Businesses require the allocation of both incomes and expenses to the same accounting period. However, there are often instances when the expenses and revenues do not occur, or the business does not receive them in a financial year. Therefore, businesses use accounting concepts such as accrual and deferral to properly record them in the accounting books. Often, there is confusion among users over the use of both these terms, and thus, they use them interchangeably. However, both these terms are very different from each other. Therefore, to better understand the two terms, we need to look at the differences between accrual vs deferral.

Before we detail the differences, first, let’s understand what these terms mean.

Accrual vs Deferral – Meaning

Both these terms are useful in the expense and revenue recognition policy of a business. Basically, these are adjusting entries that help a business to adjust their books to give a true financial picture of a company. In simple words, both these concepts come into use when there is a time gap between the actual realization and reporting of the revenue and expenses. Or, we can say accrual occurs before a receipt or payment, while deferral occurs after a receipt or payment.

Let’s understand the two terms in detail:

Accrual

The revenue or the expenses that are earned but are yet to receive by the company are accruals. One can classify accruals either as an Accrued expense or Accrued income (or revenue).

Accrued Income is the transactions for which the company is already due to get the payment but has not received the payment yet. In such a case, the company classifies the payment as accrued income for the financial year in which it is due. For example, interest on the savings account is due every December, but the payment usually comes in January.

On the other hand, accrual expenses are the payments that a company is expected to make in the current financial year but pay in another financial year. For example, the due date of the electricity bill in December, but the company pays it in January.

Deferral

Deferral or deferred is just the opposite of accrual and occurs before the due date of the expense or revenue. Deferred expense is the expense that a company pays in advance. For example, a company pays rent for a full two years in advance.

On the other hand, Deferred income is the revenue that a company gets in advance. For example, a customer pays money in advance for an order with a delivery date in January.

Accrual vs Deferral – Differences

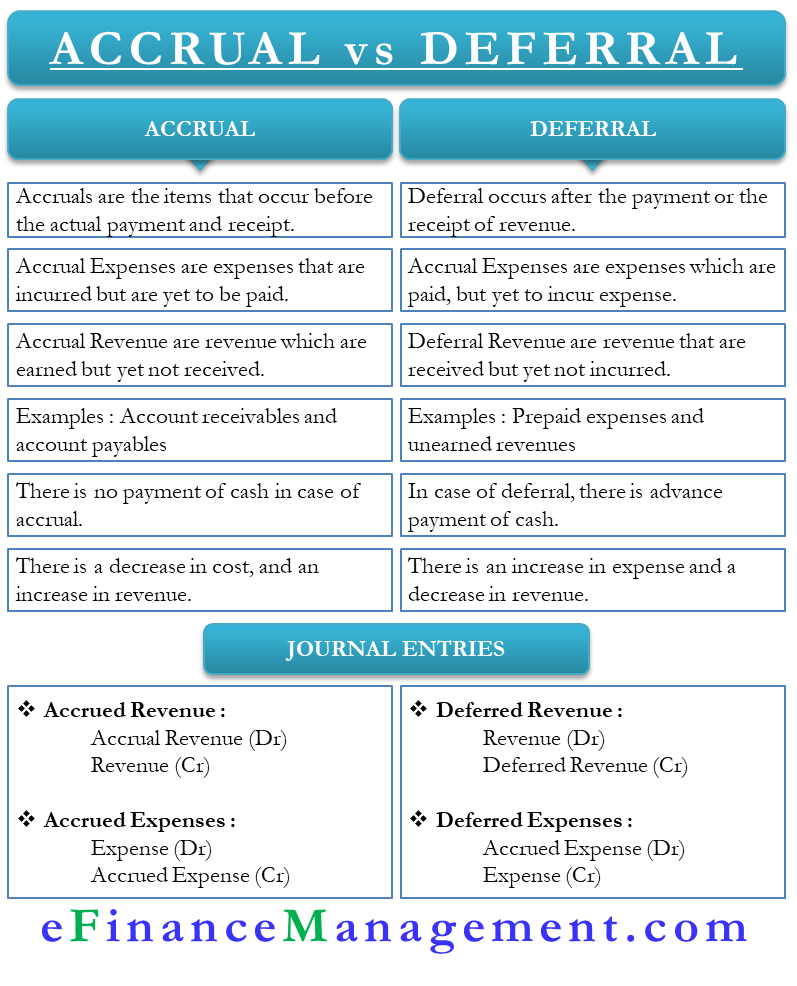

Following are the differences between accrual vs deferral/deferred:

Meaning

Accruals are the items that occur before the actual payment and receipt. Deferral, on the other hand, occurs after the payment or the receipt of revenue.

Expenses

Deferred expenses are those expenses for which the payment is made, but the company is yet to incur the expense. On the other hand, Accrued expenses are those expenses that are incurred but are yet to be paid.

Revenue

Deferred revenue is the revenue that the company gets in advance. Accrued revenue, on the other hand, is the revenue that is due, but the company is yet to receive it.

Example

Two major examples of accrual are account receivables and account payables. In the case of accounts receivable, the company sells the goods, but the customer is yet to pay. On the other hand, Accounts payable is the expense that the company is yet to pay.

Two major examples of deferral accounts are prepaid expenses and unearned revenues. Prepaid expenses are those that are not due, but the company has already made the payment. Unearned revenue, on the other hand, is the revenue that is not yet earned, but the company has already received the payment.

Cash

In accrual, a company incurs the revenue or expense without actually paying cash for it. On the other hand, Deferral is where the company pays cash in advance but is yet to incur the revenue or expense.

Increase or Decrease

Under deferral, there is an increase in expenses and a decrease in revenue. In accrual, there is a decrease in cost and an increase in revenue.

Accounts Affected

The adjusting entries for accruals and deferrals will always involve an income statement account and a balance sheet account. For example, a revenue accrual affects revenue and an asset account. Deferred revenue impact liability and a revenue account. Accrued expenses affect an expense and a liability account, while deferred expenses affect an expense and a liability account.

Journal Entry

Journal entry for accrued revenue is Revenue Accrual account debit and Revenue account credit. The journal entry for deferred revenue is Revenue account debit and Deferred revenue account credit.

| Particulars | Dr. Amount | Cr. Amount |

|---|---|---|

| Deferred Expenses A/c | xxxxx | |

| To Expenses A/c | xxxxx | |

| (For deferred expenses recorded) |

| Particulars | Dr. Amount | Cr. Amount |

|---|---|---|

| Expenses A/c | xxxxx | |

| To Accrual Expenses A/c | xxxxx | |

| (For accrual expenses recorded) |

Final Words

Both accrual and deferral entries are very important for a company to give a true financial position. Moreover, both types of adjusting entries help a business comply with the matching concept of accounting.

Continue reading – Fundamentals of Accounting.

Quiz on Accrual vs Deferral

Let’s take a quick test on the topic you have read here.

Good article in truly layman’s terms.