITs

How to Select Best REIT Dividend?

There are differences in opinions as to which type of REIT offers the best return, with some favoring mortgage REITs and some equity REITs.

To select the best type of REIT that pays more dividends, experts recommend investors make themselves familiar with different real estate sectors. Investors must evaluate the sectors that are expected to perform well going ahead.

Though office, industrial and apartment REITs are usually popular among investors, they may not always offer the best yields. So, it is recommended that investors carry out an in-depth analysis to determine the best REIT type.

Conclusion

When deciding or analyzing the REITs to invest for better dividends, investors should consider all possible factors. These factors could be REITs dividend payouts, overall economic environment, how monetary policy changes affect REIT performance, risks of a specific REIT sector, etc.