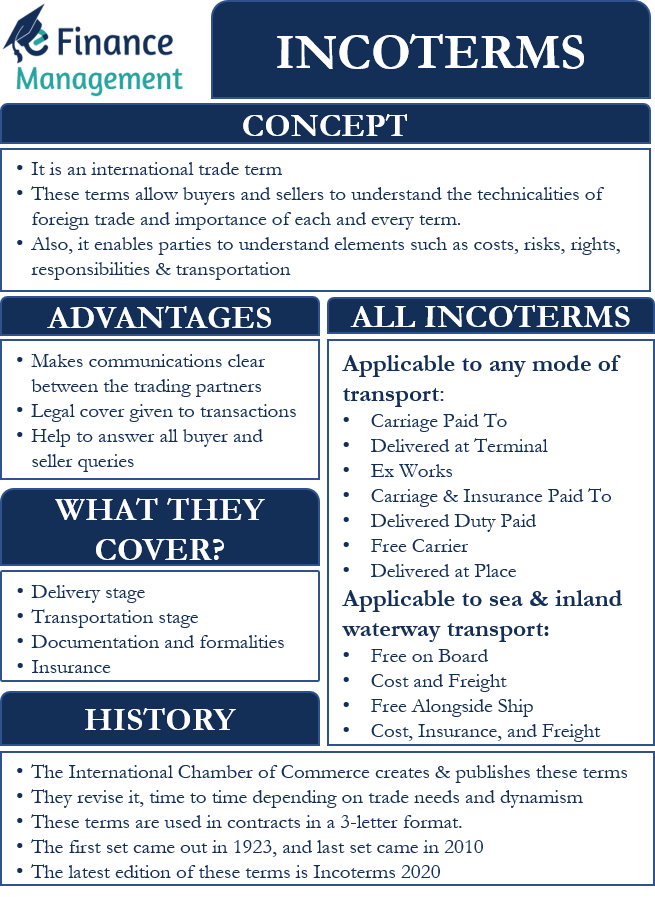

Incoterms (or International Commercial Terms) is a term that one would come across in international trade. Basically, these terms help to make buying and selling easier for both parties in international trade. These rules and standards facilitate international trade by removing the confusion. It is very important to know the terms in the same sense by all the traders internationally. In other words, these terms and definitions thereof bring every transaction at par. Without this, interpretation may differ, and then a dispute arises as cost and risks are major issues.

In foreign trade, the buyer and seller use these terms as a standard having the same meaning to avoid any interpretational issues. These terms allow them to understand the technicalities of foreign trade and the importance of each and every term. Moreover, using these terms enables parties to understand all the elements of the transactions similarly. These elements include costs, risks, rights, responsibilities, and transportation. However, these terms mostly focus on transportation and the point when the risk gets transferred from the buyer to the seller.

A point to note is that these terms in themselves are not mandatory rules. To give them legality, it is important that both parties incorporate these into their agreement.

History of Incoterms

The International Chamber of Commerce (ICC) creates and publishes these terms. They are also responsible for revising it from time to time depending on the trade needs and dynamism. These terms enjoy the backing of governments, regulatory authorities, as well as practitioners globally. These terms are used in contracts in a 3-letter format.

Also Read: What are the Disadvantages of Incoterms?

The first incoterm came out in 1923, and the last set came in 2010. And the ICC has been regularly updating these terms since then. And the latest edition of these terms is Incoterms 2020. Currently, there are 11 such terms that the parties can apply to the foreign trade contracts.

In 2010, ICC also classified these 11 terms into two categories. One category covers any mode of transport. And the second covers sea and inland waterway transport. Following are the two categories:

Group 1 Incoterms: Apply to Any Mode of Transport

These include the following incoterms:

- CPT Carriage Paid To

- DAT Delivered at Terminal

- EXW Ex Works

- CIP Carriage and Insurance Paid To

- DDP Delivered Duty Paid

- FCA Free Carrier

- DAP Delivered at Place

Group 2 Incoterms: Apply to Sea and Inland Waterway Transport

These include the following incoterms:

- FOB Free on Board

- CFR Cost and Freight

- FAS Free Alongside Ship

- CIF Cost, Insurance, and Freight

We will discuss each one of these terms later in this article.

