What is Fixed Overhead Volume Variance (FOVV)?

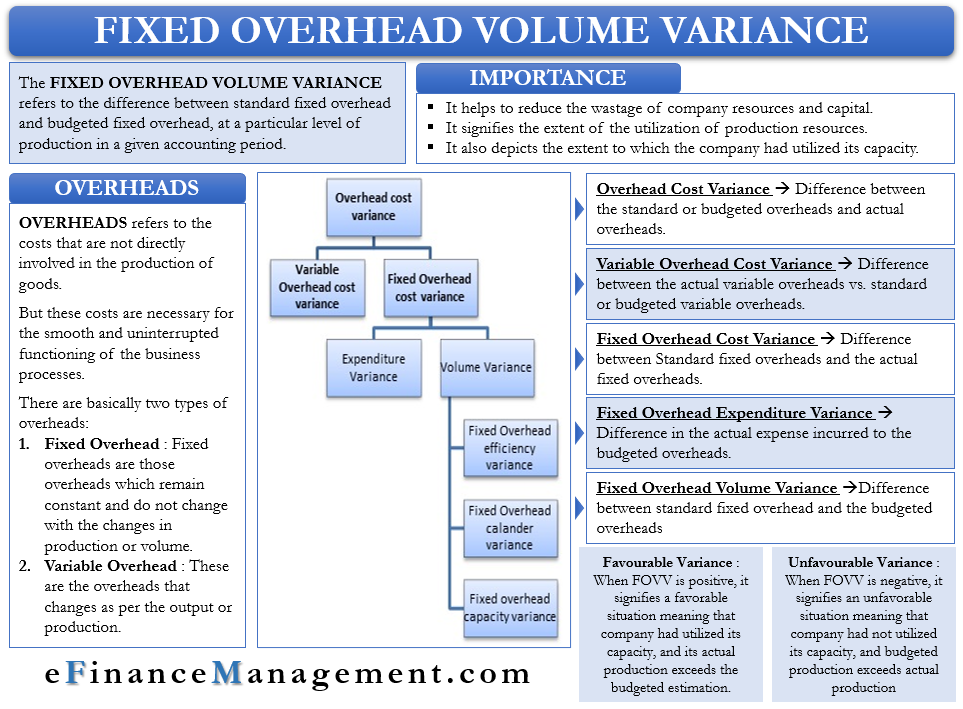

Fixed overhead volume variance is stated as a figure which is equal to the standard fixed overhead less the budgeted overheads at a particular level of production in a given accounting period. To have a better understanding of FOVV, first, it is necessary to have the basic knowledge of ‘overheads’, and its calculations.

What are the Overhead Costs?

For any company or business establishment along with specific and individual costs, there are a few costs include, which may or may not be directly included in the production. However, these are equally crucial for the smooth functioning of business processes. In other words, overheads, comprise of all such costs. For example, rent, utilities, insurance, office supplies, salaries, and wages, etc. And all these remain part of incurred business overhead expenses. Moreover, while calculating the production budgets, it is essential to calculate these overheads. It is to eliminate emergency fund crunches in the future and reduce the elements of surprises in business.

Overheads

In any given company, there is an overhead component that involves all additional expenses. However, these are not directly associated or required for creating the end products or services. And it may include costs such as indirect material, indirect labor, and incidental expenses. In other words, overhead costs are not directly required for production but are necessary for the smooth and uninterrupted functioning of the business processes.

The two types of overhead costs are fixed and variable overheads.

Fixed Overhead

Fixed overhead costs are those additional costs necessary for businesses that stay the same. These fixed costs remain constant and do not change with the changes in production or volume. For example, rent for the premises (factory), monthly and annual salaries paid, which are fixed rent, insurance, depreciation of an asset, property tax, and office utilities, etc.

Variable Overhead

Variable overhead costs include any additional cost to business processes that depends and changes as per the output or production. The variable overhead component is not constant, and changes concerning the production or volume. For example, electricity, advertisement costs and wages paid per hour or seasonal employment, raw material used, etc.

Overhead Cost Variance (OCV)

Management adds the overhead cost for the firm and overall processes while preparing budgets. However, many situations lead to a difference in actual vs. standard measurement in process or output. Variance is any variation or difference in these estimations and actual.

