What is an Implicit Interest Rate?

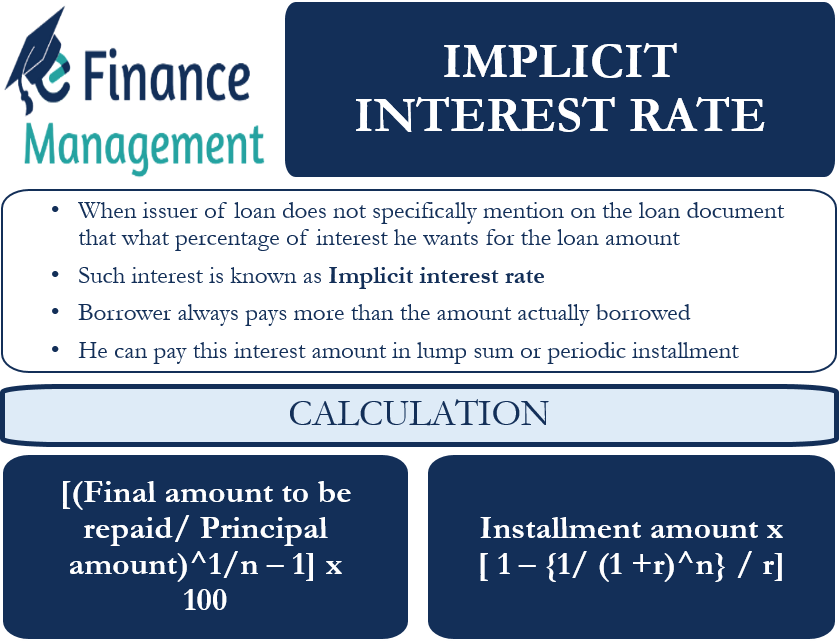

An implicit interest rate is when the rate of interest is not clearly mentioned on the loan document. The lender does not state it explicitly while entering into a contract. This means that the issuer of the loan does not specifically mention what percentage of interest he wants for his loan amount. However, the borrower always pays more than the amount actually borrowed by him. Thus, this extra payment is towards some interest on his borrowing, like in a regular loan arrangement. The lender can mention the sum to be repaid in the form of a lump-sum amount. Also, he can break the total principal amount plus interest into a fixed number of periodic installments. In the second case, the borrower will have to pay back the loan amount over a fixed tenure, as agreed upon at the time of borrowing.

Implicit interest rate is similar to a “suggested” interest rate or implied rate of interest. Even though the interest rate is not clearly mentioned in the contract, it is understood or implied one. The lender always mentions the overall amount he expects to get back against his loan. The final payment that he expects less than the original amount of the loan becomes the interest amount. Therefore, we can always calculate the actual and effective rate of interest that one has to pay from this split of the principal amount and the interest amount.

How do we Use and Calculate the Implicit Interest Rate?

Implicit interest rate is more common in informal loans and agreements. The loan can be from friends, family, or other known people. However, in some cases, it can be even from big vendors such as those automobiles, machinery, equipment, home appliances, etc. Banks and other big financial institutions generally state the rate of interest on their loans explicitly.

The formula for calculating the implicit interest rate is:

[(Final amount to be repaid/ Principal amount)^1/n – 1] x 100

Example 1

Suppose we take a loan from a friend for the amount of $50000. He does not mention any rate of interest that he expects from his loan. However, he does expect to get back a higher sum of money than what he has originally given. At the end of the year, we pay him back $60000 for allowing us to use his funds. In this case, we are paying him an interest amount of $10000 ($60000 – $50000) for a period of one year. Now let us calculate the implicit interest rate in this case with the help of the above formula.

Also Read: Types of Interest Rates

= [($60000/$50000)^1/1 – 1] x100

= [(1.2)^1 – 1] x 100

= (1.2 -1) x 100

=20%

Now suppose that the same loan was for 5 years. The implicit interest rate in this case will be:

= [ ($60000/$50000)^1/5 – 1] x100

= [(1.2)^0.2 – 1] x 100

= (1.037 -1) x 100

=3.7%

Example 2

Mr.XYZ decides to buy machinery for his factory. The seller offers him two options- pay $1000 upfront for the machinery or pay $300 at the end of every year for the next four years. In this case, the seller has not explicitly mentioned any interest rate for the loan arrangement that he is offering. The general rate of interest that is prevailing in the market for similar credit arrangements is 8% p.a. Let us find out which option is better for Mr.XYZ.

The formula for finding out the present value of the regular flow of money in this example is:

Installment amount x [ 1 – {1/ (1 +r)^n} / r]

Here, r= the prevailing rate of interest, n= number of years of the loan arrangement

The present value of the amount that Mr.XYZ has to pay until four years-

$300 x [ 1- {1 / (1+.08) ^4} / .08]

= $300 x [1-.74] / .08

=$300 x 3.25

= $975

Thus, we see that it will be beneficial for Mr.XYZ to opt for the second option as it has a present value of $975, which is lesser than $1000. He should buy the machinery by paying $300 each year for the next four years rather than paying $1000 upfront. The interest amount, in this case, will be the difference between the total amount to be repaid over the years and the present value of the total cash flow stream for the purpose of accounting. Therefore, the interest amount in the current example is $1200 – $975= $225. The effective interest rate will, however, for this transaction will, be $200 ($1200-$1000).

Summary

The implicit interest rate in a loan arrangement is similar to the internal rate of return or the IRR of all the cash flows or installments associated with it. This rate depends upon a number of factors like the time duration over which the loan amount has to be paid back, the number of installments and their frequency, etc. Also, the interest amount is treated as an expense in the books of accounts of the person paying it and as an income for the person who is receiving it.

RELATED POSTS

- Effective Interest Rate – Meaning, Formula, Importance And More

- Add-on Interest – Meaning, Importance, Calculation, and More

- Simple and Compound Interest – Meaning, Formula and Example

- Interest Rate is a Sum of Real Risk-Free Rate and Compensation for 4 Types of Risks

- Effective Annual Rate (EAR)

- Real Interest Rate