Target Profit Pricing: Meaning

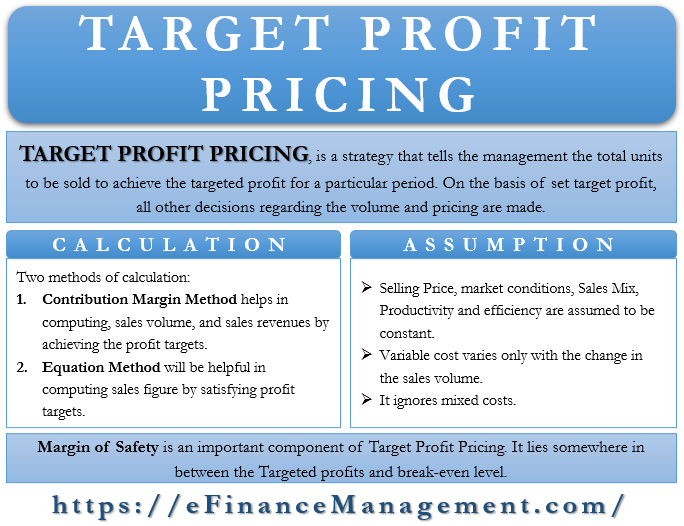

Target Profit Pricing is a cost-based pricing strategy that tells the management the total units to be sold to achieve the targeted profit for a particular period. Under this strategy, after considering total costs and profit targets, the management decides on the total production and sales for a particular period. This period can be a month, quarter, or even a financial year.

It is a step-by-step process that guides the management of the company in deciding total sales volume on the basis of the total cost, selling price, and target profits. Almost every company sets profit targets, and on the basis of it, they make all other decisions regarding volume and pricing. Target Profit Pricing strategy helps the management in deciding the price of the product and sales volume on the basis of profit targets. This strategy helps the companies earn profits over and above the breakeven point.

The other name of Target Profit Pricing is Target Profit Analysis.

Methods for Calculating Target Profit Pricing

Target Profit Pricing uses two methods for calculating sales volume and sales price by taking profit targets as a foundation. The major two methods are Contribution Margin Method and Equation Method. The breakeven pricing strategy uses both these methods without considering any profits or losses. Let’s understand these methods:-

Contribution Margin Method

This method is commonly used for the computation of Sales figures under the Target Profit Pricing” targets. The formula is as follows:-

Total Sales Volume (Units) = Target Profits + Total Fixed Costs / Contribution Margin Per Unit

Total Sales Revenue = Total Sales Volume * Selling Price Per Unit

Where,

Contribution Margin Per Unit = Selling Price Per Unit – Variable Cost Per Unit

Contribution Margin Method helps in computing sales volume, and sales revenues by achieving the profit targets.

Equation Method

As the name suggests, in this method solving an equation takes place for the computation of Sales Volume. The equation method is useful for the computation of sales volume under Target Profit Pricing. The other name of this method is the Contribution Margin Method. The formula is as follows:-

Also Read: Target Profit Sales Calculator

Selling Price Per Unit * Total Sales Volume = Variable Cost Per Unit * Total Sales Volume + Total Fixed Costs + Target Profits

Total Sales Revenue = Total Sales Volume * Selling Price Per Unit

The equation method by using the formula will be helpful in computing sales figures by satisfying profit targets.

Let’s understand these methods by an example:-

Example of Target Profit Pricing

Details are as follows:-

Selling Price Per Unit: $50

Variable Cost Per Unit: $10

Total Fixed Cost: $1000

Target Profits: $3000

Compute Sales Revenue and Volume by Contribution Method and Equation Method.

Example of Contribution Method

Sales Volume = 3000 + 1000 / (50-10)

Total Sales Volume (units) = 100 units

Total Sales Revenue = 100 * 50 = $5000

To achieve $3000 of profits, the manufacturer has to produce 100 units of goods at a selling price of $50 per unit.

Example of Equation Method

50 * Sales Volume = 10 * Sales Volume + 1000 + 3000

40 Sales Volume = 4000

Sales Volume = 100 units

Total Sales Revenue = 100 * 50 = $5000

Computation of Sales Volume and Sales Revenue takes place by solving the above equation.

The equation method and the contribution method serve almost the same purpose; the selection of the best suitable method is in the hands of management.

You can also use our Target Profit Sales Calculator

Assumptions of Target Profit Pricing

Target Profit Pricing strategy has few assumptions on which the whole strategy works. They are as follows:-

- Selling price and market conditions are assumed to be constant in this pricing strategy. The management completely ignores current market conditions and their implications on the selling price.

- In this strategy Sales Mix is assumed to be constant.

- Productivity and efficiency are assumed to be constant.

- Variable cost varies only with the change in the sales volume. This strategy ignores other factors influencing the variable cost.

- This Strategy completely ignores mixed costs. This strategy only considers separate fixed costs and separate variable costs.

The above assumptions are non-exhaustive in nature; there could be other possible pointers as well.

Target Profit Pricing Vs. Breakeven Pricing

Breakeven Pricing and Target Profit Pricing are both popular costing strategies with different functions. Let’s understand their differences.

| Target Profit Pricing | Breakeven Pricing |

|---|---|

| This strategy sets up the price and production volume according to the profit targets. | This strategy sets up the price with the target of reaching a level where there are no profits or losses. |

| Target Profit Pricing strategy is generally useful at the time of the growing stage of the company. | Breakeven Pricing Strategy is useful in the introductory stage of the company. |

| Since the company earns enough profits according to the targets, there is no additional requirement for other resources. | As the company is not earning any profits, sometimes personal resources are also deployed. |

| The implementation of this strategy is comparatively less risky. | Implementation of Breakeven Pricing is comparatively riskier, as the business earns ‘0’ revenues. |

| This strategy is useful in the long run. | This strategy is not useful in the long run. It is mostly used for entry or for market disruption or when a bulk order is received and when there is the likelihood of continuous order to take care of the extra capacity available, etc. |

| Growth can be seen due to the plowing back of profits. | In this strategy, growth can probably be seen in the long run after increasing the customer base. |

| This strategy attracts quality-centric customers as the price is the same for almost all other brands available. | This strategy attracts price-centric customers because of the lowest price provided by the company. |

| Under this strategy, there are low chances of switching. If the quality deteriorates or the company increases the profit margin, the customer can switch. | There are high chances of switching of customers once the company drops this strategy and increases the price. |

| This strategy maintains healthy competition in the market. | This strategy can create cut-throat competition in the market because of lower prices. |

Margin of Safety

The Margin of Safety is an important component in Target Profit Pricing Strategy. As the name suggests, it acts as a safety net for the management. The Margin of Safety lies somewhere in between the Targeted profits and the break-even level. In the case of Units, it is the difference between Target Sales in Units and the Breakeven volume of Units. In the case of Dollars, it is the difference between Target Sales in Dollars and Breakeven Sales in Dollars.

The Margin of Safety is anything above the breakeven point and below the target point.

Conclusion

Target Profit Pricing is one of the popular strategies which helps the management in deciding the total units of production after covering all costs and target profits. Target Profit Pricing strategy works on many assumptions; irrespective of this, it is best used in Costing. It gives the management estimates for enabling the production process. This strategy, along with the break-even pricing strategy, boosts the company’s production functioning. The management, however, should be clear what would be the stage and status in case the target volume could not be sold due to the Target Price being fixed. And what action they need to take to reach at least the break-even sales volume.