What They Cover?

There are primarily four areas of stages in foreign trade that Incoterms cover. These are:

Delivery stage – it is when the two parties finalize the terms and conditions of the final delivery. Or when the goods exchange hands and the duty of the seller finishes and the responsibility or ownership of the buyer starts.

Transportation stage – this involves agreement on the transportation costs, such as the sharing of the costs or if each party will be responsible for up to what leg of transportation.

Documentation and formalities – this stage helps to clear out the responsibilities of both parties with regard to the official formalities. These formalities could be documentation, duty payments, customs, and more.

Insurance – it clears out the responsibility of the parties towards insurance, for example, between buyer or seller who will be responsible for providing insurance during transportation or up to what leg of transportation.

Advantages of Incoterms

Following are the advantages of using these terms:

- Using these terms helps make communications clear between the buyer and seller. This leaves no room for different interpretations between the trading partners. This, in turn, helps to lower risk in foreign trade.

- Since these terms cover almost all aspects of international trade, they help to answer all buyer and seller queries, like when the delivery will be complete, what are the modes of transportation, who will bear the varying costs, and more.

- By putting or incorporating these standard terms in the contract, a legal cover can be given to the transactions.

All Incoterms: Abbreviations, Meaning and Explanation

Following are some of the most popular incoterms that buyers and sellers use in international trade:

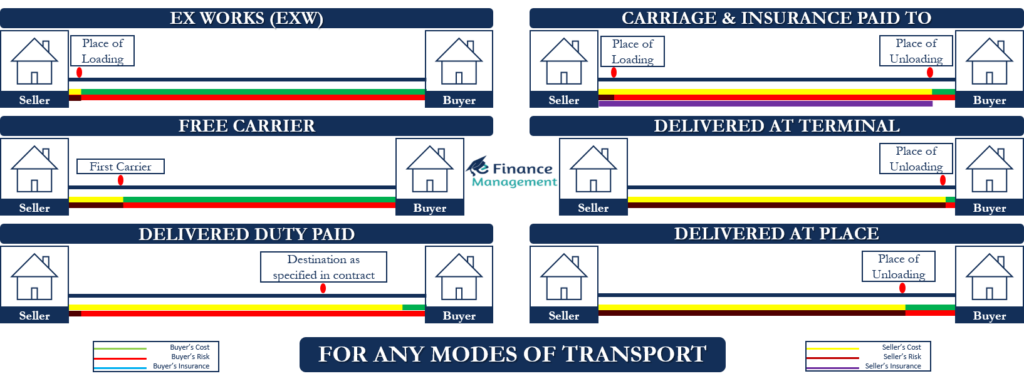

Ex Works (EXW)

This means the buyer is responsible for collecting the items at the seller’s location. Also, the buyer bears the transportation costs and the risks in transporting the goods. The sellers’ responsibility is to make available the goods at their location. And thereby, all costs and risks are borne by the buyer from the seller’s location to its place. In this, actually, the seller takes no responsibility except delivery at its premises. We can say this is the most favorable term of transactions for the seller.

Keep reading: EXW Ex Works

Free Carrier (FCA)

This implies that it is the responsibility of the seller to hand over the goods to the first carrier. After this, all risks and costs pass over to the buyer. In other words, this is the next level of operations from Ex-Works, where the seller takes the responsibility for transporting the goods up to the carrier location. In other words, it becomes the responsibility of the seller to hand over the goods to the first transporter – land or air, or water.

Read more at Free Carrier

Free Alongside Ship (FAS)

In this, the seller needs to transport the items alongside the ship and at the port that the buyer specifies/named in the contract. In other words, delivery of goods to the shipping company, alongside the ship, remains the obligation of the seller. And there onwards, the risk passes to the buyer from the seller.

