What is Money Market Hedge?

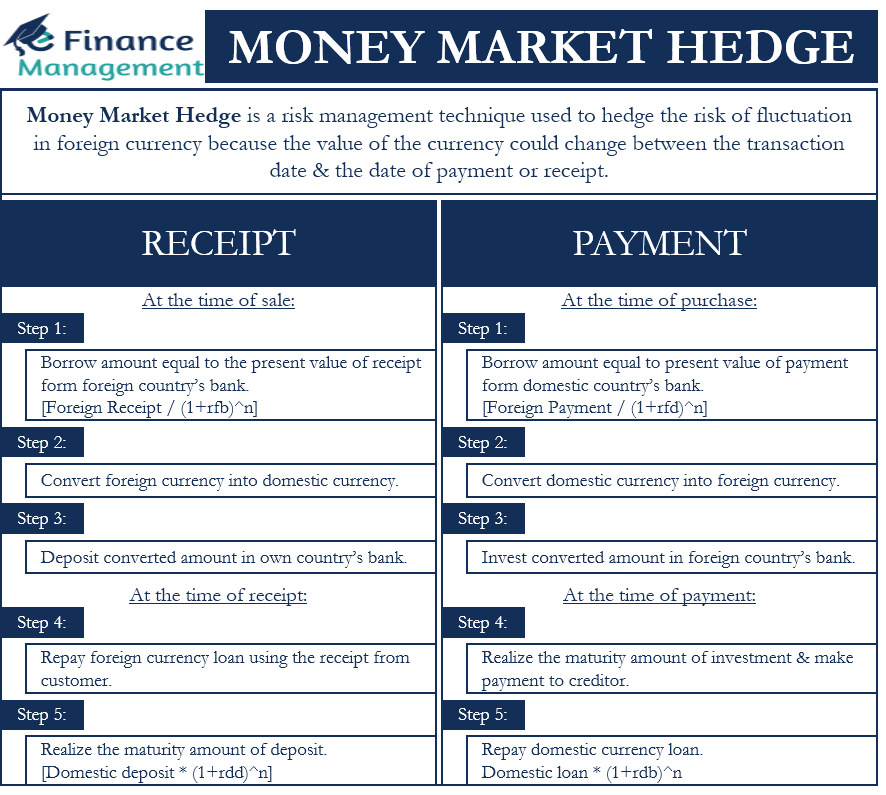

Money Market Hedge is a risk management technique. It lowers the transaction risk in a foreign exchange transaction.

A business that pays or receives money in foreign currency is exposed to currency risk if the date of paying or receiving the money is in the future. This is because the value of the currency could change between the transaction date and the date of payment or receipt. This is where a money market hedge is useful. It helps a business to reduce or hedge this risk.

How a business implements this hedge depends on if a business expects to pay or receive the foreign currency. Discussed below are both scenarios with examples.

Money Market Hedge: Receipt of Foreign Currency

Suppose a business will receive a payment from a customer in foreign currency at a pre-defined future date. The business, in this case, faces a risk that on the day of receipt, the currency conversion rates may be less. To hedge this risk, businesses adopt the money market hedge strategy.

Borrowing in Foreign Currency

The business borrows an amount in foreign currency at present, i.e., at the date of purchase or sales. The amount of the loan will be equal to the present value of the payment that a business is set to receive at a future date.

A simple formula to calculate the amount to borrow is:

Foreign Loan (Fl) = Foreign Receipt / (1+rfb)n

Here, rfb is the interest rate on foreign currency borrowing. And n is the number of years the business is borrowing the money.

Depositing Foreign Currency Loan in Recipient’s Own (Domestic) Country

The business will immediately convert this foreign currency loan into domestic currency at the spot exchange rate. It then deposits this loan amount (in domestic currency) at the domestic interest rate for the same period for which the payment from the customer is due.

So, the amount that the business will deposit (at domestic interest rate) will be:

Domestic Deposit (Dd) = Fl × Spot Rate.

Repaying Foreign Currency Loan

At the end of the loan period, the sum of the interest and the principal amount borrowed will be the same as the amount the business will get from the customer. So, the business will use the payment it gets from its customer to repay the foreign currency loan.

Receiving Maturity Amount of Deposit

Also, the business will earn interest on the amount it deposited by converting the foreign currency loan amount. And, at the end of the period, it would have a sum of money available in the domestic currency.

