Going Concern Concept: Meaning

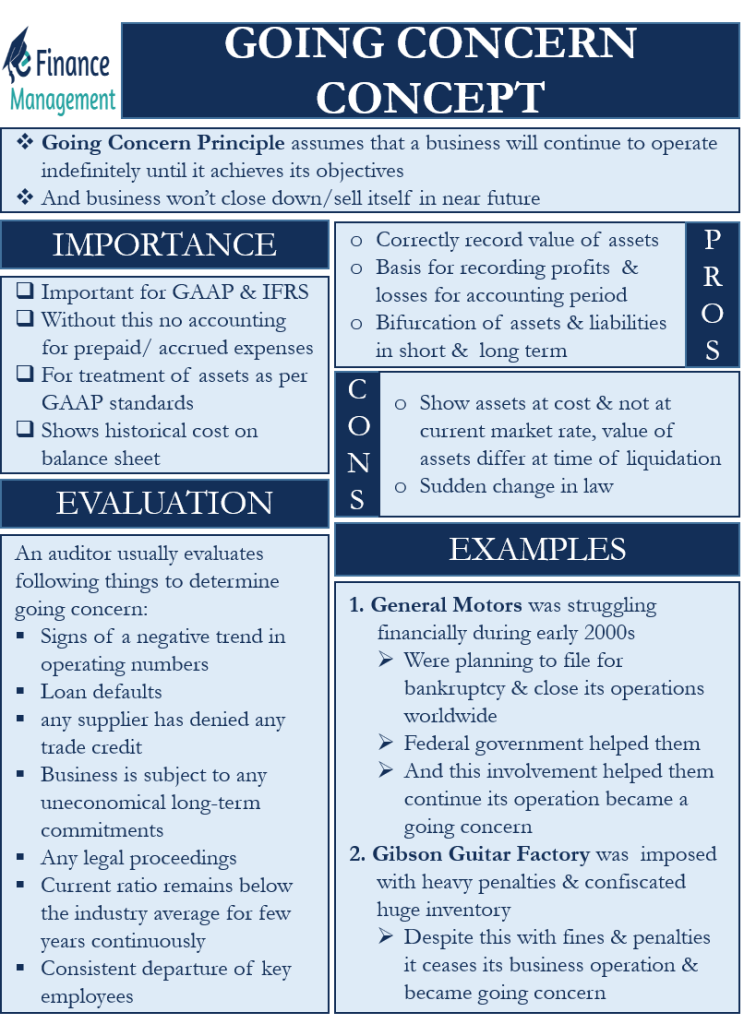

Going Concern Concept (or Going Concern principle) states or assumes that a business will continue to operate indefinitely. Or till the firm at least achieves its purpose or objective. In other words, we can say that this concept says that a business will not close down or sell itself in the near foreseeable future. All the businesses that continue their operations indefinitely are the ones that in accounting terminology are the going concern. All such businesses where there is no expectation that the firm would end the operations in the near future continue as a going concern.

One important point to be aware of at this stage is that this concept applies to the whole firm and all its businesses unless otherwise indicated clearly. Further, it means that if a firm closes any unit or stops selling one of its products, then also the business will remain a going concappliescause the going concern principle is applicable to the firm as a whole and not to any unit, segment, or product.

In general, a business should exhibit the following things to be a going concern:

- It can operate daily operations and has funds and raw materials to continue with its operations.

- It has sufficient money to honor its debt commitments.

- The products or the services offered by the firms are in demand.

- There is not a major change in the governing lodge applicable to the business.

Importance of Going Concern Concept

This concept is very important for GAAP (generally accepted accounting principles). And also for IFRS (International Financial Reporting Standards). It is because without considering this concept, there will not be any accounting for prepaid or accrued expenses.

Also, this concept is very important with regard to the treatment of assets as per the GAAP standards. For example, these guidelines provide for depreciation and amortization of assets. And these guidelines and provisions have the underlying assumption that the business of the firm will continue to operate for the foreseeable future. Businesses assume that they will operate indefinitely, and the assets will continue to be in use until they are fully depreciated. Also, we show assets at historical costs on the balance sheet due to the going concern concept only.

In case we do not use the going concern principle, then we would have to assume that the business would stop operating soon. For such a scenario, a better approach for valuing assets will be the liquidation approach. The assets will come on the balance sheet at the net realizable value in such a case. Also, we will have to treat all assets as current assets rather than categorizing them into current and fixed assets. Moreover, such an exercise of determining the net realizable value has to be done at every annual accounting event.

Going Concern Concept: Examples

Let us discuss a few such examples (both imaginary and real-life) to understand this going concern concept in a better way:

Company A deals in chemical X only. Now, suppose the government bans this chemical completely. With the loss of the only product the company has, the firm is left with no business, and hence, the firm can not be treated as a going concern.

Company X is unable to pay its creditors because of its financial condition. The court ordered the liquidation of Company X at the request of one of the creditors. In such a case, Company X will not be a going concern because there is evidence that it may not be able to continue its operations in the future.

General Motors was struggling financially during the early 2000s. The automaker was planning to file for bankruptcy and close its operations worldwide. However, the federal government bailed it out. In a normal scenario, GM will not be considered to be a going concern. However, since the federal government got involved to save GM, it was very obvious that GM will not end its operations so quickly.

Also Read: Liquidation Value Method of Equity Valuation

In 2011, authorities imposed heavy fines and confiscated a significant amount of inventory of Gibson Guitar Factory for illegally smuggling endangered wood. Despite this, the company was considered to be a going concern as it was unlikely to cease its operations because of the fines and punishment.

Going Concern Evaluation

Even though the going concern principle is important for GAAP, the GAAP does not detail this concept. Thus, this concept is open to many interpretations. However, GAAS (Generally accepted auditing standards) gives auditors some instructions regarding the going concern principle.

As per GAAS, an auditor should evaluate the ability of a business to continue as a going concern for a period of not more than a year from the date of auditing the financial reports.

An auditor usually evaluates the following things to determine whether a business is going concern or not:

- Signs of a negative trend in operating numbers. For example, a business posting a series of losses.

- Whether the business is defaulting in payment of its loan liabilities.

- If any supplier has denied any trade credit to the business.

- If a business is subject to any uneconomical long-term commitments.

- Whether or not a business is facing any legal proceedings.

- If the current ratio remains below the industry average for a few years continuously.

- The consistent departure of key employees.

If an auditor finds any such issue (or issues) with the business, then they can detail the same in their report. On the other hand, a business can work to assuage the auditors’ concern. Businesses can do so by providing a third-party guarantee of the debts or getting a third-party guarantee that it would provide funds to the business in case of a need.

Advantages and Disadvantages of Going Concern Concept

Below are the advantages of this concept:

- Businesses buy assets with expectations of reaping benefits from them for a very long time. In line with this objective, the going concern concept will allow to correctly record the value of such assets.

- This concept serves as the basis for recording the profits and losses for an accounting period.

- It also facilitates the identification and splitting of all the assets and liabilities into short and long-term.

Below are the disadvantages of this concept:

- Financial reports show the assets at cost and not at the current market rate due to the going concern concept. But, in the case of liquidation, the financial statements are on the basis of their current market value. However, these numbers would be very different from the ones at cost.

- Any sudden change in the law could affect the going concern status of a firm. In such a case, the business would have to drastically change its accounting.

Final Words

Going concern concept gives a more realistic picture of a business. Along with ensuring a more systematic approach to recording the financial statements, this concept helps to provide a better understanding of the business and its growth potential. Almost all countries recognize this concept, and this makes the statements comparable across countries.