Asset Mix Definition

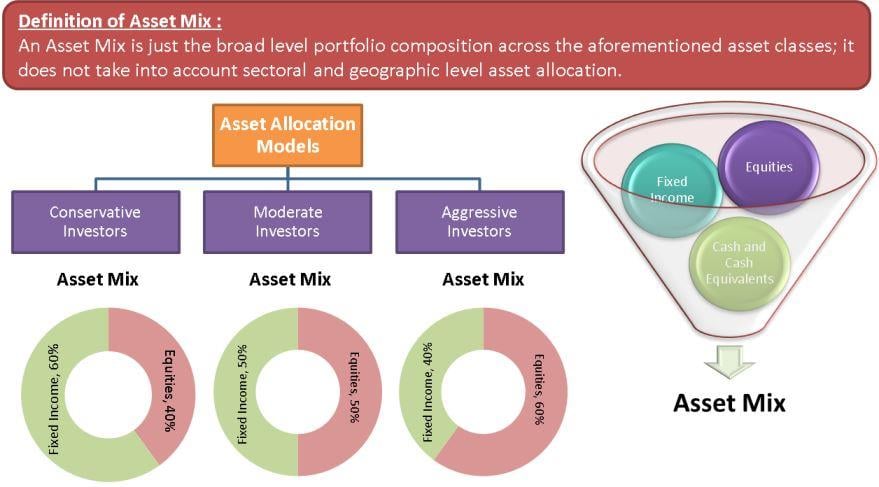

Asset Mix is the composition of an investment portfolio which is determined based on the risk-taking ability and life-cycle stage of an investor. It is the combination of the three major asset classes – equities, fixed income, and cash and cash equivalents – in an investment portfolio. An Asset Mix is just the broad-level portfolio composition across the aforementioned asset classes. It does not consider sectoral and geographic level asset allocation.

An Asset Mix is one of the first aspects an investor looks at while gauging the broad portfolio positioning of a mutual fund or an exchange-traded fund. It is typically presented in percentage form.

There are certain things one needs to determine to determine the Asset Mix.

Pre-requisites for Determining the Appropriate Asset Mix

There is no single standard portfolio composition that is suitable for all investors. Before determining the optimal Asset Mix for one’s portfolio, an investor needs to outline a few things.

- First, he needs to set a specific goal, like having $5 million by the time of retirement or accumulating $250,000 for a child’s education.

- Second, it is important to assess the period between now and the achievement of the aforementioned investment goal. For instance, 30 years to retirement or 15 years to a child’s education needs.

- Third, one needs to decide the lump sum and recurring contribution one can make towards fulfilling the investment goal.

Once these facts are known, the investor needs to gauge his risk tolerance. This also helps in making the investment goal more realistic. For example, one cannot expect to achieve an ambitious target in a short period of time while not wanting to take too much risk.

Also Read: Portfolio Investment

It is worth noting, though, that assessing risk tolerance can be tricky. Getting a personal finance professional can be helpful in the process.

Approach after Deciding the Asset Mix

Once an investor arrives at a suitable Asset Mix, he needs to execute the same with asset allocation funds providing one of the ways to achieve the desired mix.

Asset allocation funds are hybrid funds that invest across the aforementioned three major asset classes and sometimes alternative assets like gold, metals, and other commodities. Broadly, there are two types of asset allocation funds: balanced funds, which have a pre-defined range of exposure to asset classes, and dynamic asset allocation funds, which can change their asset mix based on market conditions.

Investors can adhere to certain asset allocation models which choose their portfolio investments.

Asset Allocation Models

The Asset Mix does not remain static. It changes with age and/or investment goals. Though investment advisors have their own asset models and assessment of an investor’s risk tolerance. We’ll look at three models based on three broad risk profiles: conservative, moderate, and aggressive.

Asset Allocation Model for Conservative Investors

A conservative investor is one whose risk tolerance is low. He is someone who would prefer a low-risk-low return scenario. This can also be the case with someone moving towards the end of the investment horizon. Such an investor may otherwise be risk-tolerant, but his portfolio needs to be rebalanced by lowering the risk. As he may be nearing the end of his investment horizon.

Also Read: Portfolio Management Services

Though there is no thumb rule for the same, conservative portfolios are those with over 60% investment of assets in fixed income securities. The equity allocation would generally be 30% or lower.

Asset Allocation Model for Moderate Investors

A moderate investor is one who can accept the risk but is averse to too much of it. Further, his return expectations are moderate. This type of portfolio is also suitable for an investor who is in the middle of his investment horizon or life cycle, and though there is still time to go, he may need some money intermittently.

Moderate portfolios are those in which equities comprise 40-50% of the total assets. Even among the equity exposure, a higher percentage may be towards blue-chip or dividend-paying stocks instead of more adventurous ones.

Asset Allocation Model for Aggressive Investors

An aggressive investor has an affinity toward risk and is willing to accept the higher risk to create opportunities for increased returns. Though age is not a barometer for assessing risk, typically, this investor is young, in an early lifecycle stage, or has a long investment horizon.

Aggressive portfolios are those portfolios with over 60% investment of assets in equities. Very aggressive asset allocation models can even invest over 90% of the assets in equities.

Where do they like to invest?

Higher exposure to growth-oriented companies and those lower in the market cap ladder can be found in the equities space. Stocks from companies located beyond the domicile country can also be found. Even in the fixed income space, there may be higher exposure to high-yield bonds and even bonds of overseas governments or companies.