Visit Free Alongside Ship for more

Carriage Paid To (CPT)

In this, the responsibility of the seller is to only arrange the transportation of goods to an agreed place. Seller doesn’t have to insure the goods. The risk, however, transfers when the carriage takes charge of the goods.

For a more detailed article, refer to Carriage Paid To.

Free on Board (FOB)

The seller here needs to go one more step from FAS and needs to ensure the loading of the items on board the ship that the buyer specifies/named in the contract. Risk for seller finishes when the items are on board of the ship.

See Free On Board for more.

Cost and Freight (CFR)

The seller needs to bear all the costs and freight to get the items up to the destination port. The risk, in this case, gets transferred to the other party only when the items are delivered on board the ship. Until then, all arrangements and costs remain the seller’s responsibility, including freight till the destination port.

Keep reading Cost and Freight

Cost, Insurance and Freight (CIF)

This is the same as CFR. The only difference being the seller here is also responsible for buying and paying for the insurance of goods supplied. In other words, in the case of CIF, all costs (including freight and insurance) are borne by the sellers till the destination port. At the same time, the risk gets transferred once it is delivered/handed over to the shipping company at the named port.

Read more at Cost, Insurance, and Freight

Carrier and Insurance Paid to (CIP)

In this situation, the seller pays for the carriage and insurance of the goods till the destination port or some other delivery location as may be named in the contract. Though the cost remains in the seller’s account, however, the risk passes to the other party when the seller hands over the items to the first carrier.

Visit Carriage and Insurance Paid To

Delivered Duty Paid (DDP)

Here the responsibility of the seller extends beyond his own country. And he has to pay and manage all the costs and risks till the goods reach the named destination in the buyer’s country. In other words, the seller ensures delivery of the goods to the destination in the buyer’s country. Buyer’s costs and responsibility start only after that.

Read more at Delivered Duty Paid

Delivered At Terminal (DAT)

This term, if used in the contract, means the seller is responsible for unloading and placing the goods at the terminal at the port (or at the place of destination) that the buyer specifies. The seller bears all the risk and costs up till unloading the goods at the terminal that the buyer specifies. In other words, the seller must do everything until the goods are unloaded/delivered at the named place.

Visit Delivered at Terminal

Delivered At Place (DAP)

This one way is exactly the opposite of Ex-Works, where everything was to be done by the buyer. In DAP, the seller takes over all the responsibility to deliver the goods at the buyer’s place. This means handing over goods to the transporter or on his vehicle that agrees to unload or deliver the goods at the buyer’s place. Or we can say handing over the goods to the buyer’s factory/warehouse or any such location. Obviously, all end-to-end costs and risks remain of the seller till it reaches the buyer.

Refer Delivered At Place

Delivered Ex-Ship is also a well-known incoterm that does not have its existence nowadays. You can read about it at Delivered Ex-Ship.

Final Words

There is no doubt that Incoterms helps to make international trade smooth. It clears the responsibilities of the buyer and seller at all the stages of foreign trade. However, these incoterms have their own limits. For instance, the parties can not use these terms to create contractual rights and obligations that do not relate to the deliveries. Also, these terms do not offer a solution in case a party breaches the terms of the contract. In short, these are the terms used only for the movement of goods and not for the entire transaction or trade.

Continue reading – What are the Differences Between Incoterms 2010 and 2020?

RELATED POSTS

- Inland Bill of Lading – Meaning, Importance and More

- Cost, Insurance, and Freight – Meaning, Obligations, Advantages, and Disadvantages

- FOB Destination – Meaning, Types, Importance And More

- Delivered at Terminal – Meaning, Obligations and More

- Cost and Freight – Meaning, Obligations, and Use

- Delivered Ex-Ship – Meaning, Example, and Relevance

Thank you for the information

Thanks

Happy reading

Hi, can Incoterm 2010 rule still be used instead of Incoterm 2020 rule?

Incoterms 2010 can still be used if all the parties agree to that and mention the same on export documents. But, it is recommended to use Incoterms 2020.