Accounting Transactions refer to any activity that can have a direct impact on the financial statements of an organization. It is the first step that marks the starting of an accounting cycle. Thus, it is crucial for a company to record all these transactions to ensure the financial statements’ accuracy. A company can have different transactions on a daily basis, such as selling its goods and services, buying raw materials, paying salaries and wages, taking a loan, etc. We can, however, categorize these transactions under different heads, called types of accounting transactions.

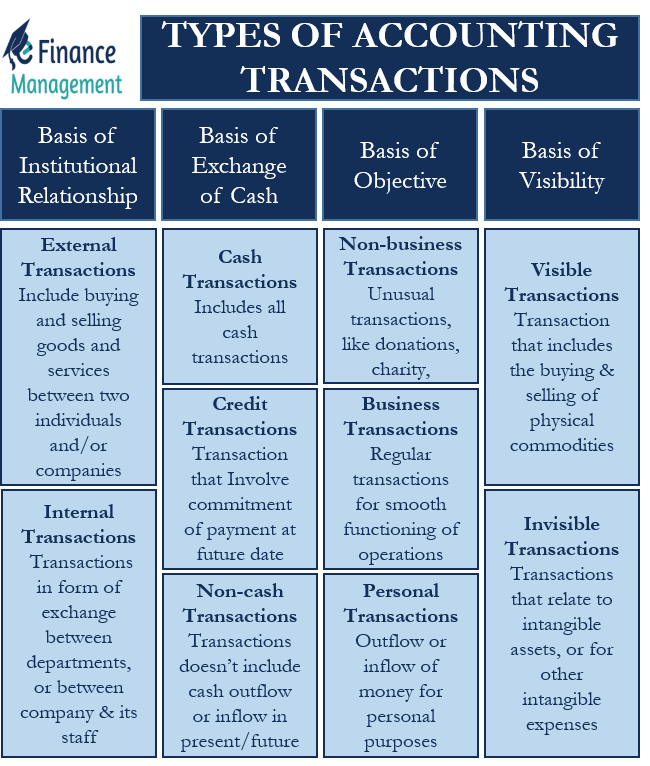

Primarily there are two types of accounting transactions – cash and non-cash. However, to make the classification more understandable, we can further categorize accounting transactions, such as on the basis of relationship, on the basis of objective, on the basis of cash, and on the basis of visibility.

Let’s take a look at all the types of accounting transactions in detail.

Types of Accounting Transaction on the Basis of Institutional Relationship

There are two types of accounting transactions under it:

External Transactions

These transactions include buying and selling goods and services between two individuals and/or companies. Another name for such transactions is business transactions. For example, Company X buying screens for making smartphones from Company Y will be an external transaction.

Internal Transactions

Such transactions don’t include buying and selling, rather involve other processes in a company. These transactions could be in the form of exchange between departments or between the company and its staff. For example, paying salary to the staff, calculating depreciation, and more.

Types of Accounting Transactions on the Basis of Exchange of Cash

There are three types of accounting transactions under this:

Cash Transactions

These are the most common transactions, and as the name suggests, they include all cash transactions. For example, a company paying for the raw material in cash, check, or online transfer, is a cash transaction.

Credit Transactions

Transactions that involve a commitment of payment at a future date are credit transactions. Companies may allow their customers to make payment for the goods and services after a certain number of days, such as after 90-days. Some credit transactions could involve payment of interest to the party that gives time to the other party to make the payment.

Non-cash Transactions

As the word suggests, these include transactions that don’t include outflow or inflow of cash in the present or in the future. Or we can also say that these transactions are neither cash nor credit. For example, a firm buys a machine but founds it to be defective and thus, returns it. This transaction doesn’t involve any cash and thus, is a non-cash transaction. Another example is a company taking a loan from another company by keeping its asset as collateral.

Types of Accounting Transactions on the Basis of Objective

There are three types of transactions under it:

Business Transactions

These are the regular transactions that a company makes for the smooth functioning of its operations. For example, paying salaries, rent, buying raw materials, etc.

Non-business Transactions

These are not the usual transactions that business makes under normal business operations. Instead, these include unusual transactions, such as donations, hosting a charity event, and more.

Personal Transactions

As the word suggests, these are the transactions that involve the outflow/inflow of money for personal purposes—for example, a department hosting a birthday party for one of their employees.

Types of Accounting Transactions on the Basis of Visibility

There are two types of transactions under it:

Visible Transactions

These are the transactions that include the buying and selling of physical commodities—for example, buying machinery and furniture. Another name for such transactions is real transactions.

Invisible Transactions

These are the transactions that relate to intangible assets or for other intangible expenses—for example, depreciation, amortization, preliminary expenses, and more.

Final Words

Though these are all types of accounting transactions, an accounting transaction may or may not be exclusive to one category. This means an accounting transaction could fall in one or more of the above categories. For instance, paying a supplier in cash will be an external as well as a cash transaction.