Companies have two possible ways to store and issue inventory and raw materials. These are LIFO and FIFO. Where LIFO means Last In First Out, and FIFO means First In First Out. And it is the scientific and logical way to use the inventory when needed by the production or sales department keeping into account various parameters, namely cost of goods sold (COGS), tax, and net profit made. LIFO liquidation uses this LIFO method of inventory valuation.

Meaning of LIFO

The companies purchases inventory or raw materials year after year or for any periodic cycle. LIFO means utilizing the most recently purchased inventory first. However, the materials bought way back will be used later. And therefore, this creates many layers of inventory based on the buying cycle, which are called LIFO layers.

Periodic segregation of inventory based on a frequency for calculation of closing stock. In simple terms closing stock at the end of the year, that is, the unsold inventory in that year, becomes the layer for the next year. This term helps to know the number of units, cost per unit, and the total cost of inventory, for a given period. Inventory at the closing time is the layer for each year.

Moreover, the LIFO method of utilizing inventory provides tax benefits to the company as the latest material stored will generally be of a higher price than the older stock. And it will be used first. Therefore, the profit margins will be narrow. Sometimes, companies use the LIFO method during inflation due to higher purchasing costs over time.

Also Read: FIFO Meaning, Importance and Example

What is LIFO Liquidation?

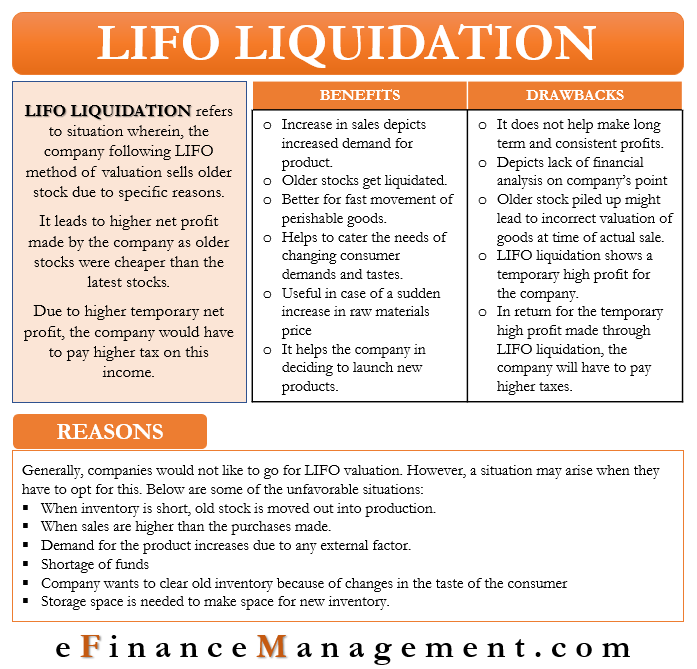

When a company uses the last-in, first-out inventory costing method has to sell the older stocks of inventory due to specific reasons like an increase in sales or demands of the product; then it is LIFO liquidation. In other words, this movement of stocks of inventory based on the LIFO principle is the liquidation of the inventory. Simply put, the company sells more than it purchased, and this sale will be made from older stocks as well.

And it will lead to higher net profit made by the company as older stocks are cheaper than the latest stocks. And these older stocks will be valued as per present market rates. Therefore, generating higher net income and subsequent higher tax liability for the company as well. So, it is a big drawback of LIFO liquidation.

Reasons Companies Opt for LIFO Liquidation

Companies never willingly deplete their low-cost acquired stocks because it will increase the profit temporarily. The net income will increase, leading to higher taxes on the company. However, a company tends to opt for LIFO liquidation as an involuntary decision due to some unfavorable situations or changes in the external environment. And few of these conditions are:

- When the inventory is short, old stock is moved out into production.

- When sales are higher than the purchases made.

- If the demand for the product increases due to any external factor.

- In case of a shortage of funds

- When the company wants to clear old inventory because of changes in the taste of the consumer, changes in fashion trends, etc.

- When there is a need for storage space for new inventory.

However, during LIFO liquidation, some companies adopt another form of liquidation to overcome their shortfalls. In this process, similar products are grouped and accounted for. It is called as specific goods pooled LIFO approach.

Also Read: Inventory Costing

LIFO Liquidation Example

Let us explain LIFO liquidation with a simple example.