Overhead cost variance is the difference between the standard or budgeted overheads and actual overheads. OCV is a practical situation that could either be over recovered or under recovered. This recovery is determined using a pre-determined overhead rate. Formula to calculate OCV is:

Overhead Cost Variance = Standard Overheads – Actual Overheads

It is further comprised of variable overhead cost variance and fixed overhead cost variance, it has also extends into fixed expenditure variance and fixed volume variance

Variable Overhead Cost Variance

Variable overhead cost variance is the difference between the actual variable overheads vs. standard or budgeted variable overheads. The formula to calculate VOCV is as below:

Variable Overhead Cost Variance = Standard Variable Overheads – Actual Variable Overheads

Where, Standard Variable Overhead = Standard hours allowed for output X Standard Variable Overhead Rate

and Standard Variable Overhead Rate= Standard Variable Overheads/Standard Output

Fixed Overhead Cost Variance

Also known as the fixed overhead variance is the difference between the Standard fixed overheads and the actual fixed overheads. To calculate FOCV:

FOV= Standard FO – Actual FO

Fixed Overhead Expenditure Variance

FOEV measures the difference in the actual expense incurred to the budgeted overheads. Also known as Budgeted variance or spending variance. The calculation for FOEV:

FOEV= Budgeted FO – Actual FO

Fixed Overhead Volume Variance (FOVV)

Fixed overheads volume variance or FOVV differs from variable overhead variance. FOVV signifies the difference or variation in the standard fixed overhead and the budgeted overheads based on the level of production in a given accounting period. It compares actual output to budgeted output. By comparing, it suggests the efficiency and extent of utilization of plant and machinery or production capacity.

Simple formulae to calculate FOVV is

Formula 1) FOVV = Applied FO – Budgeted FO

Where Applied Fixed Overhead= Standard Fixed Overhead Rate * Standard Hours Allowed

and Standard Fixed Overhead Rate= Budgeted Fixed Overhead / Budgeted Units

Formula 2) FOVV= (Actual Activity – Normal Activity)*Standard Fixed Overhead Rate

Where, Standard Fixed Overhead Rate= Budgeted Fixed Overhead/ Budgeted units

Let us understand it with an example.

Budgeted Fixed Overhead – $67500; Budgeted Units – 7500; & Actual Units produced – 8000

So, here Standard Fixed Overhead Rate = Budgeted Fixed Overhead/ Budgeted units

Standard Fixed Overhead Rate= $67500/7500=$9 per unit

Thus using 2nd formula Fixed Overhead Volume Variance= (Actual Activity- Normal Activity)* Standard Fixed Overhead Rate

FOVV= (8000-7500)*$9=$4500

A positive value of FOVV depicts that the company had utilized its capacity efficiently and more than the budgeted one.

Favorable and Unfavourable Fixed Overhead Volume Variance (FOVV)

When FOVV is positive, it signifies a favorable situation for the company meaning that the company had utilized its capacity, and its actual production exceeds the budgeted estimation. Similarly, if FOVV value comes negative, it depicts an unfavorable situation for the company suggesting lower actual production.

Types of Fixed Overhead Volume Variance

Further, there are three sub-categories of FOVV, as mentioned below:

Efficiency Variance

It explains the variance between the actual hours taken to complete the work as compared to the standard time estimated to complete the production. Simply stating this measures the efficiency of actual performance for a given job. And to calculate FOEV following is the formula:

Fixed overhead efficiency variance= Standard Fixed Rate of Recovery of Overheads X (Standard Hours-Actual hours)

Calendar Variance

It measures the difference between the actual numbers of working days to budgeted numbers of working days. Moreover, it suggests the loss or gains to the Business due to working of lesser or more number of days than budgeted/estimated. And it could happen due to extra holidays or emergency leaves vs. planned ones. Standard national holidays are taken into account while determining the standard or budgeted working days. To calculate FOCV:

Fixed overhead calendar variance = (Actual no of working days-Standard no of working days) X Standard rate of recovery of fixed overheads

Capacity Variance

This variance arises due to the difference in the usage of the plant’s overall capacity from planned vs. actual. Moreover, FOCV is in favor of the company when the actual use is more than the scheduled or budgeted use and unfavorable vice versa. And to calculate FOCV, the following is the formula:

Fixed overhead capacity variance = Standard rate of recovery of fixed overheads X (Actual Hours- revised budgeted hours)

Where, Revised budgeted hours= Standard hours per day* actual no of days

And the Standard rate of recovery of fixed overheads=Budgeted fixed overheads/Budgeted hours

Importance of Fixed Overhead Volume Variance

- It gives clear indicators to determine the variation in fixed overhead volumes, which in turn reduces the wastage of company resources and capital.

- It signifies the extent of the utilization of production resources. Moreover, it indicates whether there is still scope for better usage.

- The value of favorable and unfavorable fixed overhead Volume Variance depicts the extent to which the company had utilized its capacity.

Refer Variance Analysis Formula with Example for various other types of variances.

Quiz on Fixed Overhead Volume Variance

This quiz will help you to take a quick test of what you have read here.

RELATED POSTS

- Variable Overhead Cost Variance – Meaning, Formula, and Example

- Fixed Overhead Efficiency Variance – Meaning, Formula and Example

- Variable Overhead Efficiency Variance – Meaning, Formula, and Example

- Production Volume Variance: Meaning, Formula, Limitations, and More

- Fixed Overhead Calendar Variance – Meaning, Formula, and Examples

- Variance Analysis Formula with Example