Production Volume Variance: Meaning

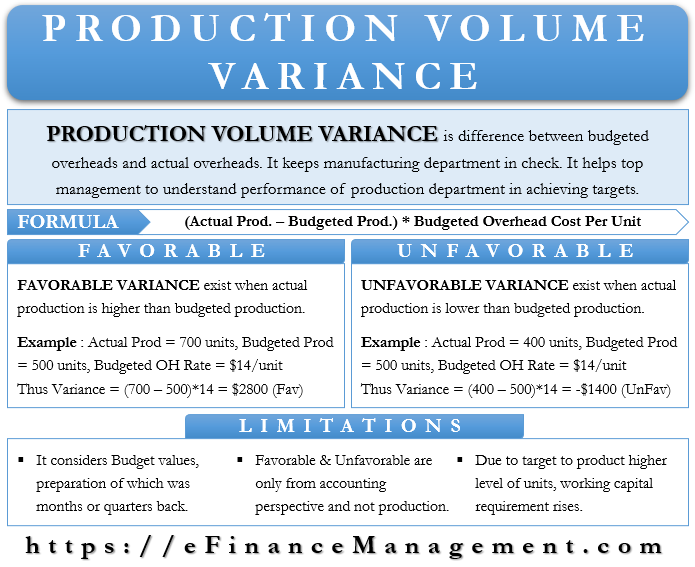

Production Volume Variance is the difference between budgeted overheads and actual overheads. In other words, as the name suggests, it compares the actual production quantity with the budgeted production quantity to come up with a variance. And the difference is later multiplied by the overheads cost per unit.

In the calculation of Production Volume Variance, consideration of only overheads cost takes place and not the total cost. And the management considers overhead costs in the calculation to understand whether the organization can produce enough volumes to earn profits. Moreover, in this analysis, as the production volume increases, the per-unit overhead costs decrease, resulting in higher profits.

The Production Volume Variance keeps the manufacturing department in check. And it helps the top management to understand the performance of the production department in achieving long-term targets for the company. It also has other names such as Volume Variance, Denominator Level Variance, or Fixed Overhead Volume Variance.

Favorable or Unfavorable

The Production Volume Variance is favorable when the actual production exceeds budgeted production. Therefore, when the production volume is huge, the allocation of total overheads costs takes place to a large number of units, and so the per-unit production cost decreases. However, when the Production Volume Variance becomes unfavorable where the budgeted production level is higher than the actual production achieved.

Also Read: Sales Volume Variance

The positive variance shows favorability, and the negative variance shows unfavorability. Moreover, when the variance is positive, the difference amount is an additional saving due to additional production. Similarly, when the variance is negative, the negative difference is a loss due to a decrease in production. Moreover, in the situation where the Actual and Budgeted production is the same, then there exist no variances.

Production Volume Variance: Formula

Let’s understand Denominator Level Variance with a formula:-

Production Volume Variance = (Actual Production – Budgeted Production) * Budgeted Overhead Cost Per Unit

As shown above, a comparison of the Production target (Budget) takes place with the Actual Production. And later, the difference is multiplied by per unit Budgeted overheads costs.

Examples of Production Volume Variance

Example 1

| Actual Production | 700 Units |

| Budgeted Production | 500 Units |

| Budgeted Overhead Cost Per Unit | $14 |

Denominator Level Variance = (700 – 500) * 14 = $2800

In the above example, $2800 is a Favorable Variance because the actual production is higher than the budget targets. And this additional saving of $2800 is because of the additional production, over and above the budget targets.

Example 2

| Actual Production | 400 Units |

| Budgeted Production | 500 Units |

| Budgeted Overhead Cost Per Unit | $14 |

Denominator Level Variance = (400 – 500) * 14 = -$1400

The negative variance depicts an Unfavorable Variance. In this case, the actual production is less than the budget targets by 100 units, and as a result, there is an additional loss of $1400.

Also Read: Variance Analysis Formula with Example

Examples 1 and 2 show a hypothetical situation of both favorable and unfavorable variance.

Refer to Variance Analysis Formula with Example for various other types of variances.

Limitations of Production Volume Variance

- One of the major limitations of Denominator Level Variance is that it considers Budget values, preparation of which was months or quarters back. And since figures in the Budget are just estimates, projected before the actual production, many organizations do not consider this an authentic tool.

- Favorable variance or unfavorable variance is mostly helpful only from the accounting angle. Moreover, from a business and cash flow point of view, the production should be in accordance with the demand and not with respect only to lower per-unit costs. Because otherwise, there may be unsold inventory lying in the store, attracting other costs. And this is the second limitation.

- As the target in Denominator Level Variance is to produce in large quantities, sometimes the Working Capital requirement increases to a higher level.

The above limitations are non-exhaustive in nature; there could be other pointers as well.

Conclusion

Production Volume Variance is a difference between budgeted overheads and actual overheads with respect to the production volume. Irrespective of its limitations, it still helps the management to keep a check on the production department. And it also helps the top-level management to understand whether the production department is working in the direction of long-term goals or not. Moreover, the Denominator Level Variance allocates overhead costs and acts as a balancing tool among budget targets and actual levels. The positive variance shows the efficiency of the production department as well as the production planning process with an overall objective of lowering the costs.

RELATED POSTS

- Variable Overhead Efficiency Variance – Meaning, Formula, and Example

- Sales Quantity Variance

- Cost Variance – Meaning, Importance, Calculation and More

- Variable Overhead Cost Variance – Meaning, Formula, and Example

- Fixed Overhead Spending Variance – Meaning, Formula, Example, and More

- Direct Materials Quantity / Usage / Volume Variance