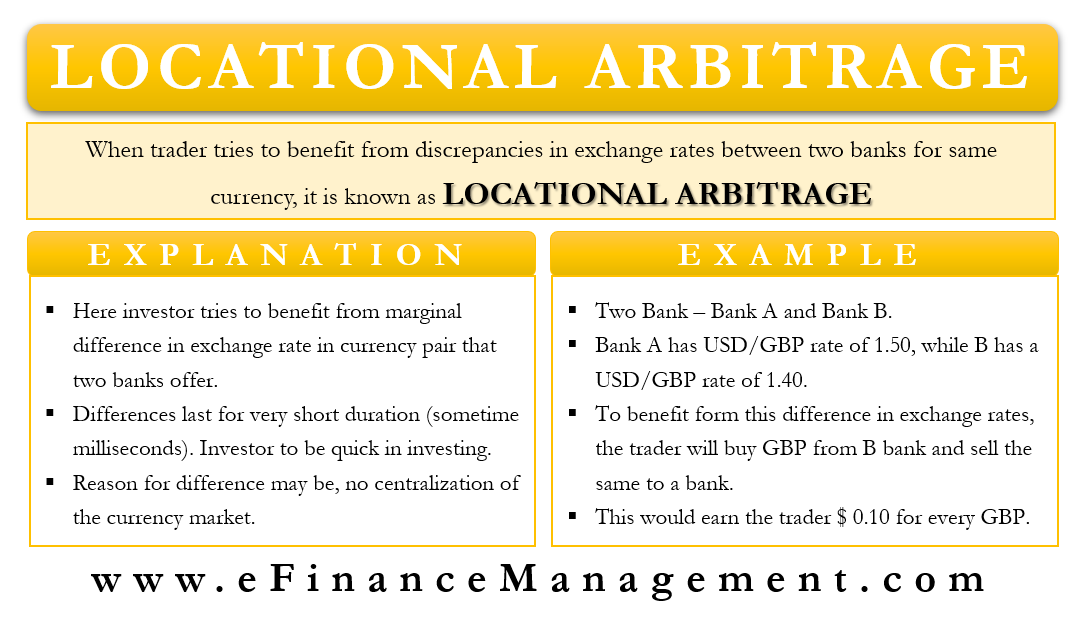

Locational Arbitrage is one of three popular types of currency arbitrages common in the FX or Forex market. The other two are – Triangular Arbitrage and Covered Interest Arbitrage. In simple words, a locational arbitrage is when a trader tries to benefit from the discrepancies in the exchange rates between two banks for the same currency.

Locational Arbitrage – Explained

Before we explain locational arbitrage, we need to know what arbitrage is. Arbitrage is a trading strategy where an investor concurrently buys and sells assets, usually currency, to benefit from the price difference. The price difference could be between regions, or two entities, such as banks. Such opportunities are rare and offer low-return but are technically risk-free.

In locational arbitrage, an investor tries to benefit from the marginal difference in the exchange rate in currency pair that two different banks offer. These differences in the exchange rates last only for a short period of time. So, it is crucial that investors and traders act very quickly to take benefit of such an opportunity. If there is a correction in the exchange rate before a trader executes the transactions, then the trader could incur heavy losses.

A primary reason why such a discrepancy in the exchange rate even exists is that there is no centralization of the currency market. Global stock markets face heavy regulations and are centralized through exchanges. But, the forex market does not face such regulations and is largely OTC (over-the-counter) market.

Since the trades are OTC and there is no centralization, this sometimes results in a difference in the exchange rate for the same pair of currencies between two banks. However, as said above, these differences last only for a short time, sometimes just for milliseconds.

Examples of Locational Arbitrage

There are two banks – A and B. To keep the example simple, we will be ignoring bid/ask spreads in this case. Bank A has a USD/GBP rate of 1.50, while B has a USD/GBP rate of 1.40. To benefit from this discrepancy, the trader will simultaneously buy GBP from B bank and sell the same to a bank. In this trade, the trader would make $0.10 for every GBP.

Now, let’s consider an example with a bid/ask spread. Suppose bank A offers a USD/GBP rate of 1.50/1.55, and bank B offers a USD/GBP rate of 1.56/1.58. In this case, there is an arbitrage opportunity if a trader buys one GBP from bank A for $1.55 and then sells the same to bank B for $1.56. In the transaction, a trader would make $0.01 per GBP.

Now, what if we change the rates that bank B offer to 1.54/1.58? Does arbitrage opportunity still exist? No, there is no arbitrage opportunity now. Even if a trader buys GBP from bank A at $1.55, the rate that bank B offers is $1.54. So, the trader will lose $0.01 per GBP here.

Triangular and Covered Interest Arbitrage

To better understand locational arbitrage, we also need to know what are triangular and covered interest arbitrage.

Covered interest arbitrage uses a forward contract to hedge the exchange rate risk. In this, an investor tries to benefit from the difference in interest rate between two markets and then uses a forward contract to lower the exchange rate risk.

Triangular arbitrage is very similar to locational arbitrage, but unlike the latter, the former involves three currencies. In triangular arbitrage, a trader tries to benefit from the discrepancy in the exchange rate between three foreign currencies with one base currency and two supporting currencies, such as EUR/USD, EUR/GBP, and USD/GBP. In this, USD is the base currency.

Final Words

The above example clearly shows that locational arbitrage is an easy-to-execute strategy. However, the difficult part is identifying such an arbitrage opportunity. Traders need keen eyes and determination to locate such an opportunity. Traders also employ state-of-art software to help them identify such opportunities. Also, they take the help of software to quickly execute such an arbitrage as it involves carrying two simultaneous trades.

One setback of this arbitrage is that the trader needs to make a big investment to make big money. Since the differences in the exchange rate are razor thin, the only way to make big money is to make a big investment.

Also, a trader needs to consider the trading expenses when deciding whether or not an arbitrage would be profitable. However, such a strategy is risk-free if a trader can execute it well.

DEAR SIR,

CAN YOU PLEASE PROVIDE TO IMPORT & EXPORT PROCEDURE MENINGES AND REQUIRED DOCUMENTS

THANKS IN ADVANCE

T. BALA

+2349010723910