Working Capital Management Definition

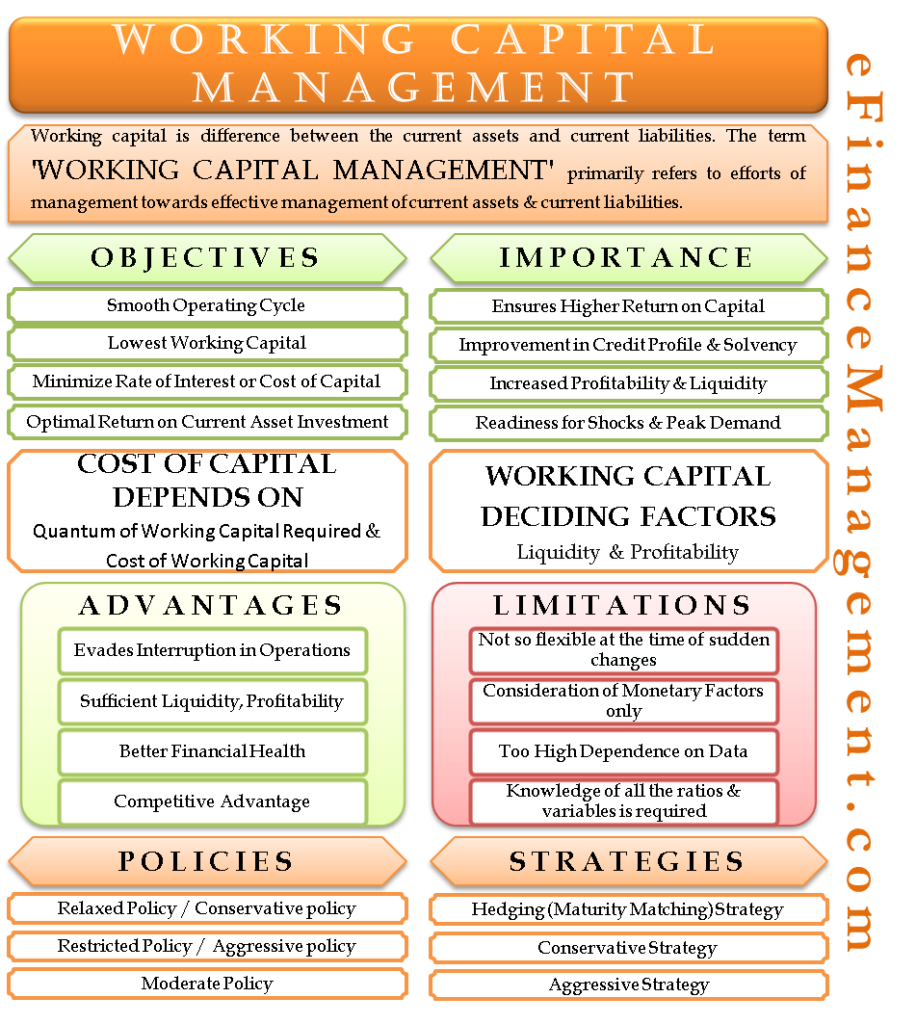

The term working capital management refers to the efforts of the management towards the effective management of current assets and current liabilities. It is mainly concerned with the fact that funds are not unnecessarily locked in current assets. In other words, efficient working capital management means ensuring sufficient liquidity in the business to satisfy short-term expenses and debts.

Objectives of Working Capital Management

The primary objectives of working capital management include the following:

- Smooth operating cycle

- Optimum working capital

- Minimize the rate of interest or cost of capital

- Optimal return on current asset investment

Importance of Working Capital Management

Although the importance of working capital is unquestionable in any business, working capital management is a day-to-day activity, unlike capital budgeting decisions. Most importantly, inefficiencies at any level of management impact the working capital and its management. The following are the main points that signify why it is important to take working capital management seriously.

