Analyzing and managing risk is highly crucial to the success of a project. If managers fail to properly identify and analyze the risk and its impact, it could be challenging to deliver the project on time and within budget. Two of the most prevalent risk analysis methods are qualitative and quantitative. Though both methods are useful and effective, each has its significance. This article discusses the differences between qualitative and quantitative risk analysis to help you understand each method.

Before we detail the differences between qualitative risk analysis and quantitative risk analysis, let’s understand the concepts of each of these methods.

Qualitative Risk Analysis and Quantitative Risk Analysis: Meaning

Qualitative risk analysis depends primarily on the perception of the person assessing the risk. Or, we can say that the rating or scoring of risk depends on the risk manager’s understanding of the severity and likelihood of its consequences. The key aim of this method is to develop a list of risks that needs more focus than others.

Quantitative risk analysis, on the other hand, depends on the data and statistical tools or is an objective approach. For this method to be effective, it is crucial that the data (historical) used for the risk analysis should be of a long period and cover multiple scenarios.

Now that you have got some idea about the two risk analysis methods let’s take a look at the differences between qualitative risk analysis and quantitative risk analysis.

Also Read: Risk Analysis Methods – Meaning and Types

Differences Between Qualitative Risk Analysis and Quantitative Risk Analysis

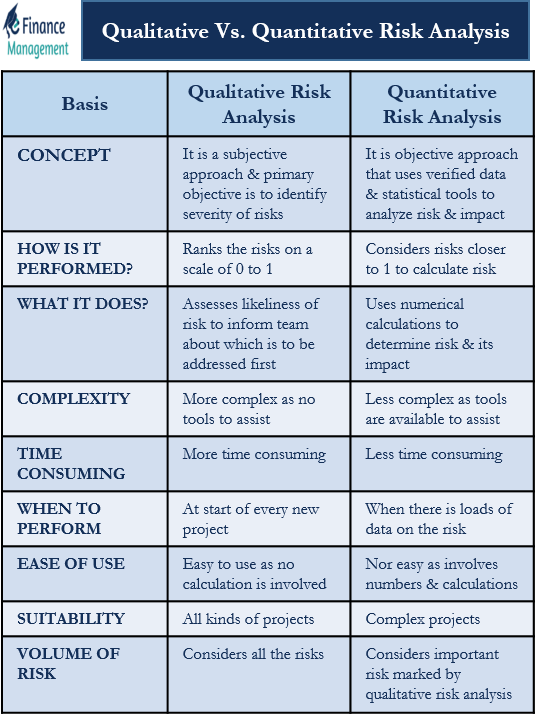

Following are the differences between qualitative risk analysis and quantitative risk analysis:

Concept

Qualitative risk analysis is a subjective approach, and its primary objective is to identify the severity of risks. Also, this method depends on the managers’ perception of risk.

Quantitative risk analysis, on the other hand, is an objective approach that uses verified data and statistical tools to analyze the risk and its impact.

What it Does?

Qualitative risk analysis assesses the likeliness of risk to inform the team and the risk that needs to be addressed first. Quantitative risk analysis uses numerical calculations to determine the risk and its impact.

How is it Performed?

Qualitative risk analysis ranks the risks on a scale of 0 to 1. Quantitative risk analysis considers risks closer to 1 to calculate the consequences of those risks.

Qualitative risk analysis is more complex as it doesn’t involve calculations. We can say that using qualitative risk analysis requires a deep understanding of the risks and their impacts.

When to Perform?

Risk managers usually perform qualitative risk analysis at the start of every new project. On the other hand, managers go for quantitative risk analysis when they have loads of data on the risk and its impact.

Complexity

Quantitative risk analysis is relatively easier as several tools are available to assist in the calculation. It still, however, is essential to have information on the right tools, how to use them, and how to interpret the results.

Time-Consuming

As it is evident, qualitative risk analysis is more time-consuming as managers need to identify risk and its consequences manually. In contrast, quantitative risk analysis uses automatic tools to speed up the whole process.

Ease of Use

Qualitative risk analysis is easier to use as it involves no numbers and tools. On the other hand, dependence on tools makes quantitative risk analysis challenging to use.

Suitability for Projects

Risk managers can use qualitative risk analysis for all kinds of projects, irrespective of their complexity. Quantitative risk analysis is used mainly in complex projects due to its dependence on tools for calculations.

Volume of Risk

Qualitative risk analysis considers all the risks and then ranks them based on their impact. Quantitative risk analysis considers only the risks that qualitative risk analysis marks as important.

Final Words

Though both risk analysis methods are independent, using the two together would yield better results. A project faces many risks, but not all are threatening. Thus, risk managers can first use the qualitative risk analysis method to rank the risks as per their likeliness and impact. And then use the quantitative risk analysis method to work further on the risks that the qualitative method found to be more crucial. This would assist in saving time and resources, as well as make risk analysis more effective.