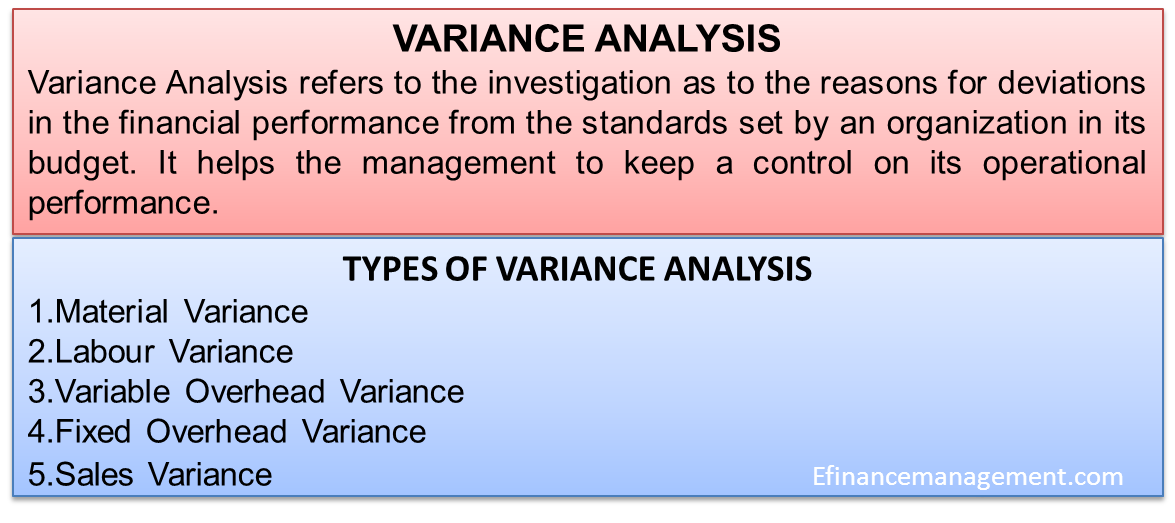

The variance analysis formula is the key to preparing variance analysis reports. For each type of variance, there is a plug-and-play variance formula to calculate. Variance analysis refers to the investigation of the reasons for deviations in the financial performance from the standards set by an organization in its budget. It helps the management to keep control of its operational performance. Now let’s look at the formula below.

What is Variance Analysis Formula?

A common formula that is applicable to compute any variance is

Variance = Actual Income/Expense – Budgeted Income/Expense

Here, budgeted stands for the amount estimated by the company.

Types of Variance Analysis Formula

Variance Analysis can be broadly classified into the following heads:

- Material Variance – (Sub-Categories – Price and Usage Variance)

- Labour Variance – (Sub-Categories – Rate and Efficiency Variance)

- Variable Overhead Variance – (Sub-Categories – Efficiency and Expenditure Variance)

- Fixed Overhead Variance – (Sub-Categories – Expenditure and Volume Variance)

- Sales Variance – (Sub-Categories – Volume and Price Variance)

Refer Variance Analysis

Now, let us look at the scenario of a company, say A, having the following standard and actual figures:

| Standard / Budgeted | Actual | |

| Price | $ 10 per kg. | $ 8 per kg. |

| Quantity | 200 kgs. | 150 kgs. |

| Hours | 250 | 300 |

| Rate | $8 | $7 |

| Output | 100 kgs. | 80 kgs. |

| FOH Rate per hour | $12 | $11.67 |

| FOH Rate per unit | $30 | $43.75 |

| FOH | $3000 | $3500 |

| Sales Price per unit | 50 | 65 |

Material Variance

The difference between the standard cost of direct materials and the actual cost of direct materials that an organization uses for production is known as material cost variance.

Material Cost Variance Formula

Standard Cost – Actual Cost

In other words, (standard quantity for actual output x standard Price) – (Actual Quantity x Actual Price)

= {(200 x 80/100**)} x 10) – (150 x 8)

= (160 x 10) – (150 x 8) = 400 (Favorable)

** 80/100 is multiplied with the standard quantity (200 kg) to adjust the standards as per the actual output levels. All the standard figures are mentioned for an output of 100 kg. Whereas the actual output is 80 kgs. As per standards, we can see that 200 Kg of Raw Material is required to produce 100 Kg of output, making a yield of 50% (100 kg / 200 Kg). In the actual situation, the yield is different, i.e., 53% (80 kgs / 150 Kgs). In other words, if the actual output had been 100 kg in place of 80 kg, 160 (200 * 80 / 100) would have been the material quantity.