A company named XYZ ltd manufactures sports shoes, and the inventory specifications for that are as per below based on the periodic cycle.

| Year | Units of Raw material | Cost per unit | Total Material Cost |

|---|---|---|---|

| 2015 | 100 | $10 | $1000 |

| 2016 | 120 | $10 | $1200 |

| 2017 | 90 | $12 | $1080 |

| 2018 | 80 | $14 | $1120 |

| 2019 | 150 | $15 | $2250 |

The company has an order for the supply of 300 sports shoe pairs. And assume that the required raw material for every pair of shoes is 1 unit. Therefore, based on the above inventory table, to execute this order, XYZ ltd will liquidate its complete inventory of 150 units from the year 2019, a full inventory of 80 units from 2018, and the remaining 70 units from the inventory of 2017. And it is LIFO liquidation of inventory.

Net Income Generated using LIFO Liquidation.

In this example, to calculate the net revenue generated, let us assume that each pair of sports shoes order price is $50.

So the formula for the revenue generated will be= No of pairs of shoes* cost per pair.

i.e. $50* 300=$15000.

To calculate the total cost of the raw material needed:

| Units of Raw material | Total Material Cost |

| 150 | $2250 |

| 80 | $1120 |

| 70 | $840 (per unit cost $12) |

| The total cost of Raw material | $4210 |

Therefore, revenue generated will be No of units of the product* cost per unit of the product.

Total Units=300 (1 unit needed for one pair of shoes)

Revenue generated=$15000 (300*50$)

Therefore, Net Income will be = (Revenue Generated-Cost of Raw material)

Net income = $15000-$4210

Net Income =$10790

In the same example, let us consider another assumption where all the raw materials to produce 300 pairs of sports shoes purchased in the year 2019, then net income and revenue calculation will be as follows:

Total Raw material cost= $15*300

Total Raw material cost $4500

Revenue generated= $15000 (300*50$)

Net Income= $10500 (15000$-4500$)

Therefore, it is clear that the company will report a lower net income if, for any product, the raw material purchase happens at the latest as compared to maintaining subsequent inventory periodically because earlier inventory may have a lower purchasing cost.

LIFO Inventory Pool

During LIFO liquidation, the inventory can be segregated and pooled together with the items which are similar to each other, which forms a group of items. This helps in better and more realistic calculations. Each group that is formed is called the LIFO inventory pool.

LIFO Reserves

This is the difference between the inventory calculated by the LIFO method and the inventory calculated by a method other than LIFO. Companies sometimes use different types of inventory valuation methods for different stocks. The major use of LIFO is for reporting. Hence, there is always a difference between the actual inventory value and inventory calculated by the LIFO method, which is known as the LIFO reserve.

Benefits of LIFO Liquidation to Companies

LIFO inventory valuation method is beneficial for companies as:

- Firstly, an increase in sales depicts increased demand for the company’s product.

- Secondly, with the help of LIFO liquidation, older stocks get liquidated.

- Thirdly, it is better for the fast movement of perishable goods.

- Fourthly, the movement of the most recent inventory happens first to cater to the needs of changing consumer demands and tastes.

- The LIFO method is useful in case of a sudden increase in the price of raw materials. Because by using this method, a company can predict an increase in raw material costs. Thus earlier stock of raw materials purchased at a lower rate is liquidated in the future when the prices are higher. And thereby, a company can maximize net profit.

- Most importantly, it helps the company in deciding to launch new products.

Disadvantages of using LIFO Liquidation

There are lots of drawbacks to liquidating inventory using the LIFO method. These are:

- It is useful for jacking up short-term profits by liquidating old inventory. However, it does not help make long-term and consistent profits.

- Liquidating stocks depicts a lack of financial analysis on the company’s point as it will first consume raw materials obtained at a higher cost.

- Older stock piled up in the warehouse might lead to an incorrect valuation of the goods at the time of actual sale.

- The company keeps on purchasing new materials at higher prices and stocking old materials obtained at lower costs. And when the consumption of the latest stock of material happens first means, costly material will get the precedence, and the old stock continues to remain stocked. It will lead to a higher cost of the final product.

- LIFO liquidation shows a temporary high profit for the company.

- And most importantly, In return for the temporary high profit made through LIFO liquidation, the company will have to pay higher taxes.