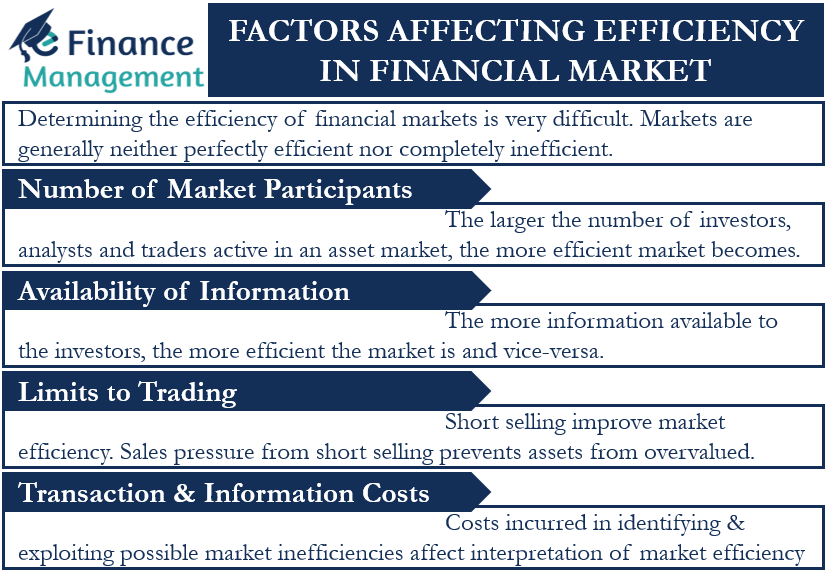

Determining the efficiency of financial markets is very difficult. Markets are generally neither perfectly efficient nor completely inefficient. The degree of informational efficiency varies across countries, time, and market types. In this article, we will learn about the factors affecting efficiency in financial markets.

Factors Affecting Market Efficiency

The following factors affect the degree of market efficiency:

Number of Market Participants

Efficiency in markets is directly related to the number of participants in the market. The larger the number of investors, analysts, and traders active in an asset market, the more efficient market becomes. Through time, there can be large fluctuations in the number of market participants and the resulting trading activity. Lack of trading might contribute to or intensify other market flaws that hinder market efficiency.

Availability of Information

Information availability and disclosure is one of the key determinants of market efficiency. The more information available to the investors, the more efficient the market is. In large, developed markets such as New York Stock Exchange and London Stock Exchange, information is readily available because of investor participation and analysts’ coverage. This makes these markets one of the most efficient in the world. Some assets such as bonds, currencies, and swaps that trade in over-the-counter (OTC) markets may have less available information which hinders the market efficiency significantly.

The availability of information should also be uniform and unbiased. Access to information should not favor one party over the other. Therefore, regulators of financial markets require that firms disclose the same information to the public that they disclose to stock analysts. Traders with inside information should be prohibited from trading on that information.

Limits to Trading

Arbitrage refers to buying an asset in one market and simultaneously selling it at a higher price in another market. This buying and selling of assets continue until prices in two markets are equal. Such trading activities contribute to market efficiency. Barriers to arbitrage, such as high transaction costs, and lack of transparency, will limit arbitrage activity. This allows the persistence of price inefficiencies and impedes overall market efficiency.

Short selling improves market efficiency. The sales pressure from short selling prevents assets from becoming overvalued. Restrictions on short selling can reduce market efficiency.

Transaction and Information Costs

The costs incurred by traders in identifying and exploiting possible market inefficiencies affect the interpretation of market efficiency. The two major costs to consider are transaction cost and information-acquisition cost. To the extent that the costs of information, analysis, and trading are greater than the potential profit from trading misvalued securities, market prices will be efficient. It is generally accepted that markets are efficient if there are no risk-adjusted returns to be made from trading based on publicly available information.