- Ensures Higher Return on Capital

- Improvement in Credit Profile & Solvency

- Increased Profitability

- Better Liquidity

- Business Value Appreciation

- Most Suitable Financing Terms

- Interruption Free Production

- Readiness for Shocks and Peak Demand

- Advantage over Competitors

Advantages of Working Capital Management

The following points describe the advantages of working capital management:

- It ensures liquidity when required.

- It evades interruptions in operations.

- Maximizes profitability.

- Helps in achieving better financial health.

- Develops competitive advantage due to streamlined operations.

Disadvantages of Working Capital Management

Below are the points that highlight the disadvantages of working capital management:

- It only considers monetary factors. It ignores non-monetary factors like customer and employee satisfaction, government policy, market trend, etc.

- Difficult to accommodate sudden economic changes.

- Too high dependence on data is another downside. A smaller organization may not have such data generation.

- Too many variables to keep in mind, say current ratios, quick ratios, collection periods, etc.

Decisions in Working Capital Management

Reserving funds for ‘working capital needs’ involve cost. It is the interest if financed by a bank or the cost of equity capital if financed from equity. There are broadly two important decisions involved in working capital management that impact the total cost of funds.

Deciding the Level of Working Capital to Maintain

The two main factors that decide the quantum of working capital a business should maintain are liquidity and profitability. Let’s understand the impact of both of these factors in detail.

Nobody denies the importance of liquidity, but the most relevant question is – how much should that liquidity be? What are the right levels of liquidity? We know that a business can’t sit on unlimited or too high liquidity because higher liquidity means higher investment in working capital. And higher investment in working capital means a higher cost of capital. In contrast, lower liquidity may hamper the operating cycle of the business.

Working capital policies can help to help find out the right level of working capital that a business should maintain. Working capital policies deal with the quantum factor, i.e., how much current assets should be maintained? These policies, in essence, are different levels of the tradeoff between liquidity and profitability. Theoretically, the following three types of policies are explained, whereas they can be n number of policies depending on where the tradeoff is stricken between liquidity and profitability.

- Relaxed policy

- Restricted policy

- Moderate policy

Deciding How to Finance this Working Capital

In the first point, we have already decided what level of working capital we will maintain. The next most important question is how businesses finance this capital. Should it be equity financed or debt-financed, or a combination of both? Should it entirely be financed by short-term or long-term finances, or a combination of both?

Working capital financing strategies guide businesses in taking the best way of dealing with these questions. Following are the three working capital financing strategies:

- Hedging strategy

- Conservative strategy

- Aggressive strategy

Evaluating Working Capital Management

The activity of working capital management does not end with addressing the above queries. It is an ongoing process. The management needs to evaluate its decisions. The management is available with various metrics for assessing its decisions.

Also Read: Importance of Working Capital Management

Working Capital Cycle

The working capital cycle determines how many days a business takes to convert its raw material into cash. The following methods can help in determining if a working capital cycle is running well or not:

- Days Inventory Outstanding

- Days Sales Outstanding

- Days Payable Outstanding

Liquidity Ratios

Liquidity ratios determine the ability of a business to meet its short-term requirements. It includes the current ratio, quick ratio, cash ratio, etc.

Conclusion

In a broader view, working capital management includes working capital financing apart from managing the current assets and liabilities. That adds the responsibility for arranging the working capital at the lowest possible cost and utilizing the capital cost-effectively.

RELATED POSTS

- Techniques for Finding Optimal Level of Working Capital

- Objectives of Working Capital Management

- Factors Determining Working Capital Requirement

- Types of Working Capital – Gross and Net, Temporary and Permanent

- A Comparison between 3 Strategies of Working Capital Financing

- Working Capital Policy – Relaxed, Restricted and Moderate

Your detailed analysis report of working capital is excellent, thank you !!

Sir, I am doing my masters and I must say that your notes are very much helpful in this covid 19 pandemic situation for studies and knowledge and it’s simplicity in the language makes it more understanding.