This money will be equal to:

Final Domestic Value = Dd * (1+rdd)n

Here, rdd is the domestic deposit interest rate.

Calculation of Effective Exchange Rate

Once the business gets the money from the customer, we can calculate the effective exchange rate. The formula to do so is:

Effective Exchange Rate = Final Domestic Value / Foreign Receipt.

Also Read: International Financial Markets

Since the payment from the customer will also be in foreign currency, the foreign currency loan will be repaid by the same. And the business will also receive the maturity amount of the deposit, which is in domestic currency only. Hence, no actual foreign currency transaction takes place at the date of receipt.

Receipt of Foreign Currency: Example

Company A, a U.S. firm, allows a credit period of six months (0.5 years) to its customers. It has sold goods to one of its European customers for 20,000 Euros. To make it simple, let’s assume the spot exchange rate is 3 units of dollars per 1 unit of Euro. The annual interest rates are 8% in the U.S. and 10% in Europe.

Firstly, Company A will take a loan in Euros.

Loan amount = 20,000 / (1+10%)0.5 = 19,069 Euro

Now, it will deposit this loan amount in the home country (US). So, we need to convert the loan amount to the domestic currency ($).

Domestic Deposit = 19,069*3 = $57,207

The amount that Company A will get at the end of the period:

Final Domestic Value = $57,207 * (1+8%)0.5 = $59,451

So, Effective Exchange Rate will be = $ 59,451 / Euro 20,000 = 2.97.

Money Market Hedge: Payment of Foreign Currency

Suppose a business has to pay a supplier in foreign currency at a future date. In this case, the business faces a risk that the foreign currency may appreciate in value in comparison to the domestic currency. Thus, the business can hedge the risk by depositing an amount in foreign currency for the same period when it expects to make the payment to the supplier.

Investing in Creditor’s Country

The business deposit an amount equal to the present value of the payment to be made to the supplier in his country for a period equal to the credit period allowed to business. That is, the principal amount and the interest that the business will get (from the deposit) must be the same as the amount the business needs to pay to the supplier. So, the business will use this deposit money to pay the supplier.

Amount to be deposited:

Foreign Deposit (Fd) = Foreign Payment / (1+rfd)n

Here, rfd is the interest rate on the foreign deposit.

Borrowing in Own Country

To execute the hedge, the business will have to buy foreign currency in order to make the deposit. So, it needs to take a domestic loan to purchase foreign currency.

We can calculate the amount that a business needs to borrow using the below formula:

Domestic Loan (Dl) = Fd * Spot Rate

Making Payment to Supplier

Now, at the end of the credit period, the business will use the amount it deposited in the supplier’s country to make payment.

Repaying Loan

Also, it will repay the loan it took in its own country for making the deposit in the supplier’s country.

The total loan amount that the business will have to repay:

Final Domestic Value = Dl * (1+rdb)n

Here, rdb is the interest rate that the business needs to pay on the loan amount.

Effective Exchange Rate

Similar to the receipt above, we can calculate the effective exchange rate for the business after it makes the payment.

The formula for this will be:

Effective Exchange Rate = Final Domestic Value / Foreign Payment

Payment of Foreign Currency: Example

In the above example, suppose Company A has to make a payment to a European supplier of Euro 100,000 after a year.

We first need to calculate the foreign deposit amount. It will be:

100,000 / (1+10%)1 = Euro 90,909

To deposit Euro 90,909, Company needs to take a domestic loan of:

90,909 * 3 = $272,727

Final loan amount in domestic currency after a year:

$272,727 * (1+8%)1 = $294,545

So, the effective exchange rate will be:

2.945 ($294,545/Euro 100,000)

Money Market Hedge: Is it Effective?

Money Market Hedge is a good tool to reduce foreign currency risk. But it is more complex to execute (as it involves multiple stages) in comparison to the currency forwards. This is why such a hedge is more suitable for casual or singular transactions. Moreover, it could prove expensive as well because businesses will have to pay processing fees to take a loan, convert the currency, and more.

Thus, for businesses that regularly deal in foreign currency transactions, forward contracts are a better option because of the complexity of the Money Market Hedge.

Continue reading – What are the Advantages and Disadvantages of a Money Market Hedge?