Material Variance is further sub-divided into two heads:

Material Price Variance

MPV = (Standard Price – Actual Price) x Actual Quantity

= (10 – 8) x 150 = 300 (Favorable)

Material Usage Variance

MUV = (Standard Quantity for actual output – Actual Quantity) x Standard Price

= (160 – 150) x 10 = 100 (Favorable)

Visit Material Variance for a more detailed description.

Labor Variance

It arises when there is a difference between the actual cost associated with a labor activity from the standard cost.

Labor Variance Formula

Standard Wages – Actual Wages

In other words,

(Standard Hours for actual output x Standard Rate Per Hour) – (Actual Hours x Actual Rate Per Hour)

= {(250 x 80 /100) x 8} – (300 x 7)

= (200 x 8) – (300 x 7) = 500 (Adverse)

Labor Variance is further sub-divided into two heads:

Labor Rate Variance

LRV = (Standard Rate Per Hour – Actual Rate Per Hour) x Actual Hours

= (8 – 7) x 300 = 300 (Favorable)

Labor Efficiency Variance

LEV = (Standard Hours for Actual Out Put – Actual Hours) x Standard Rate

= (200 – 300) x 8 = 800 (Adverse)

Keep reading Labor Cost Variance

Variable Overhead Variance

A variance that arises due to the difference between the actual variable overhead and the standard variable overhead based on budgets is termed a variable overhead variance.

Variable Overhead Variance Formula

Standard Variable Overhead – Actual Variable Overhead

In other words, (Standard Rate – Actual Rate) x Actual Output

= (8 – 7) x 80 = 80 (Favorable)

Similar to other variances, a variable overhead variance is further sub-divided into two heads:

Variable Overhead Efficiency Variance

VOEV = (Actual Output – Standard Output) x Standard Rate

= (80 – 100) x 8 = 160 (Adverse)

Variable Overhead Expenditure Variance

VOEV = (Standard Output x Standard Rate) – (Actual Output x Actual Rate)

= (100 x 8) – (80 x 7) = 240 (Favorable)

Refer to Variable Overhead Cost Variance for more.

Fixed Overhead Variance

It arises when there is a difference between the standard fixed overhead for actual output and the actual fixed overhead.

Fixed Overhead Variance Formula

= (Actual Output x Standard Rate per unit) – Actual Fixed Overhead

= (80 x 30) – 3500 = 1100 (Adverse)

Fixed Overhead Variance is further sub-divided into two heads:

Fixed Overhead Expenditure Variance

FOEV = Standard Fixed Overhead – Actual Fixed Overhead

= 3000 – 3500 = 500 (Adverse)

Fixed Overhead Volume Variance

FOVV = (Actual Output x Standard Rate per unit) – Standard Fixed Overhead

= (80 x 30) – 3000 = 600 (Adverse)

Also, read Fixed Overhead Volume Variance

Sales Variance

This variance is the difference between an organization’s actual sales and budgeted sales.

Sales Variance Formula

= (Budgeted Quantity x Budgeted Price) – (Actual Quantity x Actual Price)

= (100 x 50) – (80 x 65) = 200 (Favorable)

Similar to other variances, sales variance is further sub-divided into two heads:

Sales Volume Variance

SVV = (Budgeted Quantity – Actual Quantity) x Budgeted Price

= (100 – 80) x 50 = 1000 (Adverse)

Sales Price Variance

SPV = (Budgeted Price – Actual Price) x Actual Quantity

= (50 – 65) x 80 = 1200 (Favorable)

Visit Sales Value Variance

Conclusion

Thus, correct knowledge and understanding of the variance analysis formula are important to analyze the difference between an organization’s actual and planned behavior. If such analysis is not carried out at regular intervals, it may cause a delay in the management action to control its costs.

Also, read Production Volume Variance,

Static Budget Variance,

And, Flexible Budget Variance

RELATED POSTS

- Fixed Overhead Efficiency Variance – Meaning, Formula and Example

- Price Variance – Meaning, Calculation, Importance and More

- Material Variance

- Variable Overhead Efficiency Variance – Meaning, Formula, and Example

- Production Volume Variance: Meaning, Formula, Limitations, and More

- Sales Volume Variance

where 80/100 comes from on standard cost of material

The same question has been replied above and in the content too. Please refer.

It is okay

I don’t understand where the 80/100 is coming from please explain

80/100 is inserted there to adjust the standards as per the actual outputs. The content is 100% correct. But for the sake of a detailed explanation, we have added a detailed note there. You can go through it.